From the OPIS Renewable Energy, Solar, Biofuels and Carbon Editorial Teams

Tight margins, alternative fuel headwinds and increased competition for bunker volumes are just some of the challenges facing the current and future bunker market, according to Adrian Tolson, principal of 2050 Marine Energy.

OPIS caught up with Tolson to expand on his presentation at the recently held Maritime Week of the Americas in Tampa. The long-time bunker industry player laid out the hard reality of the global bunker market.

One of Tolson's main themes is the decline in bunker margins, which he said is indicated by financial reporting from Bunker Holdings, World Fuel Services and Monjasa, three major bunker suppliers/traders.

While the bunker business has always been a low-margin endeavor, he pointed to Bunker Holdings' pre-tax net margin dropping to about break even in 2024, which came with some exceptional write offs, from roughly $9/mt in 2023. Monjasa's margins dropped to $10/mt in 2024 after being around $20/mt in 2023. World Fuels has been a bit steadier, showing a margin of some $5/mt 2023 and $4.75/mt

in 2024.

As Tolson explained, "Peak margin performance for the industry started in 2019 with the runup to IMO 2020 and continued with the Covid and Ukrainian war disruptions. Industry margins are now returning to a more normal, tighter margin pattern and anecdotally 2025 looks to be worse than 2024."

Tolson pointed to obvious margin issues in the U.S. Gulf Coast, where Houston bulk VLSFO has consistently traded at a premium to retail bunkers, according to the OPIS Global Marine Fuels Report. That dynamic is atypical of the traditional bunker market structure. He attributed this inversion of pricing to several factors, including:

--Different specifications for finished bunker fuel compared to 20 API bulk VLSFO.

-- Too many suppliers in the Texas market.

"Houston and the surrounding area has 12 suppliers (soon to be 13) competing both onshore and offshore for about 4.6 million metrics tons per year -

supplier market shares will have to fall and will lead to losses," noted Tolson.

Decline in Demand?

Industry talk of disappearing demand may not be as accurate as many think, Tolson said.

He pointed out that only a few ports worldwide report actual official demand figures, which do not show any consistent declines.

"No one is recording data in supply locations such as Texas, so demand is what it is perceived to be by individual suppliers and traders. For suppliers, term contract deals have increased as alternative fuels relationships develop, and this takes spot demand off the spot market leading to a feeling there is less

activity. ... Bunker traders are also impacted with bunker inquiry demand consistently lost to buyers purchasing pools (e.g., Seascale Energy) in recent years" he said.

Alternative Fuels Face Headwinds

Tolson argues that the global decarbonization movement has slowed in 2025. This slowdown comes at the same time as European regulatory ambition pulling back.

In the U.S., a new administration appears to be unclear on a decarbonization stance and renewable credits.

And Asia has slowed its decarbonization efforts because of Europe and U.S. headwinds and the absence of strong local support from shipping and financiers.

One bright spot for global decarbonization is the International Maritime Organization's Marine Environment Protection Committee, or MPEC 83, which has measures before it that include a new fuel standard for ships and a global pricing mechanism for emissions. These measures, set to be formally adopted in October 2025 before entry into force in 2027, will become mandatory for large ocean-going ships over 5,000 gross tons, which emit 85% of the total CO2 emissions from international shipping.

But even with the MEPC 83 regulations, Tolson predicts the shipping industry could face serious challenges to getting near the goal of net zero by 2050.

Among his other observations:

--LNG will continue to be one of the hottest fuels long into the future, with bio-LNG and onboard carbon capture helping the cause.

--Green hydrogen-based fuels will disappoint because shipping will fail to commit until the last moment and supply infrastructure providers without shipping support will fail to get to FID. MEPC83 helps, but the path is not aggressive enough as yet, and much-needed local and national government support

will most likely fail to step in.

--Oil products will continue to supply 55% of marine energy demand in 2050, while LNG will supply 13%, biofuels 9%, methanol 12.5% and ammonia 7.5%.

Tolson predicts that even up to 2035, traditional oil products will represent more than 75% of supplied bunkers. And surprisingly, HSFO, which several years ago was talked of as an antiquated dinosaur fuel, continues to play a critical role in today's market. Demand for the product is most likely not dropping

until well into the next decade.

Reporting by Tom Sosnowski, tsosnowski@opisnet.com Editing by Eric Wieser, ewieser@opisnet.com and Michael Kelly, mkelly@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

Citing ongoing trade disruption and decreased shipments to the U.S., Chinese module supplier Jinko on Tuesday reported a net loss of $181.7 million for the first quarter of 2025.

The company shipped more than 19 GW of modules, cells and wafers in the first three months of the year, down 27.7% from the previous quarter and 12.7% from the first quarter of 2024. Total revenues of $1.91 billion represented a drop of 33% from the previous quarter and 39.9% from a year earlier.

Low prices and decreased demand driven by international trade policies "pressured profit margins" in all segments of the supply chain over Q1, according to Jinko's Chairman and CEO Xiande Li.

"Due to a year-over-year decline in shipments to the U.S. market and a continued decline in higher-price overseas orders, our module prices and profitability decreased both year-over-year and sequentially," Li said.

In response to the disruption of reciprocal tariffs, Li said Jinko, which has 10 GW of manufacturing capacity across Southeast Asia, has "flexibly adjusted our supply chain strategy and regional shipment mix."

According to the earnings presentation, the expansion of Jinko's Florida plant to 2 GW of n-type capacity is now complete, and the "largest overseas n-type production facility" is steadily progressing in Saudi Arabia. When it starts operations in the second half of 2026, that facility will produce 10 GW each of cells and modules annually.

The company is making the overseas market its "strategic priority" for its energy storage business. Battery shipments totaled 300 MWh in the first quarter, a "substantial" increase from this time last year, and Jinko expects to ship around 6 GWh worth by the end of 2025, leveraging its PV customer base to offer integrated solar-and-storage options.

The company anticipates shipping between 20 and 25 GW of modules in the second quarter and between 85 and 100 GW for all of 2025. Jinko shipped a total of 92.9 GW in 2024.

Installations were up 31% in China year-over-year in the first quarter, and the average monthly bids for modules are "returning to a more rational level.", which Li attributed to "market self-regulation and high-quality development initiatives."

Reporting by Colt Shaw, cshaw@opisnet.com

Editing by Jordan Godwin, jgodwin@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

Vietnam will require the trading of emission quotas and carbon credits in its domestic carbon market to be conducted via designated securities firms through the Hanoi Stock Exchange, according to a notice released Tuesday by the Ministry of Natural Resources and Environment.

The requirement, proposed by the Ministry of Finance, is included in a draft decree outlining the organization and operation of the country's carbon trading exchange.

A pilot phase for the carbon market is scheduled to run from June 2025 through the end of 2028, with full-scale operations expected to begin in 2029. However, the June launch is expected to be largely symbolic, due to the absence of an operational national registry, said Mai Duong, carbon analyst at research firm Veyt.

Before credits or quotas can be listed for trading, they must be verified and registered in the national registry by the Ministry of Agriculture and Environment.

Participation in the market will be open to both authorized individuals and organizations for carbon credit trading. However, only facilities subject to compliance obligations will be allowed to trade emission quotas.

Covered entities are unlikely to engage in quota trading until benchmarks are set and allowances are allocated, as their obligations remain undefined, Duong added.

The draft decree also introduces a phased approach to emissions quota allocation. Sectoral management ministries will be responsible for proposing annual emission quotas for facilities under their jurisdiction, with allocations scheduled across three periods: 2025-2026, 2027-2028 and 2029-2030.

In the initial phase, quotas will be distributed to major emitters in thermal power, steel production and cement manufacturing. Approximately 150 facilities are expected to receive allocations, covering around 40% of the country's total greenhouse gas emissions.

In addition, sectoral ministries will be tasked with approving technical guidelines for generating carbon credits, registering and deregistering carbon projects, and issuing carbon credits for eligible projects under their purview.

While the notice did not specify how offsets would be applied toward compliance obligations, an agriculture ministry official recently stated at a carbon event that the ministry is proposing to allow up to 30% offset usage -- three times the original proposal, according to Duong.

Reporting by Lujia Wang, lwang@opisnet.com

Editing by Mei-Hwen Wong, mwong@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

Massachusetts and Maryland -- two of the 10 states that passed California's Advanced Clean Truck Rule -- have delayed enforcement of the stringent emissions targets.

