We have expanded our coverage of the U.S. West Coast and carbon markets. Please click below to find current, featured news from OPIS on each of these market segments:

The Latest Carbon Credit Market News from OPIS

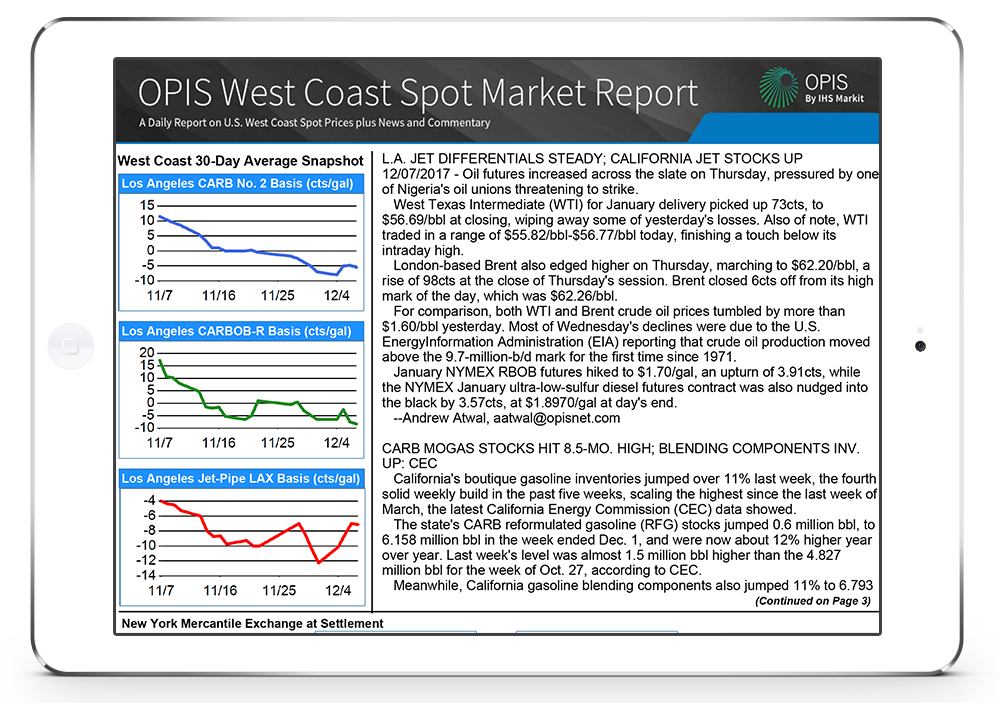

U.S. West Coast Spot Fuel Pricing Trends & Market News

ICAO Chooses Six CORSIA Programs, Restricts Offset Requirements to Post-2016

UN's aviation body ICAO has adopted the recommendations from its Technical Advisory Body for its CORSIA program, which means that it is choosing six carbon offset programs and restricting eligible emission-reduction activities to those undertaken between January 1, 2016 and December 31, 2020, the UN body said Friday evening in a statement.

Created through the UN's International Civil Aviation Organization (ICAO), Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) aims for carbon-neutral growth in global aviation using offsets and sustainable fuels, setting the baseline case of emissions in 2020. The pilot stage begins on January 1, 2021.

The six offset programmes chosen by ICAO are:

TAB recommendations, which were published in January, said that the Forest Carbon Partnership Facility and the Global Carbon Council should be "conditionally eligible, subject to further review by TAB of their updated procedures."

British Columbia Offset Program and Thailand Voluntary Emission Reduction Program were invited to re-apply.

Nori, myclimate, REDD.plus and The State Forest of the Republic of Poland were not assessed due to "either their early stage of development, or because key elements of an emissions unit's programme."

Under CORSIA, international flights between the 82 countries that have signed up to the UN scheme will have to offset their carbon emissions if they exceed the baseline case of 2020.

From 2021 until 2026, only flights between states that volunteer to participate in the pilot and/or first phase will be subject to offsetting requirements.

From 2027, all international flights will be subject to offsetting requirements

IHS Markit hosts three of the programs on its Environmental Registry, namely British Columbia Offset Program, Global Carbon Council, and REDD.plus.

IHS Markit is the parent company of OPIS.

--Reporting by Nandita Lal, nlal@opisnet.com;

--Editing by Kylee West, kwest@opisnet.com

Copyright, Oil Price Information Service

Rishi Sunak, the new U.K. Chancellor of the Exchequer, has left the door open for the country's future carbon policy in his maiden budget today ahead of negotiations on the future trading relationship with the European Union.

Sunak said the government will legislate in the finance bill for 2020 to prepare for a U.K. carbon market, which could be linked to the European Union's cap-and-trade market (the E.U. Emissions Trading System) in the future.

But the chancellor also said the government will legislate for a carbon emissions tax as an alternative carbon pricing policy and consult on the design of a tax in spring 2020.

Previously, the U.K carbon tax was mooted at £19/metric ton, which would be the equivalent of around 21.36 euros ton, as a replacement for regulation in Europe's carbon market following Brexit.

E.U. Allowances (EUAS), the main trading unit in Europe carbon market, the Emissions Trading Scheme (ETS), are settled at 23.92 euro/ton for December 2021 delivery on the ICE bourse on Wednesday.

The U.K. will remain part of the EU ETS until the end of this year.

Meanwhile, the U.K. government has frozen its carbon price floor called the Carbon Price Support (CPS), an additional tax on power generation, at £18 per ton until 2022.

However, Sunak pledged an "an ambitious carbon price" from 1 January 2021 to "support progress towards "reaching net zero emissions" by 2050, which became a legally binding target this year.

In addition to the carbon policy, the chancellor announced a carbon capture and storage (CCS) infrastructure fund of £800 million to establish at least two plants in the UK over the next decade.

A further £1 billion will be invested in green transport solutions.

However, at the same time, the Budget also froze duty of road fuels for the tenth year in a row.

