From the OPIS Renewable Energy, Solar, Biofuels and Carbon Editorial Teams

The pursuit of goals such as increased sustainable aviation fuel usage and carbon capture pipelines are needed to help struggling farmers, an industry trade group said Wednesday.

"Creating new markets, embracing SAF and carbon capture pipelines, while also promoting higher blends is the holistic approach needed to address the challenges faced by American farmers," said Tom Buis, chief executive of the American Carbon Alliance. "It is time to rally behind these initiatives to

ensure the long-term sustainability and resilience of our agriculture sector."

ACA was launched last year "to be one unified voice for carbon capture pipelines, ethanol producers, landowners, farmers, construction trade workers and citizens that embrace this new energy future for America."

Senior advisor Collin Peterson, a former Congressman and Chair of the House Agriculture Committee, said that "carbon capture and sequestration creates new domestic demand for ethanol and corn and will result in higher prices for farmers."

He added that "without new demand, we risk a continued decline in farm commodities."

Peterson said that the present is mimicking the past.

"We have witnessed this before," he said. "In the 80s and 90s, farmers had to count on government assistance to survive, then the ethanol industry took off and farmers received profitable prices from the marketplace. Now we again have excess production, and demand is not keeping up."

Buis, former CEO of Growth Energy, said that the farm economy is "in a downward spiral, with prices for agricultural commodities hovering at or below the cost of production in many areas."

"This decline is exacerbated by reduced exports, declining domestic market demand and burgeoning excess supplies," he added.

Reporting by Michael Schneider, mschneider@opisnet.com

Editing by Jordan Godwin, jgodwin@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

The Science-Based Targets initiative has clarified its position on the use of carbon credits to offset supply chain emissions after a staff revolt, saying on Friday that "no change has been made to SBTi

current standards."

In a surprise statement issued on April 9, SBTi said its board of trustees had approved the use of "environmental attribute certificates, including but not limited to voluntary carbon markets,"

to offset Scope 3 emissions.

The move sparked a staff revolt, with employees saying in an open letter that the board had no authority to make such a decision.

They also stressed that "carbon credits are not permitted for emissions reductions" under SBTi's Corporate Net-Zero Standard.

The London-based organization did not address the issue in its latest statement but said "any use of EACs for Scope 3 will be informed by evidence" and based on its Standard Operating Procedure approved in December.

It also said that a draft proposal on potential changes to Scope 3 will be published in July.

Last week's decision was widely welcomed by voluntary carbon market stakeholders who said it will boost the market.

SBTi was launched in 2015 as a partnership between the global environmental disclosure firm CDP, the United Nations Global Compact, the World Resources Institute and the World Wide Fund for Nature.

It is incorporated as a charity in the U.K. The organization provides science-based guidance to businesses to achieve their climate goals.

By the end of last year, more than 4,000 companies had set SBTialigned targets, according to its website.

Reporting by Abdul Latheef, alatheef@opisnet.com

Editing by Michael Kelly, mkelly@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

The Science-Based Targets initiative will allow businesses to use environmental attribute certificates, including voluntary carbon markets to offset Scope 3 emissions, the organization said on Tuesday.

"While recognizing that there is an ongoing healthy debate on the subject matter, SBTi recognizes that, when properly supported by policies, standards and procedures based on scientific evidence, the use of environmental attribute certificates for abatement purposes on Scope 3 emissions could function as an

additional tool to tackle climate change," it said in a news release.

Scope 3 emissions are upstream and downstream greenhouse gases from activities that are related to, but not directly controlled by, an organization's operations.

SBTi said it plans to outline "specific guardrails and thresholds as well as the rules to be applied for these certificates to be considered valid for scope 3 emissions abatement purposes."

The organization added that it does not plan to assess carbon credit quality, saying that "other entities are better positioned to deal with this activity." It will, however, draft and publish rules regarding the use of carbon credits by July 2024, it said.

SBTi, launched in 2015, is a joint effort of the United Nations Global Compact, the World Resources Institute, CDP and the Word Wide Fund for Nature. It provides a framework for businesses to pursue net zero and decarbonization strategies.

For SBTi approval, the organization requires businesses to reduce Scope 1 and Scope 2 emissions - or those that derive directly from sources that are controlled by the business and purchased power, heat and cooling, respectively - rather than rely on external mitigation activities.

The organization said it earlier considered the use of carbon credits as "beyond value chain mitigation," meaning they could not be used to offset Scope 1, 2 or 3 emissions.

Because of that, setting a decarbonization target with SBTi posed a challenge to many businesses who produce hard-to-abate emissions.

Voluntary carbon market stakeholders welcomed the announcement.

"Companies are not reducing emissions fast enough and most are struggling to meet their scope 3 goals," the Voluntary Carbon Markets Integrity Initiative said.

"Without the requirement that they fill any gap with high quality carbon credits once they've made every reasonable effort to meet their targets, we risk falling further even behind in our efforts to reach Net Zero."

Reporting by Henry Kronk, hkronk@opisnet.com

Editing by Kylee West, kwest@opisnet.com and Jeff Barber, jbarber@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

Negotiations on a binding global treaty to eliminate plastic pollution will resume in Ottawa later this month, with the plastics industry still strongly opposed to any plan to limit production despite growing international support to do so.

The talks will be the fourth session of the Intergovernmental Negotiating Committee since March 2022, when 175 countries met at the United Nations Environment Assembly in Nairobi, Kenya, and endorsed a plan to develop a treaty by the end of 2024.

At the weeklong INC-4 session that begins in Canada's capital on April 23, negotiators will work on a document that lays out potential pathways to an agreement.

At the INC-3 session in Nairobi, three contact groups were established to revise the "zero draft" after negotiators failed to narrow differences. The UN Environment Program recently said the updated document will be the basis for the Ottawa talks.

"This treaty is a once in a lifetime opportunity and a critical international multilateral environmental deal that aims to profoundly change humanity's relationship with plastic," a UNEP spokesperson told OPIS earlier this month. "The focus is on a comprehensive approach that addresses the full life cycle of

plastic, which is key to overcoming the plastic pollution crisis," the spokesperson said in an email.

The problem

The Organization for Economic Co-operation and Development's first Global Plastics Outlook released in 2022 revealed that plastic waste volume had more than doubled from 156 million metric tons in 2000 to 353 million mt in 2019, but just 9% of it was recycled. That report also projected plastic waste will

top 1 billion mt by 2060.

In 2022, plastics generated 1.9 gigatons of carbon dioxide equivalent, accounting for 3.8% of total global greenhouse gas emissions, according to an OECD report released in November 2023.

UNEP projects that annual global plastic production will reach 450 million mt by 2025 and 1.2 billion mt/year by 2060. More than 90% of plastics are made from fossil fuels.

"As production increases, so does plastic pollution, with the ocean accumulating most of it," the UN agency said in a September report. "It is estimated that 11 million metric tons of plastics enter the ocean every year from land-based sources alone."