The rule requires manufacturers of on-road medium- and heavy-duty vehicles to produce and sell an increasing percentage of zero-emission vehicles from model years 2025 through 2035.

The Massachusetts Department of Environmental Protection on Tuesday announced a two-year reprieve for truck manufacturers unable to meet the requirements of the Advanced Clean Trucks program. Manufacturers will get a grace period for the 2025 and 2026 model years if they continue to make internal combustion

engine trucks for distributors.

And Maryland Gov. Wes Moore earlier this month signed an executive order suspending enforcement of the ACT program for two years.

MassDEP said that truck manufacturers find the regulation too difficult. Some manufacturers are limiting ICE truck sales to ensure they comply with the sales requirements.

The department also said the Trump administration created "significant uncertainty around ZEV incentives, charging investments, manufacturing and tariffs, each of which threaten a smooth transition to medium- and heavy-duty ZEVs."

The delay gives manufacturers "flexibility" while keeping the state "on track" to achieve emissions reductions, MassDEP said.

The rules in Massachusetts, New Jersey, New York, Oregon and Washington arescheduled to go into effect with MY 2025 vehicles. Vermont's rules will take effect in the 2026 model year and rules in Colorado, Maryland, New Mexico and Rhode Island are set to begin in the 2027 model year.

"Legislation has been introduced in all of the 2025 states to delay implementation of the rule until at least 2027," the RV Industry Association said this month in a legislative update.

A bill was also introduced in the Vermont legislation last week and a proposal in Washington would repeal the ACT Rule in the state.

"While federal law permits states to adopt California's motor vehicle emission standards as an alternative to the federal [Clean Air Act] standards, this remains optional," according to the Washington bill (SB 5091). "Decarbonizing the transportation sector is achievable and an important objective in Washington state but adopting California's standards limits flexibility in meeting Washington's unique needs and economy."

Reporting by Donna Harris, dharris@opisnet.com

Editing by Jeff Barber, jbarber@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

California Gov. Gavin Newsom announced Tuesday he along with Senate President pro Tempore Mike McGuire and Assembly Speaker Robert Rivas would work together to extend the state's Cap-and Trade Program this legislative year.

Newsom noted updates on extending the program would be revealed "in the coming weeks."

"California must continue to lead on reducing pollution and ensuring our climate dollars benefit all residents," Newsom said in a news release. "That's why we're doubling down on cap-and-trade: one of our most effective tools to cut emissions and create good-paying jobs. Cap-and-trade is a huge success and, working together, we'll demonstrate real climate leadership that will attract investment and innovation to deliver the technologies of tomorrow, right here in California."

Tuesday's announcement was made a week after President Donald Trump published Executive Order: Protecting American Energy from State Overreach. The order called out states with emissions reduction goals that included California, New York and Vermont.

According to the EO, these state policies increase energy costs for consumers and undermine the principles of federalism by imposing the regulatory preferences of a few states on the entire nation.

The EO directs the Attorney General to identify and take action against any laws that may be unconstitutional or preempted by federal law, particularly those related to climate change or environmental initiatives.

Meanwhile, California Assembly Bill 1207 and Senate Bill 840, both introduced on Feb. 21, aimed to reauthorize extending the program past its current end date of 2030 before being amended.

AB1207 was amended on Mar. 17 to require the California Air Resources Board to "consider the full social cost associated with emitting a metric ton of greenhouse gases, as determined by the United States Environmental Protection Agency in November 2023."

Meanwhile, SB 840 was amended on Mar. 26 to "extend indefinitely the requirement for the Legislative Analyst's Office to annually submit to the Legislature the report on the economic impacts and benefits of those greenhouse gas emissions targets. The bill would require the committee, at a public hearing, to review the annual report by the Legislative Analyst's Office."

The Trump administration sued California in October 2019, alleging its Cap-and-Trade Program -- which has been linked to the Canadian province of Quebec since 2014 -- constituted a treaty and overstepped the federal government's authority. The Biden administration dropped the lawsuit in April 2021.

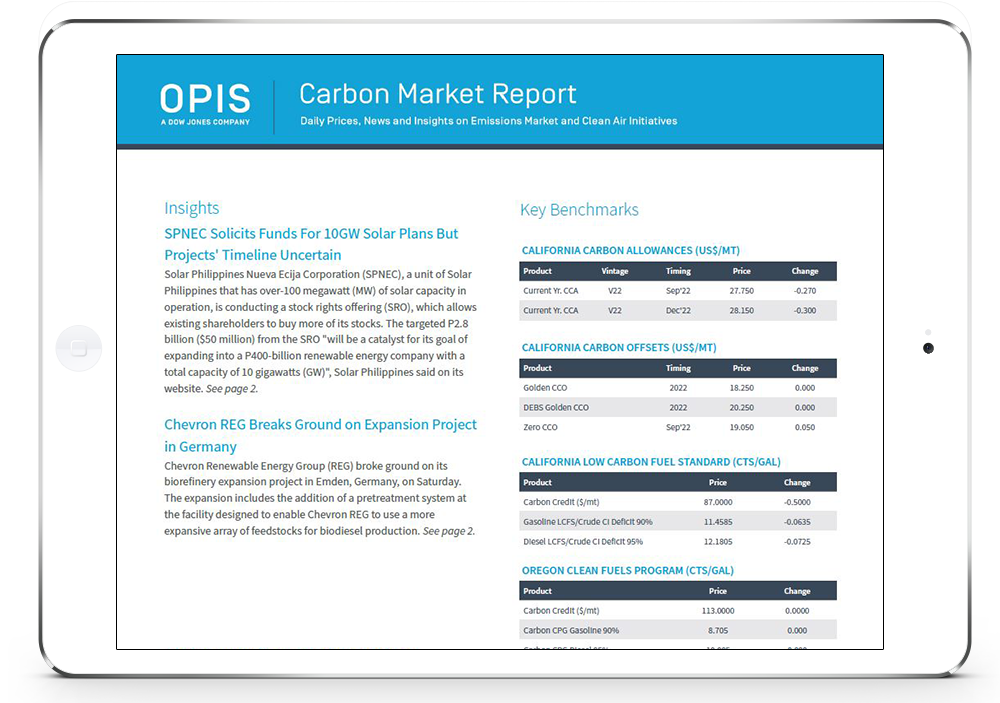

The California Carbon Allowance V25 December 2025 forward delivery contract traded at $27.25/mt and $28.27/mt on the Intercontinental Exchange by 1 p.m. CT. On Monday, OPIS assessed the CCA V25 December 2025 price at $26.69/mt.

Reporting by Mayra Cruz, mcruz@opisnet.com

Editing by Kylee West, kwest@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

California Carbon Allowance secondary market prices stumbled Monday morning, sinking further following President Trump's executive order last week targetingstate-level emissions reduction efforts. Meanwhile, Regional Greenhouse GasInitiative prices were up slightly, and Washington Carbon Allowances weakenedbased on lower offers.

The CCA V25 December 2025 contract traded at $26.53/metric ton and $26.85/mt on the Intercontinental Exchange as of 1:30 p.m. ET Monday. OPIS on Friday assessed the CCA V25 December 2025 price at $26.89/mt, down more than $2/mt on the week.

The ICE CCA V25 April 2025 contract traded at $25.58/mt and $25.85/mt by midday Monday. OPIS on Friday assessed the CCA V25 April 2025 price at $25.90/mt.

OPIS CCA prices Friday were down $2.715/mt for April and $2.735/mt for December compared to a week ago.

North American compliance carbon market prices sank during trade following the executive order, titled "Protecting American Energy from State Overreach." The order specifically called out the emissions cap in California as one that "punishes carbon use by adopting impossible caps on the amount of carbon

businesses may use, all but forcing businesses to pay large sums to 'trade' carbon credits to meet California's radical requirements."

California Air Resources Board Chair Liane Randolph said Wednesday that the state would continue to maintain its authority to curb emissions.

"Since our first climate change scoping plan, we have used a portfolio approach that includes performance standards, incentives and carbon pricing," according to a statement from Randolph. "Emissions have gone down while [the] economy has grown. We are committed to defending our record of success."

OPIS CCA prices Wednesday reached their lowest mark since September 2022, according to OPIS data. The OPIS assessment of $26.225/mt on Wednesday was the weakest for the current year forward delivery since $26.085/mt on Sept. 27, 2022.