--Reporting by Nandita Lal, nlal@opisnet.com;

--Editing by Paddy Gourlay, pgourlay@opisnet.com

Copyright, Oil Price Information Service

Oregon Governor Kate Brown is vowing to take executive action after the short legislative session ended on Sunday without a vote on a cap-and-trade bill intended to reduce greenhouse gas (GHG) emissions in the state.

Republican senators walked out in the middle of the 35-day short session on Feb. 24 after Senate Bill 1530 passed the Ways and Means Committee.

"The vast majority of Republican lawmakers have spent the last ten days on a taxpayer-funded vacation running down the clock. That's not how democratic representation works. Every time they don't like something, they just get up and leave. That's not compromise. It's holding Oregonians hostage to ultimatums and political posturing," Brown said in a statement.

Brown said that she intends to take executive action to lower GHG emissions, although a plan has not been released.

SB 1530 sought to reduce GHG by at least 45% below 1990 levels by 2035 and 80% below 1990 levels by 2050.

A previous version of a cap-and-trade bill had been introduced during the regular session in 2019, prompting 11 Republican senators to walk out in protest and deny a quorum.

The proposed legislation would have also included a carbon price on fuel that would have instituted in the Portland area for the first three years before all metropolitan areas would been subject to the tax.

According to a statement released by the Oregon Senate Republicans, legislators returned on Sunday to pass budget bills.

Republican Senate Leader Herman Baertschiger had previously stated before the session that the legislation should be decided by voters.

"It's been a very interesting session and if you think about it, the only thing we were asking for is to refer that bill to the people. That's all we're asking. We weren't saying, 'Kill it.' We weren't saying anything else," Baertschiger said during a press conference hosted on Thursday.

If the bill had passed, Oregon would have been the second state to have a cap-and-trade program that covered transportation fuel emissions.

Brown said she may special session, which she previously threatened to do after Republican walked out the during the regular session in 2019.

"I am open to calling a special session if we can ensure it will benefit Oregonians. However, until legislative leaders bring me a plan for a functioning session I'm not going to waste taxpayer dollars on calling them back to the State Capitol," she said.

--Reporting by Mayra Cruz, mcruz@opisnet.com;

--Editing by Kylee West, kwest@opisnet.com

Copyright, Oil Price Information Service

*EasyJet defends carbon offset use.

*CEO Lundgren sees SAFs, hydrogen, electric planes as long-term solutions.

*Airline association calls for full CORSIA implementation.

EasyJet Chief Johan Lundgren said Tuesday that carbon offsets are "an interim step" before they can start using ground-breaking technology like sustainable aviation fuels (SAF), hydrogen and electric planes.

"Aviation today doesn't have those technologies [like SAF, hydrogen and electricity] available. So, carbon offsets are an interim step that need to be in a context of getting ourselves to those very different technologies,"

Lundgren said at the Airlines for Europe (A4E) Aviation Summit on Tuesday in Brussels.

London-based budget airline carrier easyJet is part of A4E -- Europe's largest airline association.

"If you are using the high qualified standardized offset projects like the gold standards and the VCS (Verified Carbon Standard) they will do what it says on the tin. These are one of the few available scientifically proven methodologies available today," he said via live broadcast. The airline industry doesn't have "the luxury today to exclude any technology that is out there."

EasyJet began offsetting all of its emissions in November last year.

In a note today, the airline association called for a "full and swift" implementation of CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation), the initiative adopted by the International Civil Aviation Organization (ICAO) in 2016.

"The EU must also step up its climate diplomacy efforts to ensure more reluctant countries such as China, Russia, India and Brazil join the CORSIA system by 2021," the statement said.

The statement also called for a dedicated EU industrial policy for SAFs, which could have "the potential to reduce CO2 emissions from aviation by up to 85%."

ICAO Council Meeting Begins

ICAO's council session began in Montreal, Canada, on Monday.

The Council will be sitting through March 20 "in order to review an ambitious agenda, a major highlight of which will be its discussions and expected agreement on the eligible emission units to be included under the ICAO CORSIA offsetting framework for international flights."

Environmental think tank Carbon Market Watch said last week in a statement that "some countries and industry representatives are pushing for ICAO to give a blank cheque to all offset programmes, including the controversial UN Clean Development Mechanism (CDM)."

"They claim that otherwise there will not be enough credits for the airlines to buy. This is nothing but scaremongering. As our recent analysis shows, the existing number of credits from the three voluntary programmes alone (without the CDM) would be enough to cover CORSIA demand until 2025. It is therefore of utmost importance that the ICAO decision is based on ensuring that only high-quality credits from new projects will be eligible under CORSIA," the think tank said.

Under CORSIA, international flights between the 70 countries that have signed up to the UN scheme will have to offset their carbon emissions if they exceed the baseline case of 2020.

From 2021 until 2026, only flights between states that volunteer to participate in the pilot and/or first phase will be subject to offsetting requirements.

From 2027, all international flights will be subject to offsetting requirements.

--Reporting by Nandita Lal, nlal@opisnet.com;

--Editing by Bridget Hunsucker, bhunsucker@opisnet.com

Copyright, Oil Price Information Service

LONDON -- Shell sees a multipronged approach to reaching net zero emissions by 2050 that addresses both the growing global demand for energy with the rising population and the necessity to hold the global temperature increase to below 2 degrees Celsius of pre-industrial levels, said Sinead Lynch, Shell's U.K.

country chair, on Tuesday at IP Week's forum on clean energy transition.

Shell plans to target widespread electrification around the world to satisfy the company's course on the energy map, but also agrees that radical improvements to resource and energy efficiency are needed, Lynch said.

Additionally, the oil industry needs to focus low-carbon technologies and delivering renewable fuel solutions to customers such as solar, wind and biofuels, Lynch said.

Her colleague Paul Bogers, vice president, fuel technology at Shell, said the company is "bullish about technology" in enabling the clean energy transitions.

He gave the example of Shell investing in all-electric world of Formula E car racing.

Shell has a net carbon footprint ambition that will reduce the carbon intensity of its products by 50% by 2050, Lynch said.

Government also has a role to play in the transition to net zero emissions by establishing economywide carbon pricing mechanisms, she added.