Recent studies have also highlighted the health problems posed by microplastics, plastic particles smaller than 5 millimeters in diameter, and a smaller category called nanoplastics. They have been found everywhere, including in human and animal bodies.

The European Commission last year proposed measures to prevent microplastic pollution and Canada in January said it will fund research into its health effects.

Canada wants 'ambitious' treaty

In the run-up to the INC-4 session, Canada, Uruguay, France, Kenya and South Korea formed a Host Country Alliance to promote the negotiations.

Steven Guilbeault, Canada's minister of environment and climate change, told OPIS on Friday that he wants to see an "ambitious" treaty that includes measures across the full life cycle of plastics.

"It is not simply enough to treat plastic pollution as a waste management issue," Guilbeault said in a statement to OPIS.

He added that Canada recognizes that any ambitious deal will require investment and he is ready to discuss mobilizing finances with his fellow ministers.

"Business-as-usual growth in plastics would burn through a projected 20% of the [remaining] carbon budget for 1.5 degrees Celsius by 2040. There is no time to waste, and no single country can tackle this problem alone," Guilbeault said.

He was referring to the net amount of carbon dioxide that still can be emitted without breaching the goal of the Paris Agreement to limit global warming to 1.5 C.

Production cuts key issue

Sabaa Khan, climate solutions director at the David Suzuki Foundation, who attended last year's INC-2 session in Paris as an observer, believes the current level of production and consumption of plastics is "completely out of control and out of sync" with global environmental and health goals.

In an email Friday, she said the treaty is focused on the life cycle of plastics, adding that there are multiple options in the INC-4 draft to reduce demand for and production of primary plastic polymers.

"The right approach is one that is embedded in the protection of human and indigenous rights, aligned with the Paris Agreement objective to transition away from fossil fuels, and the objectives of the Global Biodiversity Framework," Khan said.

Adopted in 2021, the GBF is a blueprint for halting and reversing biodiversity loss by 2030.

Amid mounting pressure to include deep production cuts in the treaty, a global survey released last week by Greenpeace showed that there is growing international support for such reductions.

The poll revealed that 82% of respondents support plastic production cuts to stop pollution. The survey was conducted in February by the British consultancy Censuswide in 19 countries.

Greenpeace has been calling for production cuts of "at least 75%" by 2040 to be included in the treaty.

Asked whether that goal is realistic, Sarah King, Greenpeace Canada's head of oceans and plastics campaigns, on Friday said such deep cuts are necessary "to truly get at the heart" of the plastic pollution crisis.

She said in an interview that governments must take a "precautionary approach" and set ambitious global reduction targets.

King described the current draft as a "bloated version" of the original proposal that lacks focus and covers a broad range of measures.

"It won't be good unless governments start to find areas of alignment and really focus on ensuring that the strongest measures stay within that draft."

Industry opposition

The Plastics Industry Association, a Washington-based group that represents the U.S. plastics supply chain, referred to a May 2023 statement that called for "a collaborative and inclusive approach" to negotiations.

"Trying to limit plastic production will stifle that innovation and result in the production and use of less environmentally friendly alternatives," the statement said. "Instead, the focus should be on fostering a more circular economy where even controlled plastic waste is valued for what it can achieve.

Any international agreement that makes circularity a priority will be more successful."

Robin Waters, director of circular plastics at Chemical Market Analytics by OPIS, said the American Chemistry Council in a recent letter to President Biden outlined "a set of elements needed for a successful global plastics agreement... We are concerned that the negotiations are moving away from the original intent of the UNEA 5/14 resolution to end plastic pollution and instead turning into an activist wish list to end plastic. A legally binding agreement must address plastic waste in the environment while continuing to enable the benefits of plastics in helping to achieve a lower carbon and more sustainable future."

"Draconian cuts to plastic production would have significant unintended adverse consequences to people all over the world," Nick Vafiadis, vice president of global plastics CMA said. "The impact would be most harsh on developing nations struggling to provide adequate quantities of safe food, water, and critical medical supplies to their population as plastic packaging provides a low cost and highly effective method of reducing food spoilage. Those least able to afford the increased costs of essential products produced with alternative materials would suffer most."

Vafiadis said plastics production in Canada is already being adjusted to minimize its impact on the environment and pointed to Dow's recent announcement that it was investing $6.5 billion to build a world-scale ethylene and polyethylene production facility in Fort Saskatchewan that will have net-zero

carbon emissions.

But King said global public opinion is not aligned with industry's view on what needs to be done to tackle the crisis.

"We certainly can't have those that have created the crisis driving the conversation about what the solutions are to solve it," she said. "We know that bans work, and in order to address the plastic pollution crisis, we need to turn off the plastic tap."

The Suzuki Foundation's Khan added that phaseouts and bans of toxic substances have been successful in other environmental treaties.

She cited the 1987 Montreal Protocol, which outlawed the use of ozone-depleting substances. It is considered one of the most successful international environmental agreements.

The UNEP spokesperson said in the email that while no timeline has been set for specific measures, the group's aim is to end plastic pollution by 2040.

"A future treaty needs ambitious targets and accelerated timelines to effectively address the plastic pollution crisis," they said. "Focus must also remain on addressing and dealing with legacy plastics, which will continue to be cleaned up for some time to come."

After the Ottawa talks, negotiators will meet again in Busan, South Korea later this year to finalize the treaty.

Reporting by Abdul Latheef, alatheef@opisnet.com

Editing by Xavier Cronin, xcronin@opisnet.com, Donna Todd, dtodd@opisnet.com and Jeff Barber jbarber@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

The Integrity Council for the Voluntary Carbon Market has approved ACR, Gold Standard and Climate Action Reserve as Core Carbon Principle-eligible programs, the organization announced Friday.

Verra, the largest registry by credit issuances, and the Architecture for REDD+ Transactions have not yet been fully assessed, the Council said.

"We are launching a new chapter for the voluntary carbon market: the CCPs set a global benchmark for high-integrity, building trust, increasing standardization and making it easy for buyers to identify high-integrity carbon credits," ICVCM Chair Annette Nazareth said in a statement. "This will help mobilise private capital at scale for projects to reduce and remove billions of tonnes of emissions that would not otherwise be viable and will channel investment to the Global South."

ICVCM's CCPs set out 10 criteria for carbon credits. They are intended to establish a quality threshold in voluntary carbon markets which, in recent years, have been subject to a range of criticisms involving the rigor of carbon avoidance, reduction and removal methodologies.

"Building the integrity of the carbon market so it can deliver real impact where it is needed most is vital, and the CCPs represent an important step on this journey," Gold Standard CEO Margaret Kim said in a statement.

The Council has worked in recent months to assess more than 100 individual methodologies based on its CCPs and its Assessment Framework, it said. It did not approve any specific methodologies in its announcement.

It remains unclear if all or some methodologies authored by the eligible registries have been approved. ICVCM did not immediately respond to a request for comment.