The 2025 floor price, or auction reserve price, is set at $25.87/mt. CCA contracts traded below that level on Wednesday following the executive order, before rising later in the day.

Prior to last week, CCA trade prices had not fallen below the auction floor, which often serves as a soft floor to secondary market trade prices as well, since March 2020. Prices most recently dipped below the then-floor of $16.68/mt on March 17, 2020, when they were assessed at $16.58/mt for prompt delivery at

the beginning of the Covid-19 pandemic.

OPIS CCA V25 December 2025 prices had already dropped below $30/mt multiple times this year following mounting uncertainty about the timeline for the state's Cap-and-Trade Program Update process to be completed. The process began in 2022.

Regional Greenhouse Gas Initiative secondary market prices recovered Monday morning following significant losses last week.

The ICE RGGI V25 December 2025 contract traded at $18/short ton and $18.40/st by 1:30 p.m. ET Monday. OPIS assessed the blended RGGI V24/V25 December 2025 price at $17.525/st on Friday.

The ICE RGGI V25 April 2025 contract was bid at $17.40/st and offered at $17.57/st by midday Monday. OPIS assessed the blended RGGI V24/V25 April 2025 price at $16.985/st on Friday.

RGGI prices Friday were down $4.84/st for April and $4.93/st for December compared to a week ago.

Last week's executive order, in addition to singling out California, called out rulemaking for forthcoming cap-and-invest programs in New York and Vermont as "extortion."

In a Tuesday news release, New York Gov. Kathy Hochul said the Trump administration has already taken $325.5 million in federal funding for future state infrastructure and resilience projects and another $56 million for projects that have already started.

While other compliance market prices recovered last Thursday, the RGGI market sank further on a second day following the executive order.

OPIS RGGI prices on Thursday fell below the 2025 cost containment trigger price of $17.03/st for the first time this year, which in the past has served as a soft price ceiling for secondary market RGGI prices, but has been less so as the CCR has been depleted in recent years.

The OPIS RGGI forward delivery price Thursday reached lower than it had since an assessment of $16.35/st on March 14, 2024.

Also last week, Pennsylvania Republican lawmakers introduced a bill April 7 allowing the Department of Environmental Protection to create a measure for General Assembly consideration to limit carbon emissions and repeal regulations regarding the state's participation in RGGI.

Rep. James Stuzzi (R) introduced House Bill 1164, co-sponsored by 25 Republican representatives. The bill would authorize the DEP to have a public comment process on a proposed draft legislation to limit carbon emissions within 180 days and have a minimum of four public hearings.

The bill included a memo dated Dec. 9, 2024, which aimed to repeal RGGI regulations. Pennsylvania officially joined RGGI in 2022, but has been prevented from participating in the quarterly auctions due to legal challenges.

RGGI also announced Tuesday its second quarterly auction will be held June 4. The auction will offer 15.24 million allowances.

The first quarterly auction in March sold out of 15.39 million RGGI allowances at a clearing price of $19.76/st. The 2025 cost containment reserve of 8.13 million allowances was exhausted at the auction.

Washington Carbon Allowance secondary market prices were pointed lower amid softening offers.

The ICE WCA V25 December 2025 contract was bid at $57.11/mt and offered at $57.50/mt by 1:30 p.m. ET Monday. OPIS on Friday assessed the WCA V25 December 2025 price at $58/mt.

The ICE WCA V25 April 2025 contract was bid at $55.50/mt and offered at $55.89/mt by midday Monday. OPIS assessed the WCA V25 March 2025 price at $56.25/mt on Friday.

WCA prices Friday were down $1.78/mt for April and $2/mt for December compared to a week ago, also driven downward by the executive order.

Reporting by Christie Citranglo, ccitranglo@opisnet.com

Editing by Slade Rand, srand@opisnet.com and Kylee West, kwest@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

The World Bank's core mission is development and language around the institution's work and investments should align more with that and not climate, according to an internal email seen by OPIS.

"It's all about going back to basics," said the email sent last Friday by Valerie Hickey, global director of the climate change group at the World Bank. "That's the tune that I heard [last] week from three distinct constituencies: Ajay [Banga, the bank's president], the US [Environment Department's] office, and senior representatives from Ministries of Environment, Forests and Finance across the Congo Basin," she said.

"...We need to remember our roots as a development bank. That we are not a climate bank even as the weather is becoming a major constraint to ending poverty," she added.

Communications regarding the World Bank's work "also have to go back to basics", the email said, including altering how staff in the climate change team talk about the Paris Agreement climate goals. Instead of referring to "climate finance", it should talk about "smarter development finance that has

climate co-benefits", according to the email.

The email does not suggest making actual changes to World Bank policy or its climate investments. The proposed changes in communications around climate do not represent changes to the bank's core development mission and will not result in "doing less of what our clients need us to do", the email said.

Recalibrating communication and vocabulary would be a "journey", Hickey said.

"But it's a journey that will get us to where our client countries, our major shareholders and our management want us to be. And be quickly," the email said.

In November, the World Bank said it was committed to increasing its climate finance from 35% of total lending to 45% over its 2025 fiscal year, which runs between July 2024 and June 2025. In the previous fiscal year, the World Bank provided $42.6 billion in climate finance, or 44% of its total financing target for that fiscal year.

At an event at The Economic Club of Washington D.C. in late March, Banga responded to a question about how the World Bank was adapting to the current political climate in the US.

"What I've done over the last few months... is to go to people [on Capitol Hill] and now people in the [federal] administration and tell them what's inside 'climate change'. I understand the words can be not what you want, but let's talk about what's inside it first," Banga said.

Banga added that half of the bank's 45% climate finance goal for fiscal year 2025 is aimed at resiliency or adaptation efforts and the other half is focused on mitigation.

The World Bank declined to comment.

The email is part of a wider trend of institutions and corporates altering language around climate change in the wake of President Donald Trump's election in November. Since then, the US has withdrawn from global institutions like the World Health Organization and from the Paris Agreement, the international treaty signed in 2015 aimed at limiting the rise in global temperature to below 2 degrees Celsius above pre-industrial levels.

Similarly, since President Trump assumed office, government agencies have ordered via official and unofficial guidance that certain terms like "climate crisis" and "climate science" be removed from public-facing websites, according to the New York Times.

In late March, Bloomberg reported that mentions of "sustainability and related terms on earning calls" across S&P 500 companies fell on average by 76% compared to how companies were talking about the environment three years ago.

The World Bank is owned by 189 countries, and the US is the largest single shareholder of the bank's International Finance Corporation (IFC) with a 17.34% share, according to the bank's website. The US is also the only World Bank shareholder that has veto power regarding changes in the structure of the bank.

The World Bank Group was founded in 1944 and is composed of five international organizations: the IFC, the International Bank for Reconstruction and Development (IBRD), the International Development Association (IDA), the Multilateral Investment Guarantee Agency (MIGA) and the International Center for Settlement of Investment Disputes (ICSID).

The bank's main lending arms are the IBRD, which issues loans to middle-income countries, and the IDA, which provides loans and grants to the poorest countries.

Reporting by Humberto J. Rocha, hrocha@opisnet.com

Editing by Anthony Lane, alane@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

The Bundestag, the lower house of Germany's parliament, has agreed to enshrine reaching net zero carbon emissions by 2045 in the country's constitution after a two-thirds majority voted in favor of spending reforms that mark a break with its longstanding fiscal conservatism.

The constitutional reform -- approved on Tuesday by 513 of the Bundestag's 733 parliamentarians -- will allow the government to spend hundreds of billions of euros to fund defense, infrastructure and climate efforts.

The country's constitutional 'debt brake' was established in 2009 and limited the federal government's deficit to 0.35% of gross domestic product. Legislators from the center-right Christian Democratic Union (CDU) and the Christian Social Union (CSU) along with the center-left Social Democratic Party and the Greens approved the exemption of defense, infrastructure and climate spending from the rule in Tuesday's session.

As part of the constitutional reforms, €100 billion euros will be allocated towards Germany's Climate and Transformation Fund over the next 12 years to achieve the country's climate targets for 2045. This is part of a wider €500 billion fund designated for infrastructure over the same time period.

The Bundesrat -- a council of German federal states -- is expected to approve the package on Friday, finalizing the legislative process.