As of April 2019, there were 57 carbon pricing initiatives implemented or scheduled for implementation around the world in a mixture of emissions trading systems (ETS), carbon taxes, or both, according to a carbon study by World Bank Group. Global carbon pricing mechanisms raised $44 million in revenues during 2018, the study said.

However, even with success in those market-based solutions, the oil industry must go even further to solve the climate equation, Lynch said.

"Shell thinks we need to do more. We need to invest as society in natural ecosystems in preserving, restoring and generating forests and wetlands. And we need to invest in technologies like carbon capture and storage," she said.

"Both of these take carbon emissions out of the atmosphere to address sectors that are difficult to decarbonize."

The challenge for the oil industry remains in transparency and identifying alignments with climate policies as well as listening to society's expectations and needs during the energy transition, Lynch said.

According to think tank Carbon Tracker Initiative, out of the global publicly listed oil companies Shell's portfolio is "most aligned" to the Paris Agreement. However, the company would need to cut its oil production by 10% by

2040 to be compatible with the climate change agreement.

Shell peers such as Exxon and ConocoPhillips would need deeper cuts of 85% and 55%, respectively. Oil majors would need to cut group production by an average of 35% by 2040 to align with the Paris Agreement, according to the think tank.

--Reporting by Lisa Street, lstreet@opisnet.com;

--Editing by Nandita Lal, nlal@opisnet.com

Copyright, Oil Price Information Service

The United Nations aviation body is expected next month to select which carbon offset validation programs will qualify for the flight emissions program CORSIA, answering a key question that has hung in the air for years: which units will measure up?

The International Civil Aviation Organization (ICAO) ratified The Carbon Offset Reduction Scheme for International Aviation in 2016 but left the dialogue running as to what units will be deemed CORSIA-eligible and in line with the program's emissions unit criteria.

Players in the business of producing, marketing and trading carbon offsets picked up the conversation and ran with it to make CORSIA's big unknown variable a leading industry discussion.

Meanwhile, participating airlines pondered how best to prepare for international flight emissions reduction costs. Around 80 ICAO member states covering 77% of aviation activity have agreed to cap international flight emissions as part of CORSIA in coming years.

CORSIA aims for carbon neutral growth in global aviation, setting the baseline case of emissions in 2020. Next year, the scheme begins a pilot phase for voluntary airline participants. From 2027, all international flights will be subject to the requirements.

The CORSIA scheme is a potential boon for offset credit production as another outlet outside of established carbon compliance programs such as California's Cap-and-Trade market and a large increase in recent years of global companies purchasing voluntary offsets to become carbon neutral, sources have said.

Many global airlines already set out to erase emissions voluntarily purchasing offsets ahead of the CORSIA starting bell. OPIS sources have said that the voluntary offset markets are opaque and deal prices can vary widely due to differing perceived values of the unit. This results in a challenge for airlines that need to source the correct CORSIA-eligible offsets, which are thus far undecided.

The decision will likely come sometime during the ICAO Council's 219th session, scheduled to run March 2-20, Anthony Philbin told OPIS Wednesday.

"The order of business for this session isn't final yet, and depending on how other discussions go, various topics could end up earlier or later in the schedule than they may originally be slated for," he said. "Otherwise, though, yes, these topics are expected to be covered by Council sometime between 2 and 20 March when it is next in session."

Last summer, an ICAO technical advisory board received 14 responses to a call for applications to become a CORSIA-eligible Emissions Unit Program, which ICAO defines on its website as a company that administers standards and procedures for developing activities that generate offsets and verifying and issuing offsets as created by those activities. Some of those companies are well-established carbon industry options, such as the VCS program, which is managed by Verra.

According to a timeline listed on ICAO's website dated May 19, 2019, the board should make recommendations to the ICAO Council before the end of this month.This "decision could make or break international efforts to reduce aviation's climate footprint," the Environmental Defense Fund said in a story posted on its website Friday. The non-governmental organizations of the ICAO "are urging Council members to bar old, questionable carbon credits, ensure carbon credits aren't double counted, and make ICAO's decisions process transparent, "the group said.

Earlier this month, Environmental Exchange CBL Markets Head of Global Carbon Markets Rene Velasquez told OPIS that CORSIA compliance needs should result in a robust over-the-counter market. His comments came after his company announced a new CORSIA-based offset trading platform called ACE.

Backed by Xpansiv CBL Holding Group (XCHG) and the International Aviation Transport Association (IATA), the innovative Aviation Carbon Exchange fully launches this summer as a centralized, price-transparent marketplace for greenhouse gas offsets eligible under CORSIA.

The partners said in a joint news release that ACE will serve as a "secure, intuitive destination for airlines to access real-time data with full-price transparency" to purchase offsets for the Carbon Offset Reduction Scheme for International Aviation.

CBL Markets runs an environmental commodity trading exchange with more than 1,500 voluntary carbon market participants registered, Velasquez said. IATA's nearly 300 members will use the system for free to boost liquidity, Velasquez said. "It will be open to all variety of buyers, sellers, project developers, and intermediaries," he said of ACE. "It will draw upon our existing voluntary exchange platform but limited to CORSIA-eligible units."

ACE begins a pilot phase this quarter for airlines that want to start offsetting voluntary credits before it launches in June. Trading on the platform will be supported by the IATA Settlement System and Clearing House, "offering seamless and risk-free settlement to airlines, including non-IATA airlines," the release said.

ACE will list the CORSIA-related units as soon as they are published by ICAO, the release said.

The new platform is designed to close a commerce gap between CORSIA-covered airline operators and voluntary carbon offset project developers, who typically operate in separate business arenas.

Leading offset product developer ClimeCo Chief Business Officer Derek Six said this month that offset "product developers and investors are looking forward to receiving clarity as soon as possible on what registries and vintages will be eligible for airlines to use for CORSIA. Until those parameters are announced and we understand the potential breadth of the market, it is hard to comment on the utility of, or need for, this new platform."