The Council has now moved on to consider other applicants, including Verra, ART, Social Carbon and Isometric, the organization said. It expects to make a determination for those registries "in April or at the latest in May," ICVCM said.

ICVCM expects to make the first announcements involving individual methodologies in the same time frame. It aims to assess methodologies covering more than half of the voluntary carbon market by the end of September.

The council has divided its work into several multi-stakeholder working groups. The first three groups, which took up methodologies involving improved forest management, sustainable agriculture, rice cultivation methane avoidance, nutrition and nitrogen management, buffer practices, afforestation/reforestation and revegetation and renewable energy, have wrapped up their work and will report their decisions "in the coming months," IVCVCM said.

The fourth working group is considering reducing emissions from deforestation and forest degradation. It has now begun that process.

Other working groups, which will consider methodologies relating to clean cookstoves, biochar and technology-based CO2 removal, will soon get underway, ICVCM said.

Carbon market stakeholders have eyed CCP labels as a means of boosting confidence and capital investment in the market.

Speaking during a webinar panel hosted by carbon market intelligence platform Abatable last month, Emral Carbon Founder and Managing Director Simon Jones projected that credits with CCP labels could carry a "double digit" premium.

"We've seen in the Article 6 context that those cookstove projects that have a corresponding adjustment are trading at a double-digit premium," Jones said. "I think I would say with a fair degree of confidence that you can expect a double-digit premium on something that has a CCP label versus something that

does not."

REDD+ projects have come under media scrutiny over the last year and a half, with credit quality becoming one of the leading factors in trade prices.

OPIS Afforestation/Reforestation and Blue Carbon price assessments have remained at a strong premium to OPIS Voluntary REDD+ credit assessments over that period, with REDD+ assessments weakening over that span, while ARR and Blue Carbon assessments remained firm.

OPIS Blue Carbon assessments started 2023 at a $13/mt premium to REDD+, but that had widened to nearly $22/mt for newer vintages on Thursday. OPIS ARR assessments started 2023 at a $1.50/mt premium to REDD+, but that had widened to over $8.50/mt for some newer vintages as of Thursday.

The OPIS Voluntary REDD+ V23 credit average was at $11.21/mt Thursday, compared to $33.01/mt for the Blue Carbon V23 credit average and $18.018/mt for the ARR V23 credit average.

The ICVCM published the CCPs on March 30, 2023, establishing a global quality benchmark for carbon credits. The CCPs set out fundamental principles for high-quality carbon credits that create real, verifiable climate impact, based on the latest science and best practice, the ICVCM said at the time.

In addition, the council published program-level Assessment Framework and Assessment Procedure and CCP Attributes, which set criteria for assessing whether carbon crediting programs were CCP-eligible.

The CCPs focused on three key areas: governance, emissions impact and sustainable development. Governance CCPs cover effective governance, tracking, transparency and robust independent third-party validation and verification; emissions impact CCPs cover additionality, permanence, robust quantification and no double counting; and sustainable development CCPs cover sustainable

development benefits and safeguards as well as contribution to net-zero transition.

The final Assessment Framework was published at the end of July last year.

Reporting by Henry Kronk, hkronk@opisnet.com

Editing by Jeremy Rakes, jrakes@opisnet.com and Michael Kelly, mkelly@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

Carbon credit standard-setter Verra issued just over 2.1 million REDD+ credits in the first quarter of the year, according to registry data.

By comparison, the registry issued five times that volume - nearly 10.6 million credits - in the first quarter of last year. Q2 2023 saw even more, with over 26.8 million credits issued over the three-month period. Issuances then slowed to just under 3.6 million in Q3 and 3.7 million in Q4.

OPIS calculated the V24 REDD+ Credits Average at $11.71/metric ton on Wednesday. REDD+ stands for reducing emissions from deforestation and forest degradation. Q1 2024 nature-based removal credits issued from afforestation, reforestation and revegetation (ARR) and blue carbon projects amounted to 501,517 credits. These projects account for a lower overall share of total credit volume and

issue credits more slowly in their early years.

Still, Verra issued over 8 million nature-based removal credits last year. Over 3.6 million were issued in Q1, although Q3 issuances came in at just 63,040 credits.

OPIS calculated the V24 Blue Carbon Credits Average at $33.51/mt on Wednesday, while the V24 Afforestation/Reforestation Credits Average was calculated at $18.768/mt.

In recent months, numerous developers of nature-based projects have told OPIS that both securing third-party monitoring, reporting and verification and progressing through Verra's issuance pipeline has proved more challenging.

Jonathan Dodd, chief financial officer of Forest First Colombia, which operates an ARR project in Colombia, previously described to OPIS how a series of events have compounded to slow issuances.

"As of today, we're behind where we thought we were going to be in 2018 and 2019," Dodd said.

Forest First planned to conduct MRV on an annual basis, but was delayed by COVID-19. Then, just as challenges related to the pandemic were easing, Verra came under criticism from media and academic sources for allowing for the over-issuance of credits and other quality issues.

"They were asking their verifiers to become more stringent," Dodd said. "And that delayed Verra's processes, understandably. So as of today, we're about to do our second issuance after this two-year period. And now, for our third issuance, we're looking at another two-year window. Our original intent was to [issue] fairly rapidly, because our investor wanted us to do that. And we said we could do it. Times have changed. It's taking longer to verify, we're still behind the eight ball, we're still playing catch-up from the pandemic."

Verra did not immediately respond to a request for comment.

During the first quarter of the year, the vintage of Verra's REDD+ credit issuances spanned 2013 to 2022. Over 700,000 credits were V22, while V21, V20, V18 and V15 accounted for over 200,000 credits each.

All Q1 REDD+ issuances came from eleven different projects. The Kasigau Corridor REDD Kenya led the group with 600,000 issuances. It was followed by REDD Project in Brazil Nut Concessions in Peru, with 351,337 credits and the Makame Savannah REDD+ project in Tanzania with 246,811 credits.

Meanwhile, the REDD+ Project Magnolios de Yarumal in Colombia and the Hiwi REDD+ Project in Brazil were issued their first credits in Q1.

Reporting by Henry Kronk, hkronk@opisnet.com

Editing by Kylee West, kwest@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

The settlement price of the Intercontinental Exchange's CORSIA Eligible Emissions Units (2024-2026) Futures contract has more than doubled over the past week, though key questions remain regarding the delivery of eligible credits.

The contract provides credits issued by ACR that can theoretically be retired under Phase I of the International Civil Aviation Organization's Carbon Offsetting and Reduction Scheme for International Aviation.

From its launch in October to March 25, the prompt-year ICE CORSIA Phase I contract had traded in a range of $12.75/metric ton to $8/mt, according to ICE data. But over the last week, it began to trade steadily higher. It reached $20.05/mt on Thursday and has continued to trade above $20/mt since. On Tuesday, it cleared in a range of $21/mt to $22.50/mt.