Germany originally set out its 2045 goal in its Climate Change Act in 2021, which had the goals of reducing emissions by 65% by 2030 based on 1990 levels and 88% by 2040 before reaching climate neutrality by 2045.

Viviane Raddatz, climate director at conservation campaigner World Wildlife Fund Germany, said that the fund had great potential for boosting climate protection and that enshrining climate neutrality in the country's constitution represented a milestone.

"But one thing is clear: €8 billion per year is far from enough to truly close the financing gap. Last week's [government carbon] emissions data show that we urgently need to invest in the transport and building sectors: Germany needs €30 billion annually here alone -- €18 billion for heat pumps and building renovation, €3.7 billion for heating networks and €12 billion for climate-friendly mobility, including €10 billion for rail," Raddatz said.

Sebastian Manhart, a policy advisor at CarbonFuture, a startup focused on carbon removals technology, said in an online post that the constitutional amendment bucked the trends of countries like the US backtracking on their climate commitments.

"Instead, [Germany] has done the opposite: enshrined [its 2045 commitment] in the most visible and long-lasting way possible," Manhart said.

Melina Maier, an associate at Global Counsel, an advisory firm, said that the 2045 target date "is a spending guideline, not a new binding target." Maier explained that the country's top court has previously ruled that the German constitution mandates a timely transition regardless of a specific deadline and that while the new constitutional amendment does reference 2045, "it does not have immediate legal implication for the approval of infrastructure projects."

The 2045 date can, however, shape future legal debate on climate policies that entities like non-governmental organizations can use, Maier said.

Maier noted that around €8 billion a year will be allocated to the fund focusing on "energy-efficient buildings and low-emission industries", but added that infrastructure and climate funds will not be sufficient to achieve decarbonization in Germany.

"It needs a coherent government strategy to align investments with priorities. The fund's impact -- both domestically and across the EU -- will ultimately hinge on how the next government allocates and prioritizes investments," Maier said.

The changes to the constitution come in the aftermath of German federal elections in late February when the conservative CDU, led by chancellor-in-waiting Friedrich Merz, and its CSU allies came out on top with a combined 28.6% of the vote, followed by the far-right party Alternative for Germany, which gained 20.8% of votes.

Reporting by Humberto J. Rocha, hrocha@opisnet.com

Editing by Anthony Lane, alane@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

Corning, Suniva and Heliene have announced a partnership they say will produce the first fully made-in-America solar modules.

Corning will produce wafers in Michigan, sourcing polysilicon from its subsidiary Hemlock Semiconductor. Suniva will treat the wafers in its Georgia plant to make cells, which Heliene will assemble into modules in Minnesota. The resulting panels will have a record 66% domestic content, offering developers a "significant advantage" to clearing percentage thresholds needed to secure the

10% domestic content bonus to the Inflation Reduction Act's Investment Tax Credit (ITC).

Corning has not released the timeline or annual capacity for its wafer facility. The company in October announced that it would be expanding Hemlock's polysilicon production, and developing ingot-and-wafer manufacturing in the state.

That followed shortly after news that ingot and wafer producers would be eligible for a 25% Advanced Manufacturing Investment Credit established in 2022's CHIPS and Science Act, and that Hemlock had locked up roughly $325 million in federal funding to expand its polysilicon production.

South Korea's Qcells had billed itself as the first firm to develop a soup-to-nuts U.S. supply chain, a claim that crumbled when REC Silicon in December announced it was ceasing production at its Moses Lake polysilicon plant in Washington. Qcells will now supply its forthcoming ingot-wafer-cell-module facility in Georgia with OCI polysilicon made in Malaysia.

After filing for bankruptcy in 2017, Suniva re-asserted itself with the help of the IRA, starting U.S. cell production at its 1 GW Georgia factory again in September. It is now one of just two cell producers operational in the country after ES Foundry fired up production lines in South Carolina in January. Suniva had previously established a supply partnership with Heliene, which produces 800 MW of modules annually and will add 1 GW of additional capacity in 2025.

Reporting by Colt Shaw, cshaw@opisnet.com

Editing by Jordan Godwin, jgodwin@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

Global commodities trader Trafigura has emerged as the highest bidder in Singapore's first public tender for Article 6-aligned nature-based carbon credits, offering S$299.19 million ($223 million) for an undisclosed volume, as the city-state seeks to complement domestic climate action with international offsets.

The government's request for proposals closed on Feb. 14 and attracted 17 bidders, including major commodities traders and energy firms. "Trafigura has offered to supply high-integrity carbon credits from our global portfolio of nature-based removals," a spokesperson from the commodities firm said on Wednesday, in response to queries on proposal details.

Other major bids to supply correspondingly adjusted nature-based credits through 2031 include Mercuria Asia Resources' S$206.65 million for 5.36 million metric tons at S$38.52/mt, with an alternate offer of S$35.41/mt, with detailed pricing depending on the delivery year and project. Singapore-based DNZ ClimateTech proposed S$200 million for 5 million mt, averaging S$40/mt.

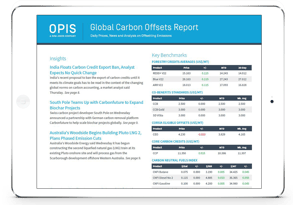

Singapore aims to cut emissions to 60 million mtCO2e by 2030, using international credits to help meet its climate targets. The country expects to use 2.51 million mt of internationally transferred mitigation outcomes annually from 2021 to 2030, which must comply with Article 6 rules to prevent double counting in emissions reductions. Price signals from early Article 6-aligned deals suggest a clear premium compared to credits traded in the voluntary markets. Switzerland's Klik Foundation, which manages the country's decarbonization efforts, paid an average price of CHF 27/mt ($30/mt) for its Article 6-aligned credits in 2023, as reported by OPIS.

Carbon Credit Prices Across Voluntary and Compliance Markets

Source: Average bid price data available*, OPIS APAC Carbon Report,

Global Carbon Offsets Report (Feb. 20, 2025)

Disclosed average per-unit bid prices, excluding outliers, ranged from S$25 to S$55/mt, higher than offsets eligible under the CORSIA aviation offsetting scheme, which OPIS last assessed at $18.25/mt. This range also surpasses prices in regional compliance markets such as Australia, New Zealand and South Korea ($6.70 to $35.90/mt). In the voluntary market, OPIS priced 2025 REDD+ credits at $12.13/mt and blue carbon credits at $28.24/mt.

Each bid could include a portfolio of projects with pricing quoted in Singapore dollars per mtCO2e for each annual delivery tranche, according to tender documents seen. Singapore has signed legally binding agreements with Ghana and Papua New Guinea for such transfers and has substantially concluded talks with Bhutan, Paraguay and Vietnam.

Carbon Solutions Services submitted the highest disclosed per-unit price at S$55/mt for 500,000 mt, offering credits from Ghana and Paraguay backed by Temasek's GenZero platform. Malaysia’s Carbon Trace submitted the lowest disclosed price of S$25/mt for 1 million mt.

Other bids include U.S. firm Native, a public benefit corporation, which bid S$190.99 million for 5.4 million mt, with tiered pricing from S$26.41 to S$44.07 per mt over five years. Energy major Shell Eastern Trading submitted a S$34.04 million bid pending management approval, while PetroChina International (Singapore) offered S$21.84 million for 500,000 mt, with prices escalating from S$38.88 to S$49.88/mt for 2027-2029 delivery.

Some bidders structured pricing around Singapore's carbon tax, which allows liable companies to offset up to 5% of emissions with international credits from 2024. Climate Asset Facility offered S$73.15 million for 1.75 million mt, proposing a 50% discount to the projected tax rate, starting at S$22.50/mt in 2027 and rising to S$40/mt by 2031, plus a S$13.50/mt fee for corresponding adjustments.

The tender called for credits from approved methodologies, including forest management, grassland sustainability and wetland restoration under Verra, ART-TREES and Gold Standard. The National Climate Change Secretariat said the total procurement volume will be decided after proposal assessments. Partial offers are expected to be considered unless bidders specify otherwise.

Singapore is positioning itself as a carbon trading hub, with the sector projected to create up to $5.6 billion in economic value. Successful bidders must provide a 5% security deposit and could face penalties of up to S$80/mt if they fail to deliver credits. Bids remain valid for 180 days.