--Reporting by Bridget Hunsucker, bhusucker@opisnet.com

--Editing by Kylee West, kwest@opisnet.com

Copyright, Oil Price Information Service

--Reporting by Frank Tang, ftang@opisnet.com and Mayra Cruz, mcruz@opisnet.com

--Editing by Barbara Chuck, bchuck@opisnet.com

Copyright, Oil Price Information Service

SAN FRANCISCO -- California is a pivotal example of how addressing climate change doesn't have to equate to the stifling of economic growth, California Environmental Protection Agency Undersecretary Serena McIllwain told attendees in a keynote address here at OPIS's 8th Annual LCFS and Carbon Markets workshop on Wednesday.

Environmental protection has become "part of the state's identity," said McIllwain, who, prior to being appointed to CalEPA by Gov. Gavin Newsome this year, served in a number of federal roles, including director of the Office of Continuous Improvement at the U.S. EPA, and deputy assistant secretary and chief operating officer at the U.S. Department of Energy.

California has a unique position as both a global leader in its environmental protection efforts, while maintaining a prosperous economy, McIllwain said.

The effects of climate change are also already having serious impacts in the state, most notably the increase of wildfire devastation, she said. In a recent 13-month span, the state broke records for largest wildfire (twice), most destructive wildfire (twice) and deadliest wildfire, she noted.

Early snowpack melt, spring runoff reduction, drought and increases in the likelihood of severe flooding are also besieging the state, as well as other places around the globe.

Still, California has been making progress. With the help of programs like the Low Carbon Fuel Standard (LCFS) and cap and trade in its toolkit, the state met its 2020 emissions reductions targets four years early, while significantly outpacing overall U.S. GDP growth.

Arguments that "reducing emissions hurt the economy are just simply wrong," and are "rhetoric now" McIllwain said.

California has "a duty to educate the public and our friends in Washington that improving public health and the environment do not hurt the economy," she said.

OPIS' LCFS and Carbon Markets Workshop continues at San Francisco's Intercontinental Hotel through Friday.

--Kylee West, kwest@opisnet.com

Copyright, Oil Price Information Service

A recent Trump administration lawsuit challenges the legality of California's Cap-and-Trade Program's link with partner Quebec's, but the outcome could also have a far-reaching global influence on nations considering similar environmental policy, industry experts said.

The federal lawsuit against California could present an extremely unfavorable precedent for future linkages between foreign jurisdictions, said Nico van Aelstyn, partner at Sheppard Mullin LLP. Van Aelstyn has acted on prior litigation involving challenges to California's Cap-and-Trade Program.

"The potential chilling effect of a decision in this regard, or simply the filing of the lawsuit, is a less immediate, and less clear danger, but one that I think in some ways ... could have a longer term, greater impact," van Aelstyn said. "It really goes after the ability of subnational jurisdictions to link with each other, and that imperils what is seen more broadly as the path forward, globally, for addressing climate change."

The California and Quebec cap-and-trade programs have been linked since the start of 2014 and participate in four joint carbon allowance auctions per year.

On Oct. 23, the United Sates filed a civil complaint against California, the California Air Resources Board (CARB), several of the state's officers and the Western Climate Initiative (WCI) "for unlawfully entering a cap and trade agreement with the Canadian Province of Quebec," according to a federal press release, announcing the filing.

"The Constitution prohibits states from making treaties or compacts with foreign powers, yet California entered into a complex, integrated cap-and-trade program with the Canadian province of Quebec in 2013 without congressional approval," the release said.

Filing Causes CCA Secondary Market Uncertainty

News of the lawsuit immediately injected uncertainty into the California Carbon Allowance (CCA) secondary market unseen since 2017, before the state Legislature passed a measure to authorize the program through 2030.

Prior to the reauthorization, uncertainty about the fate of the program abounded, and was seen in price volatility that would rise and fall with the passage or failure of legislative measures impacting the program and rulings in the multiple legal challenges the program faced.

The certainty of the program's continuance brought by the reauthorization is what appeared to draw in significant speculative interest earlier this year, helping boost secondary market liquidity and allowance prices by over $1/mt in just a few months.

Unlike compliance entities, speculator involvement in the program is voluntary.

If speculators were drawn to invest in the market given the relatively stable outlook of the program itself, that confidence may have been shaken by the Department of Justice's lawsuit.

On Oct. 23, the secondary allowance market sprang to life, with prices falling precipitously and trade liquidity exploding. Prompt, current year V19 October 2019 allowances traded that day from $17.04/mt to as low as $16.75/mt, according to OPIS pricing data.

That drop appeared to be a knee-jerk reaction and the price has more than recovered, to $17.15/mt on Nov. 20, according to OPIS.

Should the United States prevail in its lawsuit, delinking the California and Quebec markets would likely make them less liquid, van Aelstyn explained in an OPIS interview. The potential uncoupling could also represent less certainty in allowance supply and prices moving forward, he said.

But van Aelstyn noted that the lawsuit poses less of a fundamental threat to the program's existence than prior challenges against California. While unsuccessful previous attempts would have "effectively killed the whole program," the current federal lawsuit challenges only the linkage with Quebec.

California and Quebec would be allowed to continue to operate separately, even if the linkage is found to be unconstitutional, he said.

Breaking Down Legal Basis

Danny Cullenward, lecturer at Stanford Law School and policy director at Near Zero, a climate change mitigation research and analytics firm, told OPIS that the potential for the suit to succeed shouldn't be taken lightly.

"My take is that unlike a lot of the lawsuits and rollbacks pursued by the Trump Administration -- many of which are legally weak or even baseless -- this case presents a colorable legal question that shouldn't be ignored, even if market participants and governments think they have good arguments against it,"

Cullenward told OPIS. "There's enough in the compliant for a sympathetic judge to grant the requested relief. Whether that's going to happen is anyone's guess, but to pretend it's extremely unlikely is too dismissive."

The federal lawsuit contains multiple arguments against the joint participation, citing various parts of the U.S. Constitution. One question posed is whether California law conflicts with U.S. foreign affairs.

Although California's program may seem to conflict with what might be the personal views of President Trump, when considering the actual, concrete actions on foreign climate change agreements the U.S. has taken, the disparity is less clear, van Aelstyn said, pointing out that while "the U.S. has indicated it is in the process of withdrawing from the Paris Agreement, it has not withdrawn from the UNFCCC."

