California’s Gasoline Market:

How the State’s Unique Structure Impacts Pricing at the Pump

In 2022 and 2023, California’s retail gasoline prices saw multiple price spikes, all the more notable because of the state’s relatively high prices, when compared to the rest of the country.

Looking specifically at 2022, California retail gasoline prices reached an all-time high at $6.438/gal on June 14 of that year (compared with a national average of $5.016/gal - also a record high - on that same date). That autumn, retail prices again approached that high ahead of the seasonal RVP specification changes.

Against this backdrop, in California’s Gasoline Market: How The State’s Unique Structure Impacts Pricing at the Pump, OPIS looks at the factors behind California’s relatively high gasoline prices, including:

- California’s fuel pricing chain

- California's supply structure

- Regulatory environment

- California retail gasoline price trends

- The 2022 and 2023 gasoline price spikes

- Retail and spot price volatility trends

- The “Rockets & Feathers” phenomenon

- The impact of branded retailers

Download Spotlight Analysis

Key Features & Benefits of the

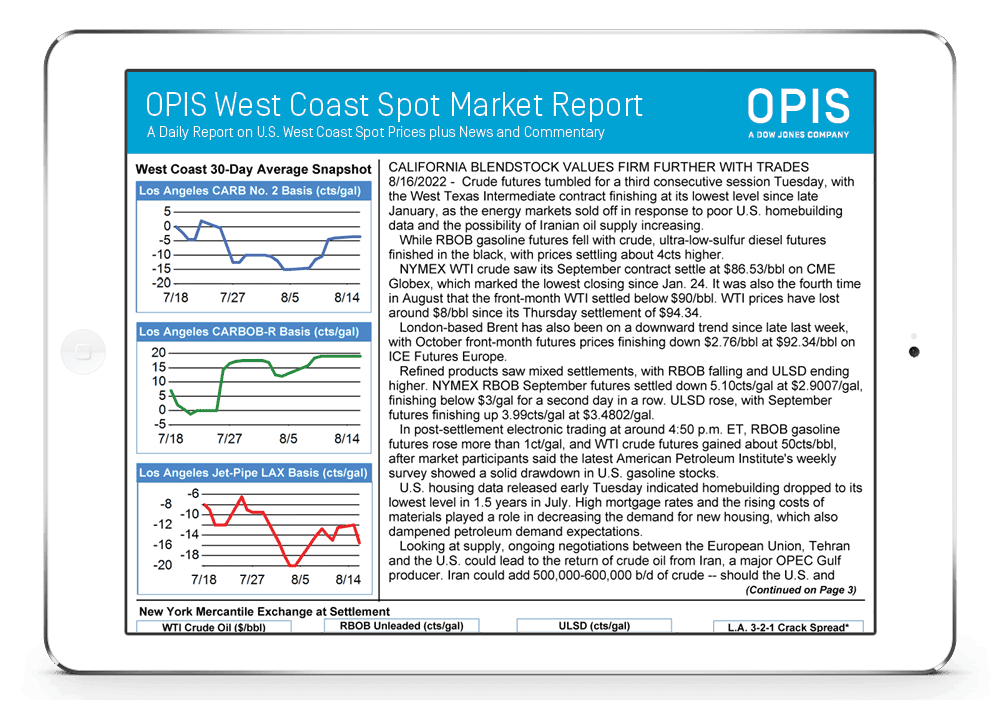

OPIS West Coast Spot Market Report

- Full-day pricing for Los Angeles, San Francisco and Pacific Northwest refined products give you benchmark low, high and mean prices for spot market deals, as well as volume-weighted averages for key gasoline, diesel and jet fuel.

- Local crude oil postings gauge refining profitability in a volatile market for precise crack spread analysis.

- Access a numbers-only pricing snapshot published up to a half hour before the full report, including full-day spot assessments for gasoline and diesel pricing.

- Spot-to-Rack-to-Retail snapshots clarify your margins by comparing the spot market to a basket of key racks and retail averages.

- West Coast paper differentials help you track your over-the-counter fuel swaps and manage your physical risk.

- California Low Carbon Fuel Standard (LCFS), California Carbon Allowances (CCA) and Cap-at-the-Rack (CAR) assessments keep you in compliance as emissions regulations transform the state’s fuel business.

- Renewables pricing coverage includes ethanol prices in the West Coast region, as well as RIN values for corn ethanol, biodiesel, cellulosic and advanced biofuel.

- DOE and CEC Inventory Analysis lets you track supply trends for the West Coast’s gasoline and distillate stocks.

- Real-time gasoline, diesel and jet fuel spot pricing and pricing for markets east of the rockies is also available.

- West Coast line space assessments for three growing regional hubs.