Reporting by Melissa Goh, mgoh@opisnet.com

Editing by Mei-Hwen Wong, mwong@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

Apple misled consumers and engaged in greenwashing when it promoted its 2023 watch lineup as carbon neutral, plaintiffs alleged in a class-action suit filed in US District Court Wednesday.

The California tech company described its 2023 watches as "its first-ever carbon neutral products" in a September news release that year. Apple had reduced value chain emissions for the watches by over 75%, it said. "The company will use high-quality carbon credits to address the small amount of remaining emissions, resulting in a carbon neutral product footprint," Apple said at the time.

The seven plaintiffs named in the lawsuit, filed in the US District Court for the Northern District of California this week, allege that Apple's carbon neutral claims were "false and misleading" because the projects from which Apple retired carbon credits to account for the products' remaining emissions "fail to provide genuine, additional carbon reductions," the complaint reads.

The plaintiffs "suffered economic injury because Apple's false 'carbon neutral' claims deprived them of the ability to make informed purchasing decisions in the smartwatch market," according to the complaint.

They are, therefore, seeking damages related to purchasing the watches on false pretenses, Fletch Trammell, one of the attorneys bringing the case, told OPIS.

"We have to prove, when we get in front of a jury, that there is a definition of what carbon neutrality means," Trammell said. "Apple claimed that it met that definition using certain components that actually quantified the amount of carbon offset. We can demonstrate that those carbon offsets are completely bogus. There was no carbon neutrality, which makes that claim untrue."

According to the complaint, Apple retired credits from the Chyulu Hills REDD+ project in Kenya and the Guinan ARR Project in China to address the remaining emissions from its 2023 watch lineup.

REDD+ stands for reducing emissions from deforestation and forest degradation, while ARR stands for afforestation, reforestation and revegetation.

Citing satellite imagery, plaintiffs allege that the majority of Chyulu Hill's protected forest carbon stocks lie within the Chyulu Hills National Park, which has been protected land since 1983. They also argue that 78% of Guinan was "already covered by trees" before the project's crediting period began.

As such, "the two primary projects from which Apple purchases its carbon credits ... fail to provide genuine carbon reductions," according to the lawsuit.

In its 2024 Environmental Progress Report, the latest available, Apple said it retired 230,000 vintage 2018 credits from Chyulu Hills and 255,000 V19-V21 credits from Guinan "toward our corporate emissions footprint for 2023" but did not specify if any of the credits were specifically designated for its watch products' carbon neutrality.

The company was named as the beneficiary of over 1.5 million credits retired since 2021 from six different projects, Verra records show. The company was not designated as the retiree of any credits on the Gold Standard, ACR or Climate Action Reserve registries.

Apple did not respond to a request for comment.

Nine other false and misleading advertising cases have been brought against companies in the US in the past, including Delta Airlines, its partner KLM Royal Dutch Airlines, JBS USA Food Co., Etsy, Danone Waters of America, Eversource Energy, Tyson Foods and Northwest Natural Gas Co., according to the Global Climate Change Litigation Database.

These lawsuits have significantly dampened demand for carbon credits, sources have told OPIS. But their plaintiffs have yet to establish a successful track record in court.

KLM had two greenwashing cases dismissed. In one, the plaintiff's attorney was found to have knowingly brought his client's claims on false pretenses and was sanctioned by the US District Court of the Southern District of New York.

The cases against JBS and Danone were dismissed, but both judges allowed the plaintiffs to bring amended complaints. The case against Etsy was voluntarily dismissed by the plaintiffs. The cases against Delta, Eversource and Northwest Natural Gas are still in progress.

At the same time, the practice of advertising products as carbon neutral has received significant criticism.

The European Union decided to ban carbon neutral claims on products following negotiations that concluded just over a week after Apple's Watch announcement in September 2023. The bloc's Empowering Consumers for the Green Transition Directive will take effect in 2026.

"There is no such thing as 'carbon neutral' ... cheese, plastic bottles, flights or bank accounts," European Consumer Organization Deputy Director General Ursula Pachl said in a statement at the time.

Besides sourcing credits from the voluntary market, Apple has dedicated significant investments to developing carbon projects.

The Cupertino, Calif.-headquartered corporation announced a $200 million initiative to fund forest removal projects in partnership with Goldman Sachs and Conservation International - one of the developers of Chyulu Hills - in 2021. The company aimed to use the fund to remove at least 1 million metric tons of carbon per year.

Apple expanded the effort in 2023 with an additional $200 million commitment and a goal of removing an additional 1 million mt of emissions that has been overseen by Climate Asset Management. Apple suppliers TSMC and Murata Manufacturing joined the Restore Fund with contributions of $50 million and $30 million, respectively, in 2024.

Apple maintains a broader corporate goal of reducing value chain emissions by 75% by 2030 and achieving carbon neutrality by offsetting the remainder with carbon credits.

Reporting by Henry Kronk, hkronk@opisnet.com

Editing by Jeremy Rakes, jrakes@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

Paraguayan President Santiago Peña signed a law on Tuesday that will bring all carbon projects in the country under one registry and manage their interplay between voluntary and Paris Agreement markets.

Law No. 7190/23 "On Carbon Credits" was passed by the Paraguayan legislature in 2023, and following its signing by Peña, will take effect within 180 days, according to its text.

All projects operating in Paraguay will need to record their activity with a national registry that will be established by the country's Ministry of Environment and Sustainable Development (MADES), according to the law. The registry will also oversee the country's participation in the Paris Agreement and prevent the double-counting of credits for voluntary retirements and nationally determined contributions of the UN climate accord.

The law "will allow the country to advance in bilateral negotiations with Singapore, the United Arab Emirates (UAE), Switzerland, Taiwan and Finland, negotiations that are already underway," MADES said in a Tuesday news release.

Projects that sell their credits to the voluntary market will need to contribute between 3% and 10% of issuances to Paraguay to advance its own NDC.

Violations of the law could incur penalties of temporary or permanent disqualification from the Paraguayan national registry and fines, according to the text.

The law stipulates that carbon projects operating in Paraguay will have one year to register with the new system.

"This is a great opportunity, since the voluntary market is currently paying between $3 and $15 per ton of sequestered carbon, and the regulated market between $40 and $70," Minister of Industry and Commerce Javier Giménez said in the news release. "Given the type of carbon sequestration projects that Paraguay offers in its forestry sector, this could become an export market of between $300 and $500 million per year."

The prices Giménez quoted roughly matched OPIS price assessments for nature-based reduction projects. OPIS on Tuesday assessed its REDD+ V20 Tier 3 range at 50cts/metric ton to $13/mt and its REDD+ V22 Tier 3 range at $5.50/mt to $15.50/mt. But nature-based removal credits from afforestation,

reforestation and revegetation projects trade at a premium and can command forward prices of $50/mt or higher, as OPIS has previously reported.

REDD+ stands for reducing emissions from deforestation and forest degradation.

Paraguay's carbon credit law could draw a significant volume of nature-based credits from the voluntary market into the Paris Agreement system. Three REDD+ and seven ARR projects in the country are currently registered with Verra, registry records show. Three more REDD+, three more ARR and two agricultural land management projects are in Verra's development pipeline. Together, these have estimated annual issuances of over 8.9 million credits.

Two ARR projects registered with Gold Standard are also underway.

"Paraguay is a country with strategic resources and immense potential. With this regulation, we ensure that these resources translate into real opportunities for Paraguayans, in employment, investment and sustainable growth," Peña said in the MADES news release.

MADES did not immediately respond to a request for comment.

Reporting by Henry Kronk, hkronk@opisnet.com

Editing by Jeremy Rakes, jrakes@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

The stage is set for Malaysia’s solar demand growth to pick up pace following the introduction of new government policies last year aimed at broadening access to renewable energy, said Khirul Nizam, Strategic Partnerships and Business Development Lead at Malaysian state utility Tenaga Nasional Berhad (TNB)’s New Energy Division, which oversees TNB’s overseas and domestic renewable energy portfolio.

Recent solar headlines on Malaysia have focused on the impact of U.S. tariffs on Malaysia’s export- oriented solar manufacturing sector but domestically, the government is charting its own course towards a solar-dominated net-zero future.

“In any country with a regulated electricity model, the pace of energy transition will always depend on the regulations. And the growth of renewable energy in Malaysia has been driven by positive policies from the government,” said Nizam, who was TNB Renewables’ chief operating officer before a two-year overseas stint in Turkey.