The United Nations Framework Convention on Climate Change is an international environmental treaty with 165 signatories that went into force in 1994. The stated objective of the treaty is to "stabilize greenhouse gas concentrations in the atmosphere at a level that would prevent dangerous anthropogenic interference with the climate system."

In addition, "the United States has not withdrawn from ICAO (International Civil Aviation Organization), and in fact, the U.S. recently voted in favor of ICAO's CORSIA [carbon] offsets program, so with regard to the U.S. foreign affairs position on climate change, the U.S. is still engaged in things that are consistent with California's position here," van Aelstyn said.

There is also no federal cap-and-trade program that conflicts with California's program, he said.

For these reasons, van Aelstyn considers that the state law vs. federal foreign affairs point of contention in the lawsuit fairly weak.

Treaty Characterization in Question

The suit also claims that the agreement with Quebec is a treaty, making it illegal under the U.S. Constitution, which prohibits subnational jurisdictions from entering into treaties with foreign powers.

"It's an agreement," van Aelstyn said of the California-Quebec linkage under the WCI. "The drafters of that agreement were very well aware of that [constitutional] provision and sought to avoid it being determined to be a treaty."

One clear indication that it is not a treaty, van Aelstyn said, is the fact that there are no binding or enforceable provisions, illustrated by Ontario's abrupt and rapid withdraw from the program last year, in which it ignored the delinkage notification guidelines of the agreement.

"There was nothing California could do about it. That underlines that it's not a treaty," Van Aelstyn said.

A separate argument in the suit references a provision in Article One of the Constitution prohibiting states from entering into "a compact" with a foreign power without congressional approval.

There is no dispute that California did not get congressional approval before linking its cap-and-trade program, but van Aelstyn does not believe that automatically invalidates the linkage.

While the cap-and-trade program may appear to be in violation, "the practice that has arisen as our society has grown larger and more complicated is that that kind of express approval is no longer necessary, because it's not efficient," he said.

"The fact is, states around the U.S. have been entering into agreement with foreign provinces -- mainly in Canada, some also in Mexico -- to regulate more local concerns," he said. He cited many agreements between Canadian provinces and northern U.S. Midwest states involving environmental and other management issues on the Great Lakes, which do not have explicit congressional approval.

Other agreements between U.S. states and "foreign" powers, including handling emergencies at the borders are in place as well, without congressional approval. Lacking explicit approval, these agreements have "de facto, implicit approval by congress, in the fact that it is silent with regard to those," he said.

In the case of California's cap-and-trade agreement, "you've got an agreement that is more than 6 years old, and Congress has never said 'boo,' "he said.

U.S. Administration Change May Drop Case

Meanwhile, the results of next year's U.S. presidential election could affect the status of the lawsuit.

Multiple sources told OPIS that while an initial decision is likely in the second half of 2020, the decision could be appealed, drawing the case out. If a new president assumes office in January 2021, and the case is still alive, he or she could order the Department of Justice to drop the federal challenge to California's program.

For example, in 2008, the Bush administration refused to grant California's waiver to set its own emission standards. California challenged the denial, and that challenge was pending before the Supreme Court when President Obama took office.

Obama promptly withdrew the U.S.'s opposition, and "effectively the case was killed," van Aelstyn said.

Ultimately though, a lot depends on the judge hearing the case as well, Van Aelstyn warned.

"This [case] kind of goes at the fundamental issue in constitutional jurisprudence. Your Justice Scalias of the world, with their originalist interpretation of the Constitution would say, "Well, that's what the words say, that's what they say.' End of story," he said.

"If you got a judge that was more of an originalist in the case of the Constitution, then this case has legs."

--Kylee West, kwest@opisnet.com

--Bridget Hunsucker, bhunsucker@opisnet.com

Copyright, Oil Price Information Service

After California and Pacific Northwest spot gasoline premiums spiked to historic highs earlier in October, an armada of vessels carrying import cargoes is expected to offload much-needed supplies in the unusually tight U.S. West Coast physical motor gasoline markets.

While it is no surprise that shippers bring in cargoes to meet excess market demand, trading sources said those imports have not been fully factored into the current USWC spot mogas prices that are already off their highs, suggesting markets could weaken further.

Shipping sources told OPIS that at least five mogas-carrying vessels, namely Torm Thames, Largo Sea, Dee4 Birch, Ambassador Norris and Turquoise, are ready to unload resupplies in Los Angeles, San Francisco or Portland.

One West Coast shipping source said that San Francisco is the logical destination for a majority of the incoming cargoes, because physical mogas supplies there are the tightest in the USWC.

"Any CARBOB should go to the Bay," the source said.

According to sources and an analysis using IHS Markit's Market Intelligence Network (MINT) ship-tracking data, the Torm Thames is currently sitting outside and ready to unload in Los Angeles, the Largo Sea is waiting to dock outside of San Francisco, and the Dee4 Birch is travelling north along Baja California and could be heading to either Los Angeles or San Francisco.

In addition, the Ambassador Norris is in the Pacific Ocean about three or four days away from either San Francisco or Portland, while the Turquoise is still in Europe a few weeks away from Los Angeles, according to sources and MINT data.

Arbitrage activities often dictate which market should receive supplies, as the highest bidder pays and gets the cargo which includes significant transportation costs.

In September, a string of refinery outages led to consecutive drawdown of West Coast inventories. Also, both Los Angeles and San Francisco are still using 5.99 lb. summer specifications, which makes it harder to find low-RVP material because other U.S. spot markets are already transitioning to winter specs.

Under Pressure

Despite sharp pullbacks from near-record highs, USWC spot prices could weaken further because of the increase in supplies.

When asked if current USWC prices are reflecting the pending increases in supplies, one West Coast shipping source said, "Not all factored in yet."

On Friday, October S.F. CARBOB was pegged at futures plus 69cts/gal, off a seven-year high of $1.20/gal, the settlement on Sept. 27, according to OPIS spot pricing data. It is also commanding a 31ct/gal premium over that of L.A. CARBOB, and by far the most expensive spot gasoline across the U.S.