Forward-year prices have also risen, though to a lesser degree. The December 2025 contracts traded at $15/mt on Tuesday, up from $9.95/mt on March 27.

Volumes have remained small - just 20 lots of the prompt-year contract, representing 20,000 credits, had traded as of Tuesday afternoon.

While several registries have applied, ACR and the Architecture for REDD+ Transactions are the only organizations approved by ICAO to supply credits for Phase I of the scheme, which runs from 2024 through 2026.

Carbon stakeholders have speculated that the jump in credit price derives from ICAO's decision last month to withhold approval of Phase I eligibility for Verra, Gold Standard, Climate Action Reserve and SocialCarbon. The former three registries, along with ACR, represent the largest issuers of credits in the

voluntary carbon market.

Without supply from the other three major registries, the total volume of credits that can be used for Phase I remains limited.

But it is unclear if the credits ICE plans to deliver to satisfy its futures contracts will themselves be eligible.

For Phase I eligibility, project developers must obtain a letter of authorization from their host country promising the latter will issue a corresponding adjustment, which means that the country will not use the credits to satisfy its nationally determined contributions under Article 6 of the Paris Agreement.

A spokesperson for ACR confirmed Tuesday that no credits issued by the registry have so far received a letter of authorization. It is therefore unclear which credits will be delivered when the ICE contracts come due.

An ICE spokesperson confirmed its CORSIA Phase I futures contracts, for now, only deliver ACR credits but did not respond to questions pertaining to how the credits would be eligible for Phase I in the absence of a letter of authorization.

So far, the global supply of Phase I eligible credits amounts to roughly 7.14 million credits. All of these have been issued by ART to Guyana for its national REDD+ initiatives. Guyana, in turn, said it would issue a corresponding adjustment to the credits to make the credits available for Phase I.

Guyana has sold roughly 2.5 million of these credits to the oil and gas producer Hess at a floor price of $20/mt.

ClearBlue Markets Manager of Market Analysis Anop Pandey noted that the growth in the ICE futures contract could be tied to this price signal.

"There might be someone out there trying to reconcile the two price points and make a little profit margin from the trade," Pandey said. "Still the low volume is a drop in a bucket for the big traders out there so it could just be a few folks testing the waters."

Phase I of CORSIA requires airlines to offset or reduce emissions to 85% of a baseline set in 2019. CFP Energy estimated in a January report that total demand for Phase I will amount to between 64 million and 164 million credits.

The CORSIA Pilot Phase, which ran from 2021 to 2023, has seen a different supply and demand picture. Eleven registries were approved to supply credits, and growth in emissions from international aviation was limited by Covid-19. The OPIS CORSIA Eligible Offsets price was assessed in a range of 50cts/mt to

52cts/mt on Monday.

Reporting by Henry Kronk, hkronk@opisnet.com

Editing by Kylee West, kwest@opisnet.com and Michael Kelly, mkelly@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

Carbon credit registries expressed frustration this week at the UN International Civil Aviation Organization's decision to withhold full approval of the credits they issue for eligibility under Phase I of its offsetting program, in large part, because key UN processes to which they must adhere have yet to be formalized.

The ICAO's Technical Advisory Body, in its meeting last week, submitted its evaluation of four carbon registries, Verra, Gold Standard, Climate Action Reserve and Social Carbon, that had applied to supply credits under the Carbon Offsetting and Reduction Scheme for Civil Aviation. TAB found that each of the registries had failed to ensure that credits will be "only counted once towards a mitigation outcome."

"The Climate Action Reserve is somewhat perplexed by ICAO's slow decision-making process," said CAR President Craig Ebert in a statement to OPIS. "We have been very responsive to any questions they have asked us and believe we have addressed any and all issues."

While the registries have put in place measures to ensure that voluntary buyers do not count credits twice, the use of offsets under Article 6 of the Paris Agreement puts the standards bodies in a difficult position, they said.

Article 6 requires that credits retired by non-state buyers and other countries receive a corresponding adjustment saying they will not also be counted by their host country towards its nationally determined contribution.

Neither Article 6.2, which governs the process by which countries account for mitigation activities and transfer credits between them, nor Article 6.4, which establishes a global marketplace for carbon credits for participation by public and private entities, has been fully approved by Paris Agreement signatories.

Article 6.2 has been allowed to progress, and several countries have begun to sign bilateral agreements for the exchange of internationally transferred mitigation outcomes, or credits that will be used toward NDCs.

But registries say that ICAO wants them to protect against a situation in which a project issues credits that are then claimed by the host country for its NDC, even when it has issued a corresponding adjustment.

"One challenging condition is that ICAO wishes project developers to replace credits if a host country reneges on its earlier authorization and instead uses the emission reductions and removals toward its climate targets under the Paris Agreement," said Verra Senior Director of Climate Policy and Strategy Andrew Howard told OPIS.

"Asking projects to backstop countries' targets - by providing new credits at their own cost - creates unreasonable political risk. Countries should instead be held accountable under the [United Nations Framework Convention on Climate Change] for backing out on earlier authorizations, and ICAO should be in a position to bring such cases there," Howard said.

A Gold Standard spokesperson reflected similar sentiments.

"As a standard supporting projects to be eligible under the first phase of CORSIA and later phases, the most challenging issue is the question of liability in the event that a host country reneges on a commitment to apply a corresponding adjustment, under Article 6," the spokesperson told OPIS. "We will reflect on the new conditions set by the ICAO Council, which - to be clear - expect a higher burden to be placed on project proponents in such a scenario. At the same time, we also hope that governments take seriously the political risk associated with the application of corresponding adjustments as things stand, and take active efforts through the UNFCCC, ICAO, and national frameworks to establish safeguards and instill confidence that governments will abide by their commitments."

Ebert added that the fact that Article 6.4 has yet to be operationalized adds further complications.

"A major stumbling block for everyone remains the lack of clarity by countries under article 6.4 to facilitate the necessary procedures for recognition of any credits that can be used for the CORSIA program," Ebert said. "The Climate Action Reserve has virtually no control over that process, but we are ready to implement whatever specific provisions are finally specified."

ICAO declined to comment on its deliberations and decisions last week.

The registries pledged to continue to work with ICAO to gain Phase I approval. The next deadline for program change notifications is April 15. ICAO will consider these changes at its next council session in September.

ICAO had previously granted conditional approval to the four registries it considered at its meeting this month.

The registries submitted program changes to ICAO's Technical Advisory Body last summer to adhere to its requirements. During a meeting last week, the organization approved findings from TAB that none of the registries had met its requirements. While all failed to avoid double counting, according to ICAO, the registries also fell short of other criteria.

Only two registries, ACR and the Architecture for REDD+ Transactions, have received full approval from ICAO for CORSIA Phase I.

Verra, Gold Standard, CAR and ACR represent the four primary carbon credit registries by issuance volume. Because only ACR has been accepted, the supply of CORSIA-eligible credits remains limited.