Malaysia’s energy regulator, the Energy Commission, issued guidelines last September for the Corporate Renewable Energy Supply Scheme (CRESS), a new initiative that marks a radical departure from how companies can access green electricity in the country.

Current government solar schemes such as the utility-scale Large-Scale Solar (LSS) designate TNB as the single offtaker. TNB, which owns the National Grid in Peninsular Malaysia, then sells the green electricity produced to consumers.

Under CRESS however, consumers can contract directly with solar developers instead of only buying renewable energy from state utilities. Project developers previously had to wait for government tenders to be issued to bid for solar projects, but they now can negotiate at their own pace with companies looking for renewable energy capacity.

“You can describe LSS as relatively low risk, low return because you are dealing with state utilities. CRESS in comparison is more high risk and high return because it is purely willing buyer and willing seller. The faster you can get customers, the faster you can grow your projects,” said Nizam.

As geopolitical factors, trade policies, and manufacturing strategies evolve, the landscape of solar PV production and distribution is undergoing significant change. OPIS's on-demand webinar, “Solar 2025: Bust-Ups, Break-Ups And Shake-Ups,” provides an in-depth examination of the dynamic transformations occurring within the global solar photovoltaic (PV) industry. Key topics discussed include Polysilicon Supply Chain Diversification, Chinese Manufacturers' Overseas Strategies, US PV Manufacturing and Trade Policies, and Europe's PV Manufacturing Renaissance. Register and watch here.

At least two green electricity supply agreements have already been signed under CRESS since its implementation last September. Renewable energy developer UEM Lestra announced in January that it secured CRESS offtakers for its 1GW hybrid solar power plant in Johor with a target to meet commercial operations by end of 2027. TNB announced last November that it was supplying Bridge Data Centres with 400 MW of green electricity under CRESS.

Prices of these CRESS agreements were not disclosed. But bids into earlier LSS tenders have fallen below RM0.15/kwh ($0.034/kWh) amid declining module prices.

Riding on the wave of burgeoning investments in AI around the world, data centers are set to become a key driver for corporate green electricity demand, Nizam said.

As of end-September 2023, TNB completed six data center projects with around 292 MW of electricity supply and signed 2 GW of electricity supply agreements (ESAs) with eight data center projects. By September 2024, the numbers had surged to 1.7 GW of 17 completed data projects, 1.9 GW for eight projects still under construction and another 1.1 GW for six projects for which ESAs have been signed.

TNB now expects the potential electricity demand from data centers to exceed 5 GW by 2035, itself an upgrade from its 2023 projections of 4.3 GW.

“Data centers right now are looking into renewables because they are concerned about ESG (environmental, social and governance) goals,” Nizam said.

Even as it rolls out stimulus policies for green energy, Malaysia’s solar growth can appear modest compared to the breakneck speed at which some of its neighbors are expanding the sector. Solar capacity in Vietnam, for example, skyrocketed by over 400% from 2019 to 2021 after having added 11 GW in 2020 alone.

But by sitting out on the high-speed chase for expansion, Malaysia has also avoided the logjams and project failures that have at least temporarily derailed some of the growth markets.

“Malaysia is very stable in terms of regulatory policies because we are doing things for the long-term,” Nizam said, noting that grid capacity and project sustainability are key considerations.

Whether at stable or breakneck speed, energy transition is capital-intensive. Malaysian Prime Minister Anwar Ibrahim called publicly in January 2024 for government-linked governments to reduce their overseas investments in favor of domestic ones, providing yet another fillip to the country’s renewable energy sector.

TNB itself has a renewable energy project pipeline of up to 10 GW from 2024 to 2030, the bulk of which are solar or hydro-solar hybrid projects. On project count alone, most of these upcoming projects are in Malaysia rather than overseas, where TNB has built up a significant presence over the years.

Even so, there are questions over whether Malaysia’s domestic boom can sustain a domestic supply manufacturing chain on its own, Nizam said. Malaysia has around 10 GW of module manufacturing capacity, the bulk of which is absorbed by overseas markets.

“To build your own supply chain, you have to make sure your market is big enough, and that you can compete with the lowest cost supplier for the long-term,” Nizam said.

With the lowest cost module suppliers in China embroiled in a downward spiral of cut-throat price competition, questions have been raised over the health and direction of the solar industry, both for manufacturers and project developers.

Nizam, with his years of experience in international and domestic solar markets, remains unfazed. “The solar market has always experienced boom and bust cycles. The industry as whole will get through it like before,” he said.

© 2025 Oil Price Information Service, LLC. All rights reserved.

The leaders of the European People's Party (EPP), the party with the most representatives in the European Union Parliament—the EU's legislative body—with 188 out of a total 720 seats, said the carbon border tariff that importers are expected to start paying next year "should be put on hold for at least two years."

Following the EPP's leaders' retreat in Berlin over the weekend under EPP President Manfred Weber, the party published a three-page brief criticizing regulatory burdens and obligations for companies in Europe that are stymying economic growth and investment.

"We advocate cutting back bureaucracy and regulation substantially... we need to go further and be even more bold because excessive regulation and bureaucracy has today become a key reason for the EU's productivity falling further behind the US and China," the party wrote.

The centre right party—of which EU Commission President Ursula von der Leyen is a member—said a two-year pause should also look at reviewing the scope of the carbon border adjustment mechanism (CBAM) and other laws.

This would be to "limit the scope of these laws to the largest companies with more than 1,000 employees, eliminate the direct effect to [small and medium-sized enterprises], align legislative overlaps ... and significantly reduce the reporting obligations for large companies by at least 50%", the EPP leaders wrote.

The CBAM went into effect in October 2023, requiring EU importers to file quarterly and eventually annual reports detailing the embedded emissions in their products.

The CBAM will initially apply to six sectors—steel, cement, iron, fertilizers, hydrogen and electricity—but the EU could announce an increase to that scope this year in order to include more sectors by 2030.

EU importers are scheduled to start paying for these embedded emissions based on the weekly average auction price of EU carbon allowances (EUAs) starting in 2026 as the CBAM cost is phased in gradually until fully implemented in 2034.

"The CBAM has to be scrutinized as well regarding its effects on red tape and the competitiveness of the different sectors of our economy," the EPP said. The EPP said the two-year pause should also apply to the implementation of corporate sustainability regulation such as the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence

Directive (CSDDD).

An EPP representative told OPIS on Tuesday that the two year pause on the CBAM and other legislation is now part of the party's official stance according to the party leaders following their weekend retreat.

"[The] EPP Group's position on CBAM is unchanged. The EPP Group supports CBAM but the implementation and paperwork has proven to be too burdensome, including the paperwork to prove the carbon content. Therefore, we need time to fix it," the representative said.

'Certainty' Needed for Businesses and Trump Trade War Looms

Gabriel Rozenberg, chief executive officer of CBAMBOO, a software company aimed at CBAM compliance, told OPIS on Tuesday that European businesses deserve certainty, especially as there has been a ramping up phase for the CBAM since late 2023.

Policymakers should be careful when pushing for simplifications that do not undermine the credibility of the future tax requirement, Rozenberg said, otherwise companies "could get whipsawed" by a major new charge they failed to anticipate.

"There is obvious room for improvement and simplification in the way that the CBAM operates on companies. At the same time, businesses right now have less than a year to prepare for the introduction of a major new tax," Rozenberg said.

Faten Aggad, executive director of the African Future Policies Hub, wrote in a social media post Monday evening that the EPP could potentially block the ongoing legislative review as the CBAM transitions towards full entry next year.

"That process is ongoing and the [EU] Commission is expected to submit a legislative proposal to the [EU] Parliament detailing proposals on scope expansion, measures for developing countries, etc.," Aggad wrote. "That legislative proposal risks being blocked by the EPP and their allies (from right to center). This would make it a majority opposition."

Aggad noted that with President Donald Trump now in power in the United States, the EU might want to avoid a trade war, especially if the American president decides to place a steel tariff on EU goods.

"A new Trump tariff would be felt more strongly this time around... a postponement may be the least worst option considering circumstances," Aggad said.

In his first day in office, Trump signed an executive order pulling the US out of the Paris climate agreement, to which nearly 200 countries signed back in 2015 to keep global warming levels below 2 degrees Celsius above pre-industrial levels. Trump also pulled out of the agreement in 2017 in his first term and former President Joe Biden re-inserted the US into the pact in early 2021.