October L.A. CARBOB was pegged at November NYMEX RBOB futures plus 38cts/gal, sharply off a trade at plus $1.3525 on Oct. 1, also a seven-year high.

Looking at prompt-to-forward spreads, November L.A. CAROB was priced $1/gal higher than prompt October barrels on Oct. 1, which provided strong incentives for participants to charter vessels to bring in resupplies.

However, the spread has since narrowed to just 20cts/gal on Friday.

Meanwhile, prompt October Pacific Northwest sub-octane unleaded regular gasoline is currently at a 70cts/gal premium above futures, within reach of an all-time high of the 75.5ct/gal settlement set on Oct. 16.

One source said Pacific Northwest mogas prices could retreat sharply in the next few weeks.

In theory, Pacific Northwest sub-octane gasoline prices should be priced weaker than CARBOB, because it is cheaper to make and easier to find than CARBOB.

--Frank Tang, ftang@opisnet.com

Copyright, Oil Price Information Service

Will the loss of another active trading desk wipe out the already-thin liquidity in the U.S. West Coast spot product market?

After TACenergy acquired IPC USA and shut its U.S. West Coast physical trading arm, most traders and analysts said a lack of active players to make a market is a key factor behind more frequent price spikes in USWC bulk gasoline.

Limited growth opportunities in the USWC due to declining fuel sales are likely to trigger more consolidation among petroleum marketers and to motivate regional refiners to keep tapping into the budding Mexican retail market.

After TAC's recent purchase of IPC USA, OPIS learned that IPC's West Coast spot trading team with several experienced players has already closed its book.

While TAC's corporate culture does not embrace trading, the 50-year-old company named after its founder Truman Arnold, focuses on a service model by supplying fuel at the rack or wholesale level.

West Coast traders said while IPC's exit may take away some spot market liquidity, it should not dramatically change the region's fuel supply picture, as TAC will continue to supply the rack level through IPC's wholesale distribution network in the USWC.

One long-time West Coast trader cited sizable losses and recent departures of several active, high-profile spot traders for dwindling liquidity and wild bid-ask spreads in the CARBOB gasoline market.

"A couple people got whacked this month, so traders are not going to take any risks and trade much. Once this rally is over, I just think it's going to be a horrible market in the next three to four months," the trader said. "It's so hard to do deals, and the TAC deal is not helpful."The trader said West Coast refiners are to blame for the lack of liquidity, as they have adopted a "do it yourself" approach in marketing products, even chartering their own vessels to bring in cargo imports instead of relying on trading firms.

"You squeeze everybody else out of the market. When liquidity dries up, there is nobody to make a market for you, that's where we are heading right now," the trader said.

On Oct. 1, prompt L.A. CARBOB changed hands at $1.3525/gal above NYMEX RBOB futures, as premiums had more than tripled from a settlement of plus 44cts/gal on Sept. 20 and are near an all-time high of $1.45/gal set on Oct. 3, 2012.

In the broader USWC market, California has unique CARB gasoline and diesel specifications. The state is also geographically isolated relative to other U.S. refining centers. Resupply by tankers takes three weeks from the U.S. East Coast and Asia and four weeks from Europe. Those factors demand trading expertise and limit who can enter and participate in the USWC spot market.

More Acquisitions

The West Coast market has already seen an exodus of spot traders in recent years, following consolidation among refiners, such as Marathon Petroleum's purchase of Andeavor and PBF Energy's acquisition of the Shell Martinez refinery. PBF already owns a California refinery in Torrance.

West Coast energy analysts said it is likely to see more national petroleum marketers "rolling up" regional jobbers, using the growth models of World Fuel Services and Parkland Fuel during times of little organic growth. The latter agreed to buy Florida-based jobber Tropic Oil Co. just in September.

"We can see consolidation continuing because of the low and no growth in the industry," said David Hackett, president of Stillwater Associates, a transportation and energy consultant.

Better fuel economy and state mandates such as California's LCFS program encourage alternative fuel consumption, taking a bite out of petroleum demand, Hackett said.

In the first quarter of 2019, renewable diesel and biodiesel represents 18% and 5% of the total California diesel market, respectively, according to Stillwater's analysis of CARB data.

Meanwhile, California's total annual taxable gallons of gasoline, a measure of fuel consumption, fell slightly to 15.539 billion in 2018, having plateaued at

15.594 billion in 2017, following annual growth in each year between 2012 and 2017, according to data by the California Board of Equalization.

High Hopes on Mexico

In a bid to offset flagging domestic sales growth, U.S. refiners have turned to the attractive Mexico downstream market because of its close proximity, solid gasoline consumption and low density of retail stations, said Kent Williamson, IHS Markit Director, Refining and Marketing, Latin America.

IHS Markit is the parent company of OPIS.

"Companies that have refining assets in the U.S. are all stampeding into Mexico, and California is a microcosm of that because it's much more heavily regulated, taxed and even outright hostile to the oil and gas industry and refineries in general," said Williamson.

Several private terminal and storage assets that will come online sometime in 2020-2021, including Marathon Petroleum's 700,000-b/d terminal in Rosarito on Mexico's Pacific Coast, and refiners' reserved capacity at IEnova's 1-million-bbl terminals in both Mazanillo and Topolobampo could further boost gasoline exports from the USWC.

Other U.S. West Coast refiners including Chevron, Shell, BP and Phillips 66 are also building cross-border refinery-to-station supply chains in Mexico.

In September, private gasoline imports from all countries, not just the U.S., reached 17% of all of Mexico's gasoline imports, meaning the other 83% was imported by Pemex. This compares to just 7% in September 2018, and nil in 2017, according to Mexican official data from Prontuario. Private diesel imports now stand at 32% of all diesel imports in September, also up from nil in 2017.

Williamson said growth in product imports will likely continue in Mexico.

However, more aggressive discounts by Pemex-owned gas stations could be a sign that the Mexican government is feeling the heat of competition from U.S. refiners. Mexican President Andrés Manuel López Obrador's administration is viewed by some as protectionist.