ClearBlue Markets estimated in a report last July that roughly 8 million credits issued by ACR were available for Phase I. In the time since, ART has issued about 7.14 million credits to Guyana for its national reducing emissions from deforestation and forest degradation (REDD+) activities. But roughly 2.5 million of those credits have already been sold in a previous forward transaction to the oil and gas producer Hess.

Together, these two volumes of credits fall well below projected demand for Phase I. CFP Energy, in a January report, estimated that Phase I, which runs from 2024 to 2026, will foster demand of between 64 million to 164 million credits.

CORSIA requires countries to offset and reduce emissions above 85% of its baseline set in 2019. Participation in Phase I is voluntary, but, as of January, 126 countries had elected to join.

With current supply falling far below demand, it is unclear how CORSIA-eligible credits will perform in the market.

Guyana's deal with Hess delivered its vintage 2021 to V25 REDD+ credits at a floor price of $20/mt and its V26 to V30 credits at $30/mt. According to their contract, if a market index price of REDD+ credits goes above that level, Hess will pay an added 60% of that upside.

This rate already stands far above most REDD+ transactions. OPIS calculated the V23 Voluntary REDD+ Credits Average at $11.71/metric ton on Monday.

The Phase I supply and demand picture stands in stark contrast to that of the CORSIA Pilot Phase, which concluded in December 2023. Eleven registries were approved to supply credits to the Pilot Phase. Due to a major drawdown in international travel resulting from COVID-19, offsetting requirements under the scheme were limited, however.

OPIS assessed its CORSIA Eligible Offset price, which tracks credits likely to be retired for the Pilot Phase, at 62cts/mt on Monday.

Reporting by Henry Kronk, hkronk@opisnet.com

Editing by Kylee West, kwest@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

HOUSTON – California's optimistic timeline to a net zero future has hit several roadblocks of its own doing, panelists said Tuesday at CERAWeek by S&P Global.

Hyliion CEO Thomas Healy said the company has "pushed pause" on the electric powertrain side of the business due to thin customer adoption combined with the uncertainty looming over California legislation.

"The concern I see is that (California mandates) keep pushing out and pushing out and pushing out," Healy said. "One of the things that really drove that decision for us to pushing pause on the electric side of the things was the mandates."

"The mandates we saw CARB trying to enforce were just getting pushed," Healy added.

Healy pointed to mandates intended to go into effect at the start of the year, but have since been on hold.

"There's a mandate starting this year any new vehicle going into ports, it either had to be electric or had to be hydrogen," Healy stated. "As soon as the year started, that was pushed pause.

OPIS previously reported California Air Resources Board's Advanced Clean Fleets rule, requiring all newly registered drayage trucks to be zero-emission vehicles to phase out all diesel-powered engines across semi-trucks.

The California Trucking Association and the Owner Operator Independent Drivers Association filed a lawsuit against the agency, preventing CARB from moving forward with its ruling up until March 18, when U.S. District Court for Southern District of California Judge Roger Benitez tossed the suit in its

entirety.

"Remedying complexities and perceived deficiencies in AB5 are the kind of work better left to the soap box and the ballot box than to the jury box," Benitez wrote in his decision.

Vice president of the California Hydrogen Business Council Jennifer Hamilton also pointed to the state's infrastructure challenges as limiting factor in its effort to enforce mandates.

California's mandates will work together to expedite the transition to cleaner fuel technology and will incentivize companies to invest in renewable energy in the state, Hamilton said.

"So you could mandate the vehicles, but you have to have somewhere to get fuel," Hamilton said. "The timing of that I think still needs to be worked out a little bit and getting that infrastructure down before the vehicles come into ports whether that be trucks or cars."

Reporting by Sydnee Beach, sbeach@opisnet.com

Editing by Bayan Raji, braji@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

Oman's United Solar Polysilicon (FZC) started building its 100,000 metric tons (mt) per year solar-grade polysilicon plant on March 11, according to state-linked Oman News Agency (ONA) following a groundbreaking ceremony on the same day.

FZC's upcoming plant will be the largest solar-grade polysilicon producer outside of China, according to a source from a Chinese integrated solar manufacturer.

The 520 million Omani Rial ($1.35 billion) project, sited within Sohar Port and Freezone in Oman, is slated to commence operations in 2025, according to the statement.

The project aligns with objectives outlined in the Oman Vision 2040 for energy and renewable energy, the national reference for economic and social planning of the Sultanate of Oman during the period from 2021 to 2040 -- this sets out to facilitate economic transformation from an oil-dependent economy to a diversified and sustainable one, while also bolstering local value addition in targeted ventures, said Dr. Mansour bin Talib Al Hinai, Chairman of the Public Services Regulatory Authority.

Al Hinai said the project will additionally align with government policies concerning green hydrogen in the Sultanate of Oman. The locally produced polysilicon may help to lower the prices of solar panels, facilitating a reduction in operating expenses for the sector and thereby contributing to decreased energy prices.

Omar bin Mahmoud Al Mahrizi, CEO of Sohar Free Zone and Executive Vice President of Sohar Port, said the project is poised to attract numerous downstream solar manufacturing industries, encompassing cells, modules, and other ventures associated with solar component manufacturing in the region.

In January, Chinese solar material processing equipment manufacturer, Shuangliang Eco-energy Systems, announced that it had won the bid to supply United Solar Polysilicon with polysilicon production equipment valued at $58.32 million.

Based on public records, United Solar Polysilicon selected China National Chemical Engineering Sixth Construction as the project contractor, the latter having worked on numerous polysilicon projects by major Chinese companies including Daqo Energy, Xinte Energy, Tongwei, GCL New Energy, East Hope Group and Asia Silicon (Qinghai).

According to a source with knowledge of the Oman-based polysilicon project, it remains uncertain whether solar cells and modules manufactured using polysilicon from the Oman facility will gain access to the U.S. market in the future, amid regulation calling for supply chain traceability for products imported.

The source added that FZC's plant is strategically situated along the Belt and Road network, where there is substantial demand for photovoltaic (PV) installations, with polysilicon produced by the Oman plant possibly meeting needs of local solar projects. Southeast Asia is another significant target market for the factory's sales efforts, said the source.

($1 = 0.38 OMR)

Reporting by Summer Zhang,szhang@opisnet.com

Editing by Chuan Ong, cong@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

Climate Action Reserve President Craig Ebert believes global carbon markets are nearing the ability to effectively serve a broad set of decarbonization strategies.

Criticism of various projects and offsetting schemes has been deserved, Ebert added, but the factional opposition to the sector as a whole has had unintended consequences and has stifled the response to the climate crisis, he said.

Climate Action Reserve is one of the world's four largest carbon credit registries. The organization's annual North American Carbon World conference begins this week in San Francisco. Ebert sat down with OPIS for an interview ahead of the event.