Earmarking Larger EU ETS Revenues for Hard-to-Abate Industry

The EU Emissions Trading System (EU ETS) or carbon scheme is also in the EPP's crosshairs.

The EPP leaders wrote that a "larger share of ETS revenues should be earmarked to energy intensive industries, for example for supporting green hydrogen or carbon capture and storage solutions."

Energy intensive industries include the cement, steel, iron sectors among others that are the highest carbon emitters in the EU ETS. While these industries receive free EUAs on an annual basis depending on their current activity levels, the EPP appears to be calling for additional funds from EU ETS

revenues to be allocated towards these industries.

The EU ETS is a market-based mechanism that charges polluters a variable carbon price with the incentive to decarbonize in order to buy less EUAs.

As of Monday, OPIS assessed the benchmark December 2025 EUAs futures contract at €79.50/mt ($82.29), its highest level in months.

"The EU has decided on ambitious climate targets and policies to achieve them. When implementing them, we must make sure that they do not lead to deindustrialization. If climate policy becomes an obstacle for competitiveness and growth, it will not only fail to have the support of European citizens, but it will also risk increasing global emissions because products will be produced in other regions of the world with higher emissions," the EPP leaders wrote.

Reporting by Humberto J. Rocha, hrocha@opisnet.com

Editing by Yazdi Merchant, ymerchant@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

Singapore's first public tender for carbon credits, seeking at least 0.5 million metric tons (mt) of credits from high-quality nature-based projects, positions the city-state as an early mover in government-led Article 6 transactions under the Paris Agreement, potentially setting a benchmark for the nascent global market, sources said.

The Request for Proposal (RFP), issued by the Prime Minister's Office in September 2024, is intended to count towards Singapore's Nationally Determined Contribution (NDC) target to reduce emissions to around 60 million metric tons of CO2 equivalent (mtCO2e) by 2030, after peaking earlier.

Official projections have estimated Singapore will require 2.51 million mtCO2e annually in Internationally Transferred Mitigation Outcomes (ITMOs) from 2021 to 2030 to make up for residual emissions reductions required to meet its NDC target. It has sought bilateral collaboration on ITMOs with partners via Article 6.2 of the Paris Agreement, underpinned by legally binding bilateral Implementation Agreements, which require corresponding adjustments for credits transferred to Singapore to avoid double counting.

The contract will span an expected period of five years, requiring delivery of correspondingly adjusted nature-based credits generated between 2021 and 2030. Final delivery of all credits must be completed by Feb. 15, 2031, according to tender documents seen by OPIS. Initially scheduled to close in November, the submission deadline was extended twice, first to Jan. 17 and now to Feb. 14.

Each proposal must deliver a minimum of 0.5 million mt of credits, though the total procurement volume will be determined after receiving and assessing proposals, a spokesperson from the National Climate Change Secretariat (NCCS) said.

Successful bidders will be subject to a 5% security deposit based on the contract value and must source alternative eligible credits in case of shortfalls. Potential penalties will be tied to Singapore's prevailing carbon tax, which is set to rise from S$25 ($18.30) per mt now to S$45 in 2026 and as much as S$80 by 2030.

"The security deposit and liquidated damages are safeguards against non and/or late delivery of carbon credits," the NCCS said.

Market participants noted that these requirements, combined with the risks in securing host-country authorizations under Article 6, could deter smaller players - limiting participation to firms with robust financial backing and host-country relationships.

"The tender could carry more risk for sellers than what has been seen in some early private-sector deals and negotiations, which supply correspondingly adjusted credits contingent on host-country authorization," a trader said.

One project developer described the penalties as severe, particularly given the potential financial burden if credits are not delivered. "A penalty towards the upper end of Singapore's potential carbon tax hike to S$80/mt by 2030 if failing to deliver or source alternative credits would be devastating," the developer said. "It's far beyond what developers can expect to sell credits for."

Credits for the tender must meet Singapore's Environmental Integrity Criteria, be verified under approved methodologies, and align with government-to-government agreements. Accepted methodologies include Verra standards for forest management (VM0012), sustainable grasslands (VM0032), peatland rewetting (VM0036), Verra's jurisdictional REDD+ programs, and ART-TREES REDD+ (Version 2.0). Bidders may also propose alternative methodologies for consideration, such as those recognized by the International Civil Aviation Organization's Carbon Offsetting and Reduction Scheme for International Aviation or the Integrity Council for the Voluntary Carbon Market's Core Carbon Principles, following tender documents.

Proposals can include a portfolio of up to 10 projects and must specify eligible host countries with bilateral agreements or MOUs with Singapore. While Singapore is in various stages of negotiation with a range of partner countries, legally binding implementation agreements have been finalized only with Ghana and Papua New Guinea, to date. For countries without agreements, bidders must secure confirmation from the host government of its willingness to negotiate. "Clarity on its implementation agreements and processes will be critical for bidders," a second trader added.

Pricing will be based on Singapore dollars per mtCO2e for each annual delivery tranche, following the tender.

Carbon credits in the voluntary market vary significantly based on methodology, vintage and volume. OPIS last assessed nature-based REDD+ Vintage 2021 Credits at $8/mt, Blue Carbon V21 Credits at $25.71/mt, and Afforestation/Reforestation V21 Credits at $17.23/mt on Jan. 16.

Price signals from early Article 6-aligned deals suggest a clear premium compared to credits traded in the voluntary markets. Switzerland's Klik Foundation, which manages the country's decarbonization efforts, paid an average price of CHF 27/mt ($29.62/mt) for its Article 6.2-aligned credits in 2023, as OPIS reported.

Singapore's first tender highlights its ambition to position itself as a hub for carbon markets while setting standards for nature-based solutions (NBS), a segment under scrutiny in recent years, sources indicated.

"We are encouraged by early market activity, such as Singapore's RFP, as it signals progress in advancing Article 6," said Bjorn Fonden, International Policy Advisor at IETA, adding that Article 6 is fully ready for implementation following COP29.

"Supply remains constrained, largely due to the complexities of establishing national frameworks and aligning ITMO exports with NDC priorities in host countries. We believe that these early demand signals from buyers can help boost market confidence and enable the unlocking of high-integrity supply," Fonden added.

Globally, 97 bilateral agreements between 59 countries have been signed under Article 6.2, with 141 pilot projects recorded to date, most under Japan's Joint Crediting Mechanism, according to the UN Environment Program. Only five projects, including Thailand's Bangkok E-Bus Program and Ghana's Transformative Cookstove Activity, have received authorization so far, underscoring the nascent stage of Article 6 implementation.

$1 = S$1.367

$1 = CHF 0.910

Reporting by Melissa Goh, mgoh@opisnet.com

Editing by Mei-Hwen Wong, mwong@opisnet.com

© 2025 Oil Price Information Service, LLC. All rights reserved.

More regulatory clarity is needed to tap into Indonesia's carbon market potential following a moratorium on international trading that has stalled the market's growth for years, participants at the Carbon Digital Conference 2024 held Dec. 9-11 in Jakarta, Indonesia, said.

Discussions at the event focused on aligning domestic standards with international frameworks and addressing barriers and opportunities to enable the market's progress.

Vice Minister of Environment Diaz Hendropriyono emphasized the key task of improving the national carbon registry (SRN-PPI) in this effort, described as the backbone of Indonesia's market infrastructure.

"It has to be user-friendly, cost-effective, and fast," Diaz said on Dec. 11, stressing the need to reduce credit registration delays and cut transaction costs. Carbon projects in Indonesia must be registered in the SRN-PPI to be formally acknowledged and claimed for crediting.

Plans are underway to streamline project pre-feasibility stages and expand the number of validation and verification bodies (VVBs). "We currently have around five to six VVBs, and we are working to accredit nine more soon," Diaz added. "The more VVBs we have, the more competition, which will hopefully lower prices and reduce bottlenecks."

Indonesia has long been a key supplier to global carbon markets, particularly through nature-based solutions such as the Katingan Peatland Restoration and Rimba Raya REDD+ projects. A white paper released by PwC and the Indonesia Carbon Trade Association (IDCTA) last week projected that the country could generate 1.28 billion carbon credits by 2030, translating to $6.8 billion to $15.2 billion in corresponding adjustment revenue and $0.6 billion to $1.5 billion from non-corresponding adjustments.