Meanwhile, the latest U.S. Energy Information Administration data shows West Coast-to-Mexico January-June exports of gasoline recorded year-on-year gains in 2016 and in 2018, only to register a year-on-year loss for the same 2019 period.

According to EIA data, January-July 2019 exports of diesel from PADD 5 totaled 11.289 million bbl, which is 47% higher compared to the same period in 2018.

The 2018 total at 7.699 million bbl was 42% higher versus 2017.

Hackett at Stillwater Associates said that West Coast refiners only export non-California specifications gasoline and diesel, which should not directly affect U.S. West Coast's fuel supply.

Still, others said it's too early to tell what will happen to liquidity, especially in the winter months when demand tends to be weakest.

"When the market is at $1/gal (premium to NYMEX), it doesn't lend itself to a lot of trade activities. No one gets really active at these prices," said another long-time West Coast spot trader.

--Frank Tang, ftang@opisnet.com

--Beth Heinsohn, bheinsohn@opisnet.com

Copyright, Oil Price Information Service

IHS Markit has launched the IHS Markit Global Carbon index, benchmarking for the first time a global price for carbon dioxide credits, the leading information, analytics and solutions company announced Wednesday.

"The design, construction and administration of the IHS Markit Global Carbon Index is a result of extensive collaboration among the firm's Indices, Environmental and Energy businesses, including OPIS, the company's energy price reporting arm, which offers data and pricing services to help businesses manage costs and risks associated with national and regional environmental compliance programs," the statement said.

IHS Markit is the parent company of OPIS, which contributes North American carbon allowance daily pricing to the index. The index tracks the most liquid and accessible tradable carbon markets, including the California Cap-and-Trade Program, the Regional Greenhouse Gas Initiative (RGGI) and the European Union Emission Trading System (EU ETS). Along with OPIS data, the index is calculated using futures pricing.

"The IHS Markit Global Carbon Index creates a valuable new benchmark for corporations, investors and financial services firms, all of which have to navigate the emerging but increasingly important markets for carbon credits," said Sophia Dancygier, managing director and head of Indices at IHS Markit. "It also demonstrates our ability to apply our expertise in data, energy and other major industries and capital markets to develop unique products to address the most pressing and complex information demands within business today."

According to the global carbon index, the global weighted price of carbon allowances is $23.65, according to the statement. Index data shows that since the beginning of 2018, the total return potentially gained by investors in global carbon is 132%.

"Putting a price on carbon dioxide emissions through cap and trade programs and other market-based mechanisms is a primary strategy for reducing carbon emissions. Worldwide, 57 jurisdictions have carbon pricing mechanisms, up 34% since 2017, the statement said.

Climate finance specialist Climate Finance Partners (CLIFI) was consulted in the development of the IHS Markit Global Carbon Index.

"The IHS Markit Global Carbon index creates an important benchmark which helps financial institutions to better assess and price climate-related financial risks," said Eron Bloomgarden, co-founder CLIFI, in the statement Wednesday.

"We see growing investor interest in carbon credits as an asset class."

The previous day, Bloomgarden spoke on carbon pricing and the role of climate finance during an expert roundtable discussion at the IHS Markit office in New York City as part of Climate Week NYC 2019. Bloomgarden co-authored the related Global Carbon Index white paper along with IHS Markit Index Product Manager of Fixed Income Indices Nicolas Godec.

Titled "A Global Price for Carbon Emissions," the paper details among other data the fundamentals and market mechanics of the world's foremost carbon credit markets. More information on the index and the white paper is found here.

The IHS Markit Climate Week NYC program featured Robert Engle, a recipient of the 2003 Nobel Prize in Economics and Professor of Finance at New York University Stern School of Business Robert Engle.

IHS Markit administers more than 14,000 benchmark, economic and tradable indices across assets. "More than $130 billion in assets under management are held by exchange-traded funds referencing IHS Markit indices," according to the statement.

IHS Markit has growing solutions covering carbon markets, sustainable investing and corporate environmental, social and governance (ESG) needs.

"Its Environmental Registry tracks the issuance, transfer and retirement of over 350 million carbon, water, and biodiversity credits," the statement said.

"Last year, it launched a repository to collect, store and disseminate corporate ESG data, including carbon emissions."

--Bridget Hunsucker, bhunsucker@opisnet.com

Copyright, Oil Price Information Service

Since 2015, there has been an unexplained lingering price increase in California gasoline prices, independent of California's additional fuel taxes and other program costs, the California Energy Commission (CEC) said in a memo to Gov. Gavin Newsom (D) on Thursday.

The memo is in response to a directive to the CEC by Newsom last month to investigate the cause of gasoline prices that jumped to over $4/gal in the state this spring.

"The Energy Commission has identified a number of causes that could explain the residual price increase in California, ranging from refinery outages to potentially market manipulation," the memo says.

While California gasoline prices have "for some time" been higher than the rest of the nation, that disparity has increased since the beginning of 2015, the CEC said. Prior to 2015, the average price difference between California and U.S. gasoline retail prices was 34cts/gal (2008 to 2014); since 2015, the total difference has roughly doubled to an average 69cts/gal, according to the CEC.

In February 2015, an explosion at the then-ExxonMobil-owned Torrance refinery tightened supplies in the region, shooting spot trading levels to record highs.

The impact on fuel prices was seen throughout the year, particularly in the high-demand summer driving season following the incident, which sidelined production at the refinery.

In its report to the governor, the CEC identified a number of possible reasons for the growing premium for California fuel prices since then, including refinery outages and crude oil prices. While the report examines these potential causes, the CEC described their initial estimation of the impact of these factors as "imprecise" and requested another five months to further examine the issue.

The CEC also outlined factors that often make California prices the highest in the nation, including state fuel taxes, and cap-and-trade and LCFS costs.

Additionally, the agency factored in refinery outages, which they noted can lead to regional price spikes not seen during similar events in other areas of the U.S. due to California's unique fuel specifications and limited transit logistics, which hamper the ability to get resupply to market in a timely manner.

