Shares of blue-chip retailer Costco continue to get hammered by Wall Street, after reporting some tiny margin compression in first quarter 2019 earnings released last week. But OPIS’ data and comments at the company’s conference call last Friday suggest that the magical allure of gasoline is still on the ascent, with Costco fuel sites now showing some of their best returns in years.

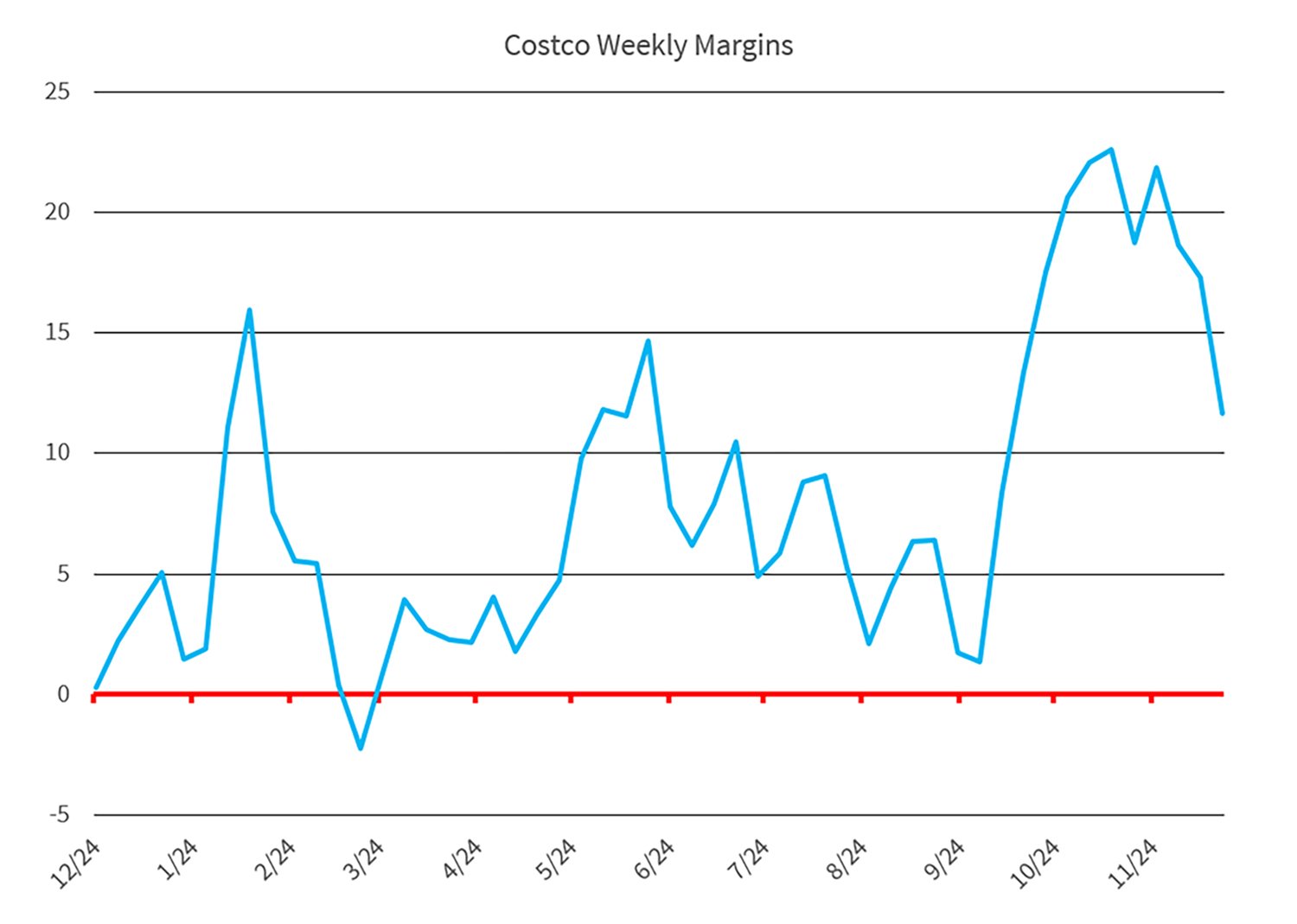

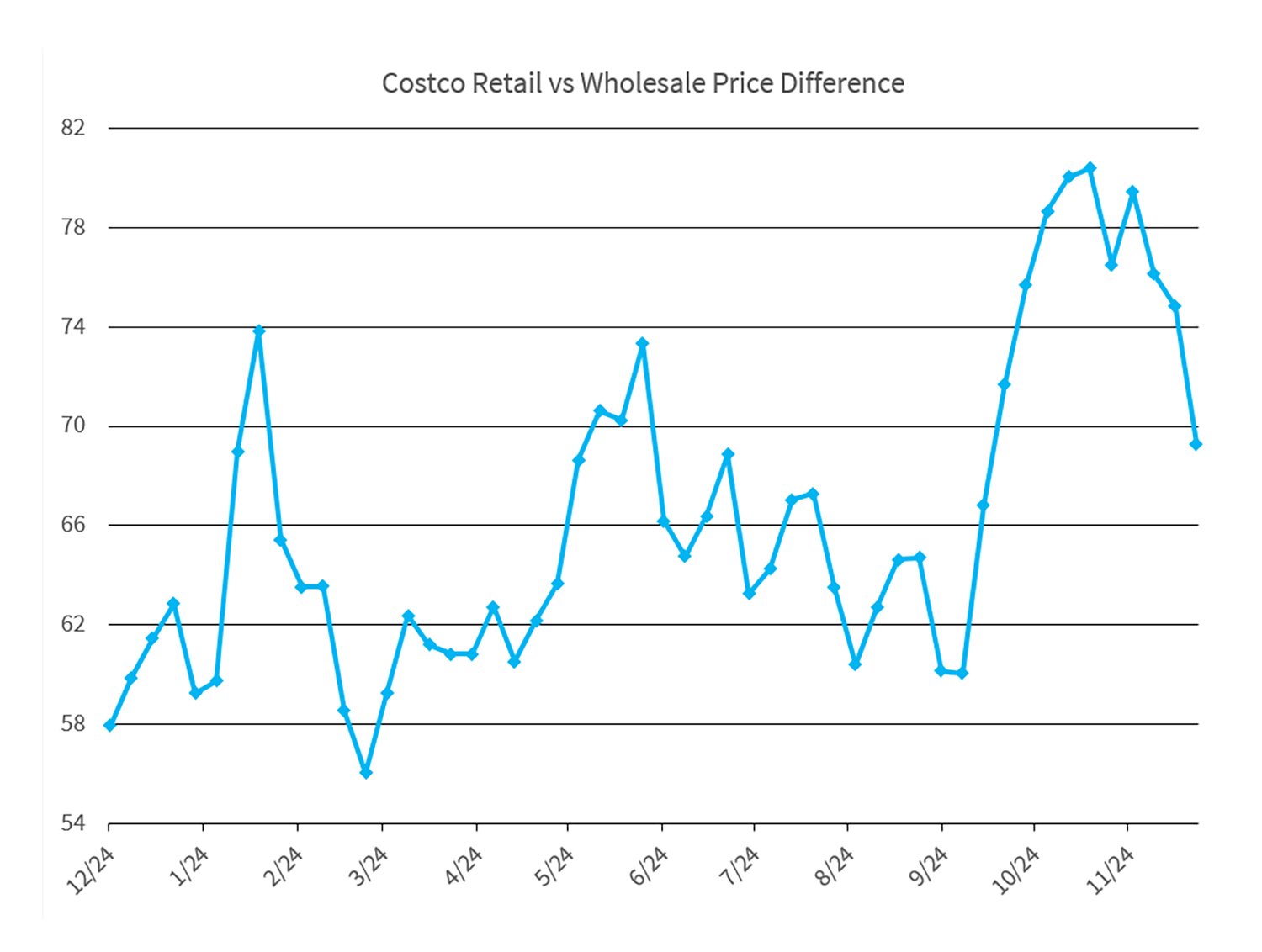

Precise margins for the Big Box chain are kept secret, but the company acknowledged that its gasoline profit increased in the twelve weeks ending November 25. If Costco were simply able to buy at an unbranded rack average at its U.S. locations, OPIS estimates they saw about 11cts gal between their cost and pump price during the period. However, Costco has a perhaps unrivaled ability to buy well under posted or spot benchmarks, and the likelihood is that benefit manifested itself through substantially wider margins.

But since the quarter ended, the company has seen implied profit margins nearly double thanks to descending wholesale costs and stickier retail numbers. OPIS data shows that the typical difference between an average wholesale cost and the Costco retail price has widened out to average over 20cts gal in the 22 days since the quarter ended.

The company is mum on volumes, but chief financial officer Richard Galanti told investment analysts Friday that its stores have seen “high single-digit gallon comps” in the U.S. population, as compared to flat sales for competitors. “So, we’re definitely taking market share and we’re enjoying being able to do that while making a little more but not a lot more,” he added. In other words, unlike many chain retailers, Costco has seen volume increases.

Many Costco sites move 700,000 gallons per month or more of fuel. Hence, the difference between a month with an 11cts gal margin and one with say a 21cts gal margin can approach $75,000 per station. Multiply that times more than 400 stores and you have an environment where fuel is giving the company tens of millions of dollars in unanticipated profits.