While Indonesia is open to collaboration under Article 6 of the Paris Agreement, it will prioritize domestic climate goals. "Carbon trading must support the achievement of our NDCs," Diaz said. The country has already signed bilateral agreements with players, including Japan, under the Joint Crediting Mechanism. However, certainty around corresponding adjustments remains essential to instill confidence among international participants.

Stakeholders noted Indonesia's potential to meet global demand for carbon credits, including under Article 6 and the CORSIA aviation offsetting scheme. "There is interest from countries like Singapore and Japan in sourcing Article 6-compliant credits globally to fulfill their NDCs," said Fam Wee Wei, Singapore's Director of Carbon Mitigation and International Trade at the Trade and Industry Ministry, as well as from companies seeking credits to manage tax liabilities or for voluntary use.

Participants also underscored the need for mutual recognition between the SRN registry and international standards such as Verra and Gold Standard. They said this alignment is essential to facilitating the flow of high-integrity credits and restarting international trade.

"There are too many standards and methodologies," said Dr. Riza Suarga, chairman of the IDCTA. "Tapping on existing methodologies can provide more assurance to secure investments as well." Suarga noted that waiting for regulatory frameworks to solidify was a legitimate strategy for market participants.

Land title disputes were flagged as another critical risk to address. "Investors need assurance that land titles and ownership structures are clearly delineated," said Fam Wee Wei. Without clarity, participants noted, such issuescould deter much-needed investment in the forestry sector, a cornerstone of Indonesia's carbon credit pipeline. Still, Fam highlighted existing investor protection clauses within regional free trade agreements that provide a measure of assurance for Singaporean investors.

Despite these challenges, optimism remains. Indonesia's new administration, which took office in October, and has signaled a commitment to restoring confidence in the country's carbon market ecosystem.

The country is already preparing a growing pipeline of projects for registration, signaling significant supply potential. Developers noted that several forestry and mangrove projects are close to being credit-ready and awaiting regulatory clarity to proceed.

As of June, more than 260 projects were registered under the national registry, with energy (172) and forestry (45) projects dominating the list. According to the PwC-IDCTA white paper, an additional 75 projects, including 33 energy and eight forestry initiatives, have been verified.

"We have shortlisted and are ready to invest in several carbon projects in Indonesia, but regulatory certainty needs to come first before we do that," one attendee said, adding that robust regulations aligned with international standards and registries will be key to supporting meaningful progress in Indonesia's carbon markets.

The CDC2024 was organized by the IDCTA in partnership with IETA, JETRO and PwC.

Reporting by Melissa Goh, mgoh@opisnet.com

Editing by Hanwei Wu, hwu@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

Opportunities abound in Southeast Asia's nascent solar market but quality still trumps quantity when it comes to project development, according to Peak Energy's CEO, Gavin Adda, undoubtedly drawing from his decades-long experience of navigating solar markets around the world.

Adda might have long left the archaeology field that he majored in during college but his illustrious career in the solar industry is no less Indiana Jones-esque.

He left Samsung in 2013 as the managing director of its utility-sale renewable business in the U.S. following a six-year stint, moved to Singapore where he engineered the sale of REC to ChemChina, helped found renewable energy developer CleanTech Solar, then took over as CEO of French oil majorTotalEnergies' utility-scale and distributed generation business in Asia.

Developing and nurturing nascent markets was his trade, a forte that took him from one pioneering deal to the next across Asia, the Middle East and Africa.

Now Adda finds himself building yet another business - regional solar developer Peak Energy, which is backed by $70 billion investment fund Stonepeak, one of the world's largest infrastructure funds.

"A lot of the value (in solar projects) comes from early-stage development but there are not many players out there focused on that stage - in Asia generally and in Southeast Asia especially. I wanted to bring more funding in at that stage," Adda said of his move to Peak Energy a year ago.

Peak Energy inherited from Stonepeak a solar investment portfolio of less than 30 MW in Japan and 99 MW in South Korea. Over the past year, Peak Energy has added an under-construction 291 MWh battery energy storage system in South Australia, around 300 MW of projects in Korea and 100 MW in Taiwan. Another 600-700 MW of projects is under development, the bulk of it in Southeast Asia.

"If you look at where global renewables growth is coming - a lot of the future growth is coming from Southeast Asia. That is where the opportunity is," Adda said.

On paper, the argument might seem obvious. Southeast Asia is expected to account for 25% of global energy demand growth between now and 2035, second only to India, according to the International Energy Agency (IEA) last month. The region however currently receives only 2% of global clean energy fundingdespite representing 6% of the global gross domestic product (GDP) and 5% of global energy demand.

But to actually navigate the region's labyrinth of solar policies requires as much guile and finesse as finding the lost Ark, and this is where Adda's globetrotting experience comes in handy.

"What's interesting for me is when I look at Southeast Asia or Asia generally, I can draw parallels between them and what happened in various states across the U.S. - 15- 20 years ago. Arizona and California are particularly good examples of the wide range of reactions you might see. This history gives us aframework and sense of what could happen next and the problems we can expect to see," Adda said.

Countries across Southeast Asia have announced a slew of policy changes over the past year aimed at driving renewable energy growth. Malaysia, Thailand and Vietnam now allow, each to a different degree, renewable energy developers to sell electricity directly to consumers. Indonesia halved in August the minimum local content requirement for solar power plants to 20%.

Adda highlighted a key driver behind this liberalization trend in Southeast Asia that mirrors the decoupling dynamics seen in the PV manufacturing space.

"The big driver behind all this is that large industrials and corporates are moving out of China and into Southeast Asia. They have carbon targets. If it is difficult to get renewable energy in one country, they will just move to another one," Adda said.

The crash in solar module prices might seem like another apparent boost to solar developers -- the China Module Marker, OPIS's benchmark for solar modules loading from China, has plunged by over 66% to $0.087/wp as of Nov. 12.

Thanks partly to this price crash, solar is indeed already outperforming grid parity for behind-the-meter (BTM) projects, Adda said. Indonesia charges electricity tariffs of around $0.07 per kWh for businesses, which is among the lowest in Asia. Solar can do lower at $0.05 to $0.06 per kWh, Adda pointed out.

But like all high-growth markets, renewable energy project development in Asia space has been attracting a deluge of new entrants. The Department of Energy in the Philippines, for example, has awarded around 510 solar projects to at least 274 different entities so far as of August 2024. It announced in October that it could terminate over 50 of these projects for not complying with agreed timelines.

"We're always going to see irrational players come into the market, maybe with not a lot of experience in power or renewables and doing deals at unsustainable prices," Adda said.

In the absence of a liquid spot electricity market, which is the case in most of Asia, solar power is typically sold via government feed-in tariffs schemes, negotiated power purchase agreements (PPAs) or auctions. Given the long lifespan and capital-intensive nature of solar projects, competing on price alone is a risk for both the developer and the off-taker.

The shortcomings of such an approach will be laid bare as funding slows, Adda pointed out.

This is already happening. Globally, fundraising by infrastructure funds tallied around $98 bn in 2023, sharply lower than the $173 bn raised in 2022, with 2024 appearing to lag 2023, according to data provider Preqin in May.

Developers that rushed into project development using equity have to turn to debt financing as funding dries up. But some would be stuck because badly built projects and badly structured contracts are unlikely to attract lenders, Adda said.

"It is really difficult to generalize across the region but I think generally you are seeing a pause and you are seeing a lot of developers tap out," he added.

Unsurprisingly, Adda notes that this "debt chasm" phenomenon is a replay of what had happened in the U.S. 15 years ago.

Not that it fazes him. "The key has always been to steer your ship without getting too distracted by everybody else," Adda said.

"If they want to be irrational, then let them go ahead. We will pick up their portfolios after they are gone. There's no magic here - it's infrastructure."

Reporting by Hanwei Wu, hwu@opisnet.com

Editing by Lujia Wang, lwang@opisnet.com

© 2024 Oil Price Information Service, LLC. All rights reserved.

Washington Carbon Allowance (WCA) secondary market prices spiked $10/mt Wednesday morning following state voters' decision Tuesday night to maintain the Cap-and-Invest Program.

Ballot measure Initiative 2117 failed with 61.69% or 1.57 million votes "no" and 38.31% or 973,000 votes "yes,” according to preliminary state results published Tuesday. The measure sought to repeal parts of Washington's Climate Commitment Act (CCA) including the Cap-and-Invest Program.