"The challenge right now is that we have a pretty fractured market," Ebert said. "We're in the early stages of a truly global voluntary carbon market developing. No one should be under any illusion why that market is not fully developed and why it's just not ready for prime time, perhaps, today. We don'thave the scale to meet potential demand. But that's all the more reason, given the severity of the climate crisis, why we need to unleash the capital and send the right message to the entire global community."

Carbon markets, in recent years, have been the subject of a range of media and academic criticism.

"I think the scrutiny is fine," Ebert said. "The way it manifests itself is problematic. I have no problem with our work being under a microscope. We have a high degree of confidence in the work that we do. We're constantly reassessing it. We are constantly retooling our protocols in response to real-world experience and how they're working. There's a variety of reasons for that. Sometimes it's just trying to make them more cost-effective in the market. Other times, it's correcting misunderstandings of the way the protocol is specified. It should be viewed as a continuous improvement process."

That goes for any effort that is addressing climate change, Ebert added, including both compliance- and voluntary market-oriented initiatives. "It's got to be defined by good faith efforts," he said.

"What's unfortunate, is there seems to be a number of parties out there that are more interested in playing accusatory and gotcha politics," Ebert said. "They've uncovered what they believe to be a shortcoming of some credit somewhere and that somehow fundamentally calls into question the entire market. That's ludicrous."

"I'm very open to constructive approaches to improving the quality of what's in the market," Ebert continued. "But too much of what's happened has just been an attempt to indict the concept of voluntary action. I think a lot of that's misguided. It's just missing the point."

According to Ebert, project developers and the registries that validated them should bear the brunt of criticism for issuing low quality credits.

"I think critics are wrong to single out companies for buying suspect credits," Ebert said. "It's akin to you buying a car and realizing that maybe you got a lemon. So someone's going to sue you for being stupid for buying a lemon. As if you don't have enough problems already."

"I've worked with a number of fortune 1000 companies over the years," Ebert said. "Frankly, they're doing their best in a space they don't know, whether it's estimating their carbon footprint or deciding what mitigation actions they should take. Shine that light on those of us in the industry [developing the credits]. Let's have that discussion."

Voluntary carbon stakeholders have worked to signal integrity among high-quality credits. The Integrity Council for the Voluntary Carbon Market published its Core Carbon Principles and Program-level Assessment Framework in March 2023. ICVCM has used the documents to assess more than 100 carbon credit methodologies for their adherence to its standards. The group plans to begin to publish its findings and allow for CCP-labeled credits beginning at the end of this month.

Providing voluntary carbon buyers with confidence in their purchases will be key for unlocking further capital and scaling the market, Ebert said.

"The market needs that right now," Ebert said. "The types of criticisms that have happened up to this point are freezing a lot of corporate action. That shouldn't be a big surprise. People keep forgetting it's a voluntary market. At the end of the day, companies don't have to do anything."

"With all the confusion in the market, and the unfair criticisms that are being leveled at companies, many are choosing to not do anything," Ebert continued. "And it's humanity that's suffering because we're not investing in aggressively trying to solve this climate crisis. That's the biggest travesty right now. There will be no climate justice without carbon credits. The sad truth is that countries, through the COP process, are simply not doing enough."

During COP15 in Copenhagen in 2009, parties committed to funding climate action with a collective $100 billion per year by 2020. That goal was likely reached in 2022, the Organization for Economic Cooperation and Development said in November.

"That was always intended to be initial seed capital," Ebert said. "And it's taken 15 years to get to the point. Who's going to pay for the transition to a non-carbon economy? Ultimately, it's likely to be the private sector. They're the ones that have access to enormous sums of capital and they've got the potential upside from the business perspective of investing in a low-carbon economy. We need to unleash that potential, not hamper it. Right now, it's being hampered."

Reporting by Henry Kronk, hkronk@opisnet.com

Editing by Kylee West, kwest@opisnet.com and Micheal Kelly, mkelly@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

U.S. solar manufacturer CubicPV is halting plans to build a 10-gigawatt (GW) solar wafer factory in the country as it undergoes restructuring, the firm told OPIS in statements on Feb. 8.

This is despite the firm having already made "significant progress" on delivering the U.S. wafer plant, which included completing 60% design, choosing a site, producing thousands of wafer and cell samples for customers, and securing silicon supply.

Construction was previously expected to be completed in 2024 with the factory to be fully ramped in 2025. CubicPV had said in a Dec. 2022 statement.

The firm will now "eliminate positions" tied to the U.S. N-type wafer factory as part of the restructuring. The factory was expected to create 1,500 new direct jobs, CubicPV previously said.

A long-term supply contract for solar polysilicon worth $1 billion signed between CubicPV and Korea-based polysilicon maker OCI Holdings late last year is also "no longer effective", a CubicPV spokesperson said.

OCI did not immediately respond to a request for comment from OPIS.

"Despite the work invested in the project and the competency of our team, the market moved against us," the CubicPV spokesperson said.

A "dramatic" 70% collapse in wafer prices "to unprecedented lows" since the passage of the Inflation Reduction Act (IRA) and "surge in construction costs" were among factors that thwarted the firm's efforts to realize domestic production in the U.S., CubicPV said in its statement.

With the "collapse in prices" across the solar value chain, "the production incentives within the IRA are no longer enough to support US solar manufacturing," the CubicPV spokesperson said. Under the IRA, manufacturers stand to gain $12 of federal tax credit per square meter of solar wafers made in the U.S.

"If we believe US solar manufacturing is of paramount importance to our energy security and economic competitiveness, our policy initiatives will need to keep pace with these changing dynamics," the spokesperson added.

CubicPV will now align all resources and operations to advancing its proprietary technology in tandem modules, which according to its website will "offer more than 30% greater efficiency than the highest efficiency conventional modules."

The firm, which has "one of the strongest tandem R&D groups" in the U.S., will prioritize solving the durability challenge that has kept perovskite from reaching commercialization, and is doing that on larger area devices, it said.

"No investors have pulled funding from the Company" and "our investors are fully behind our tandem development efforts," the CubicPV spokesperson said. "We believe the market will move to tandem and that we have the opportunity to lead that transformation."

CubicPV's project halt flags how growing production capacity in solar wafers, an upstream segment of the solar value chain, remains a challenge for the U.S. While the IRA, a sprawling federal bill passed in 2022, hands out incentives to support domestic manufacturing mainly via tax credits, most resultant new capacity is downstream.

Of the 155 GW of U.S. solar manufacturing added a year into the IRA, the ingot/wafer segment comprised only around 13% while around 83% was in the downstream cell and module segments, according to data released last August by the Solar Energy Industries Association (SEIA), the national trade association for the solar industry.

Chinese players have a more than 95% global market share in the solar wafer industry, and the sector is likely entering "a loss-making condition even for top-tier players," with the world's second-largest solar wafer maker TCL Zhonghuan booking "huge losses" in the fourth quarter of 2023, Dennis Ip and Leo Ho, analysts at Daiwa Capital Markets, said.