Costco CFO Galanti was queried by several retail analysts who asked if the overall model for gasoline sales had changed and why prices haven’t matched the overall oil drops.

“I think the reason is the traditional retailer –well all companies including us—we want to make money and what we have found is, is that as prices have come down our view is, our motive, if you will, our competitor pricing has gotten bigger.”

“What we’re saving customers relative to competitor stations nearby whether they are independents, or supermarkets or ‘nationals’, we’re saving more today than we’ve ever saved per gallon and we’re making more than we’ve ever made. Partly because everybody else is making more, we’re able to make a little more.”

Galanti added that “it does seem there is not a heck of a lot of traction on gas prices going up.”

However, Costco executives have always emphasized that fuel sales aren’t just about making money; the lure of gas that is 20cts gal cheaper than typical service stations has a dramatic impact on visits to the warehouses and trips inside to purchase various goods. To that end, Costco disclosed on Friday that shopping frequency at its U.S. locations was up 5.2%, and membership renewals rose from an already impressive 90.4% to 90.5%. The total number of cardholders for the company advanced to 95.4-million.

More warehouses are coming in fiscal 2019, with the company hinting that of 23 new sites, about three-quarters of the locations will be in the U.S. Specifics haven’t been released but reports indicate that warehouses will pop up in states that include NJ, OK, TX, IL, FL, and MN with prospects for another 20 or so sites in NY, CT MS, NC, SC, GA MO, ID, RI, and California in the next few years.

-- Tom Kloza, tkloza@opisnet.com

Copyright, Oil Price Information Service