"If Cubic is not collaborating with Chinese players, it could be hard for it to be competitive in the wafer space, especially with Chinese players now already pushing wafer price down to cost level," the Daiwa analysts added.

CubicPV's Chief Executive Officer Frank van Mierlo will step down as a result of the restructuring. While the firm seeks a replacement, Tim McCaffery - a CubicPV board member and global investment director at Thai business conglomerate SCG, a shareholder of CubicPV - will serve as interim CEO.

An SCG subsidiary led a funding round that raised $103 million in equity funding in support of CubicPV's U.S. wafer factory plans and tandem product roadmap, CubicPV announced last June. The first tranche of $33 million was released immediately, while the second tranche was tied to specific project milestones.

Reporting by Nicholas Lua, nlua@opisnet.com

Editing by Hanwei Wu, hwu@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

Washington Carbon Allowance secondary market prices have fallen by $19/mt this month after a citizen-led proposal to repeal the state's Cap-and-Invest Program advanced in the state's Legislature. Lawmakers now have the chance to act on the initiative during the 2024 session or allow it to move to a statewide vote in November's general election.

OPIS WCA price assessments tumbled more than 35% since Jan. 8 as of Friday, sliding for 18 consecutive trading sessions after Initiative 2117 solidified an official challenge to the one-year-old program's longevity.

OPIS assessed the WCA V24 December 2024 price at an all-time low $34/mt on Feb. 2, down from $53.25/mt on Jan. 8. Prior to this month, that WCA price was last below $40/mt in December 2022, when trading first opened at $35/mt on the Nodal Exchange.

Though the legislature could choose to enact Initiative 2117 without any changes, it's more likely that the legislature will do nothing and the proposal will be placed on the November ballot, carbon industry analysts said. Washington residents will likely vote on whether or not to overturn the state's emission trading program, they said.

Analysts at ClearBlue Markets said the potential challenge to the Cap-and-Invest Program created continuous downward pressure on secondary market WCA prices this past month.

"For the WCAs, we maintain a bearish outlook - the program is likely to languish given the regulatory uncertainty," the firm said in a subscriber note on Jan. 22.

Initiative 2117 would prohibit all state agencies from "implementing any type of carbon tax credit trading, also known as 'cap and trade' or 'cap and tax' scheme, including the Climate Commitment Act." If passed, it would repeal 37 acts or parts of acts related to Cap-and-Invest and ban the state from creating similar programs.

Democrats in the Washington House and Senate fought to pass the Climate Commitment Act legislation during a close vote in 2021.

Washington Secretary of State Steve Hobbs validated signatures for the initiative to the legislature on Jan. 16, which had been initially certified a week earlier on Jan. 8.

"If the Legislature rejects the initiative (Initiative 2117), it will be certified for the next general election," ClearBlue said. "The Legislature can pass an alternative to also go on the ballot, but this appears less likely."

The campaign for Initiative 2117 argued that the increased cost to fuel suppliers and producers translated to higher costs at the pump for consumers in Washington.

State representative Jim Walsh (R) filed the initiative in November, and the 2023 signature campaign was founded by "Let's Go Washington" Republican donor Brian Heywood. Initiative 2117 totaled 466,072 lines of submitted signatures.

Governor Jay Inslee (D) said in a radio interview that he was supportive of cap-and-invest and the Climate Commitment Act, along with his supporters in the state Legislature.

During a radio interview with KIRO-FM in Washington on Jan. 5 in support of the CCA, Inslee said "We cannot allow infinite pollution, we've got to have a cap on the amount of pollution. We also have got to get to transparency."

ClearBlue analysts on Monday noted that campaigns on either side of the initiative will likely ramp intensity this year.

"New public disclosure data shows a $1 million donation to the No campaign through a group called 'No on 2117.' While this still trails the $7.3 million donated to the pro-ballot initiative, the fight for the future of the Cap-and-Invest program looks to intensify in the coming months," analysts said in a Feb. 5 report.

During the program's inaugural year WCA secondary market prices averaged $56.967/mt for V23 December 2023, according to OPIS price data.

WCA secondary market prices in 2023 peaked at $70.50/mt on April 14 before the state Department of Ecology held two Allowance Price Containment Reserve auctions to release more supply into the market and dampen prices in the second half of the year.

Reporting by Slade Rand, srand@opisnet.com

Editing by Mayra Cruz, mcruz@opisnet.com and Jeremy Rakes, jrakes@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

--Reporting by Slade Rand, srand@opisnet.com: Editing by Mayra Cruz, mcruz@opisnet.com and Jeremy Rakes, jrakes@opisnet.com

Roughly 25 million carbon offsets could be issued via Article 6.2 of the Paris Agreement this year, Kevin Conrad, executive director of the Coalition for Rainforest Nations, said last week in an OPIS interview.

Many, if not the majority, of the transfers will involve credits generated by United Nations Framework Convention on Climate Change (UNFCCC) REDD+ efforts. Suriname, a CfRN member, earlier said it would seek $30/mt for its credits.

Conrad said he expects the credits will sell between $20 and $30/mt, although a number of variables could affect negotiations between countries.

CfRN, which was founded in 2004 is an intergovernmental organization focused on forest conservation and economic development. It includes more than 50 countries and supports developing countries with UNFCCC REDD+ efforts.

While CfRN does not plan to create an OPEC-like cartel, there will be coordination, according to Conrad.

"Carbon pricing is designed to impact behavior," he said. "Without properly priced carbon, no one is changing behavior. You have a continuation of this avoidance-based voluntary system where projects can barely get above 10 bucks for any sustainable amount of time. No one is changing behavior. They're just greenwashing. They're just buying credits and calling themselves carbon neutral. And so, we're saying that you're never going to get a functioning carbon market without regulation, without stringency around methodological standards."

The average OPIS REDD+ V21 assessment - a vintage that accounts for a large portion of available supply in voluntary markets - was calculated Friday at $11.21/mt.

Article 6.2 of the Paris Agreement outlines the means by which countries can transfer carbon offsets, defined as internationally transferred mitigation outcomes, to another country to count towards the latter's Nationally Determined Contributions.

At COP28 in Dubai last year, parties negotiated key aspects of Article 6.2, including measures regarding transparency and confidentiality in ITMO transfer deals. While some countries pushed to keep terms of these transfers confidential, CfRN members, the EU and others stood firm on maintaining transparency.

Negotiators ultimately did not arrive at an agreement. As things stand, countries are free to pursue bilateral ITMO transfers, but there is the possibility they will be invalidated or require changes pending further decisions agreed to by parties.

With that said, much of the framework regarding ITMO transfers has been outlined by a series of decisions made by parties over numerous COPs. Among these is the stipulation that mitigation actions must be real, verified and additional per guidance from the Intergovernmental Panel on Climate Change. Measurement, reporting and verification must be reviewed and approved by the UNFCCC.

While several deals have been struck between countries for renewable energy and energy efficiency efforts, none have so far been verified by the UNFCCC. Several countries, however, are close to receiving REDD+ verification. Conrad said he expects Suriname will complete all necessary steps in the next few

months.

That country in September said it planned to issue the world's first REDD+ ITMOs within months. But, according to Conrad, country leaders were approached by voluntary project developers who sought to repurpose their efforts. Those negotiations eventually broke down and delayed Suriname's issuances.

The country's Ministry of Spatial Planning and the Environment did not respond to requests for comment.

Besides Suriname, Conrad expects to see Honduras, Belize and Paraguay issue offset credits this year.

Because no verified ITMO transfers have occurred, the first deals will play an important role in setting the price of carbon and future mitigation activities."I think a lot of countries will be going out and trying to test the market, trying to test their cost, trying to see what's going on," Conrad said.

Some structure has been laid down on the buyers' side by Singapore, which set a fixed price for carbon purchases at S$5/mt ($3.73/mt) in 2019 to 2023. The rate was increased to S$25/mt this year through 2025 and will jump to S$45/mt in 2026. The country expects to fix it at S$50/mt to S$80/mt by 2030.

At the same time, Conrad told OPIS that he expects the supply of REDD+ ITMOs to rise sharply in the coming years. "I don't know what will happen when some large countries come in, like Brazil, and start unloading billions of tons," Conrad said. "They could say, 'Well, for us, $3/mt works.'"

Still, there are mechanisms that allow for the voluntary cancellation of credits before they are sold on the market and that could serve to maintain higher prices.

"I don't see this free-for-all in pricing that a lot of market proponents would like to see," Conrad said.

Still, UNFCCC review takes time and Article 6.2 could be revised in subsequent COPs. In the meantime, countries must weigh the growth of voluntary carbon projects in their territories, which can often deliver revenue faster, with nation-wide mitigation outcomes.

Conrad recommended that countries be patient.

"There's no financial transparency in voluntary markets," Conrad said. "We did an audit in Papua New Guinea. We found that about 7% of income generated through projects registered with Verra made it into the country. I challenge every minister to do their own audit."

"You can sit on the outside looking in while voluntary market developers run off with your assets and keep the money offshore, sending just enough to keep you interested," Conrad continued. "Or you can engage in a mechanism that gives you full control. Now that Article 6 is starting to become almost real, I think most ministers are starting to transition away from the voluntary offering and trying to take responsibility."

Reporting by Henry Kronk, hkronk@opisnet.com

Editing by Jeremy Rakes, jrakes@opisnet.com and Jeff Barber, jbarber@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

OPIS assess prices for Los Angeles and San Francisco renewable diesel fuel and sustainable aviation fuel (SAF). These new assessments bring transparency to the growing renewable fuels market in the U.S. West Coast. They are based on confirmed price intelligence reported by verified market participants.

Get news, analysis and exclusive data on climate and business, free in your inbox every week. Sign up for the WSJ Climate & Energy newsletter, with insights from across Dow Jones, including WSJ, OPIS, Barron's, MarketWatch and IBD.

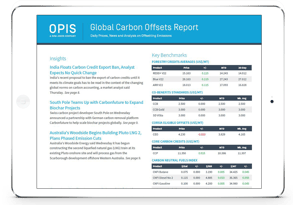

OPIS Global Carbon Offsets Report is the world's first voluntary carbon markets price report, meeting the demand for price discovery and transparency across the industry.

OPIS Global Carbon Offsets Report is the world's first voluntary carbon markets price report, meeting the demand for price discovery and transparency across the industry.

The OPIS voluntary carbon pricing suite now includes 161 daily assessments and provides solutions to stakeholders targeting emission reduction.

Get daily physical assessments of:

Plus OPIS' Carbon Neutral Fuels Index, carbon offsets trades deal log, market news coverage and insight not found anywhere else.

FREE Downloads:

Sample Report | Fact Sheet

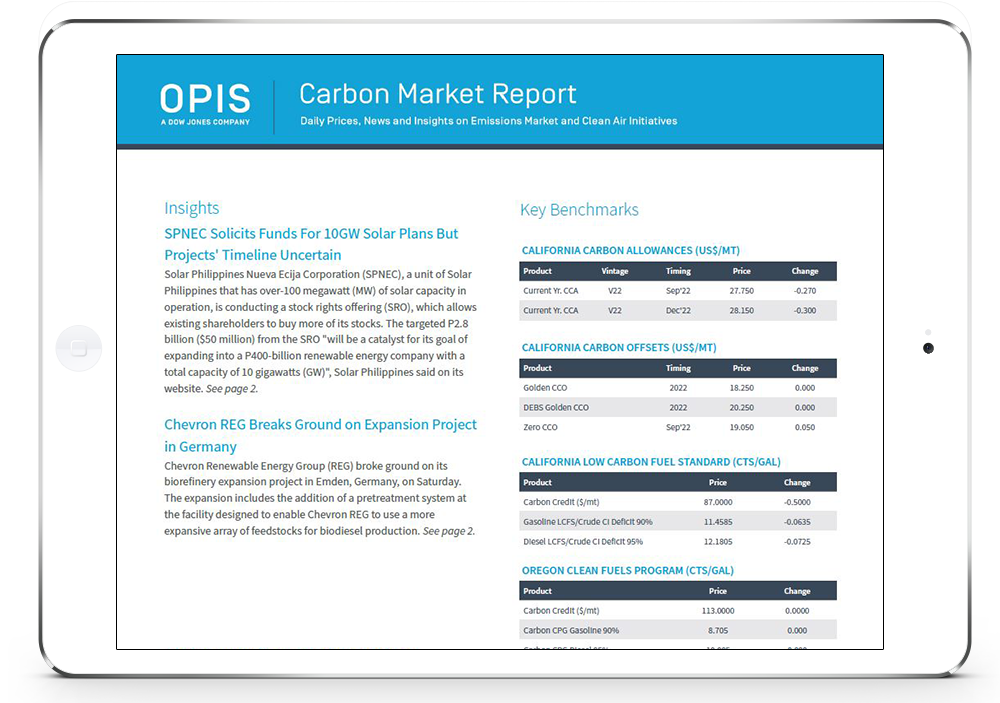

OPIS Carbon Market Report assesses the largest compliance carbon markets in the world with reliable and transparent trade-day data. The report provides comprehensive carbon coverage with transparency for over 100 indices, include prices for California Carbon Allowances, California Carbon Offsets, Regional Greenhouse Gas Initiative Allowances, U.S. Renewable Energy Certificates, California Low Carbon Fuel Standard, Oregon Clean Fuels Program, and the U.S. Renewable Fuel Standard. Easily track and manage your carbon compliance costs with daily pricing and breaking news.

FREE Downloads:

Sample Report | Fact Sheet

OPIS, A Dow Jones Company

© 2024 Oil Price Information Service, LLC. All rights reserved.