However, "even with the Energy Commission's estimate of the effects of refinery outages, there remains a portion of the residual price increase that is not easily attributed to any known and quantifiable source," the memo says.

The CEC puts forth a few possible explanations for this disparity, although it notes that further study and review with outside experts is needed.

One reason the Energy Commission suggests is an increasing price premium for "branded" gasoline in the state. In 2008, unbranded, ARCO and hypermart retailer prices were within 15cts/gal of Chevron, Shell and 76 retail prices.

Beginning in 2016, the difference rose to consistently 40cts/gal or higher, the CEC said.

The memo notes that most gasoline in the state "meets the 'Top-Tier' designation, and it can be argued that no brand of gasoline performs significantly better than any other."

While this sort of price disparity would typically drive consumers to lower-priced fuel, the combined market share of Chevron, Shell and 76 has barely budged, "indicating a low sensitivity to price changes by their customers," according to the CEC.

"Preliminary estimates show that at least part of the explanation [for the unexplained lingering price increase] could be the practice of higher-priced brand retailers of gasoline - Chevron, Shell, Exxon, Mobil, and 76 - to charge higher prices than unbranded, ARCO and hypermart retailers, for essentially the same product. While this practice is not necessarily illegal, it may be an effort of a segment of the market to artificially inflate prices to the detriment of California consumers and could account for at least part of the price differential," the memo said.

"This is possibly one reason the 'other factors' portion of the retail price difference has increased since 2014. However, it is not known if this relationship between higher- and lower-priced brands is unique to the California market," the CEC said, adding that more analysis would be required to draw any conclusions.

Another area the CEC requested more time to explore is the cost of crude oil to West Coast refiners. The memo to the governor suggests that the "shale revolution" in the Permian basin has given refiners outside of the West Coast access to cheaper crude, which may be helping keep prices lower elsewhere.

Other areas where the CEC says need further study include "lower than normal inventory levels for gasoline in California and the West Coast" and "supply constraints."

The most recent weekly supply statistics published by the CEC showed California reformulated gasoline stockpiles at state refineries were 4.572 million bbl the week ending May 10, a stout 38.1% below year-ago levels.

A request for comment from the governor's office in response to the memo had not been returned at presstime.

Western States Petroleum Association (WSPA) President Catherine Reheis-Boyd in a statement to OPIS said that the CEC's report "provides further evidence of what market experts and government agencies have maintained for years: there are many factors that influence movement in the price of gasoline and diesel, but the primary driver is the dynamics of supply and demand of crude oil."

"Moreover, experts recognize that unforeseen events -- such as storms, outages, etc. -- can have significant impacts. In addition, state-specific factors such as California's mandated fuel blend requirements, increasingly high state taxes, and regulations such as cap-and-trade and the Low Carbon Fuel Standard impact fluctuations in the price of gasoline and diesel," she said.

Meantime, the CEC staff is set to host a workshop to "discuss and receive comment on California's liquid transportation fuel infrastructure" next month, according to a notice sent out earlier this week.

--Kylee West, kwest@opisnet.com

--Lisa Street, lstreet@opisnet.com

Copyright, Oil Price Information Service

The New York Harbor gasoline market is seeing a tightening spot supply because cargoes originally meant for the East Coast are sailing to the West Coast from Europe and the east coast of Canada, sources told OPIS on Monday.

This is paving the way for an early bullish start to the peak summer season in the New York Harbor gasoline market.

A total of about 16 cargoes or 4.8 million bbl of arbitrage gasoline and blending components (naphtha and alkylate) have been re-routed away from the New York Harbor to the West Coast.

The first few of these cargos have begun to arrive on the U.S. West Coast last week, and more will follow over the next four weeks. Some are sailing to California and a few will go to the Pacific Northwest.

Some shippers include ExxonMobil, Glencore, Musket, BP, Equinor, Shell, Valero and Hartree. The cargo origins include Pt. Tupper, Antwerp, Bantry Bay, Mongstad, Amsterdam and Pembroke.

Sources note that the West Coast market is also receiving some arbitrage and term cargoes for oil products, including alkylate, from Asia in the trans-Pacific market.

It is noted that these arbitrage cargos will sail to the highest-priced market after factoring the freight costs and price backwardation and that the strongest market is the West Coast for now.

The rare inflow of massive volumes into the West Coast is expected to keep the strengthening cash CARBOB gasoline values, which rose to more than 50cts/gal over the NYMEX screen last Friday, in check, they said.

Compared with the West Coast, New York Harbor prompt RBOB values were significantly weaker at about 2cts/gal over the screen.

It is noted that the nearly 5 million bbl of imported gasoline and components would not be enough to satisfy the spot market demand or the regional refinery production loss on the West Coast. Sources estimated that gasoline production loss on the West Coast at about 300,000-350,000 b/d, and this gasoline deficit was expected to last at least until mid-May.

OPIS reported in mid-April at least six out of 10 refineries (four in Southern California and two in Northern California) suffered operational issues.

California's gasoline stocks had fallen to an 11-year low.

Products prices on the West Coast should see a backwardation, reflecting stronger second-half April prices versus May values and therefore stronger cracks in April versus May.

In theory, the West Coast bull party could be over by the second half of May if all refineries are back to normal operations, barring new problems, but in the real world, there is no guarantee on refinery maintenance and unit restart schedules.

Any delay of refineries returning to normal operations would likely prolong the West Coast market bullishness. It is noted that history shows the West Coast market displays high price volatility in daily price moves, and this could happen again in April-May.

In the New York Harbor, gasoline prices have remained firm, propped up by "West Coast stealing a few million barrels of F2 (summer RBOB) from New York Harbor" as well as firm Gulf Coast values, a source said.

In addition, the New York Harbor gasoline price is supported by relatively robust regional demand, a lack of RBOB supplies, and operating issues and maintenance at Phillips 66's Bayway and North Atlantic Refining's Come-by-Chance refineries.

This market development should be supportive of Northeast refineries which saw weak margins a few months ago.

On the NYMEX screen, the front-month backwardated May-June RBOB price spread was at plus 5cts/gal, and the June-July backwardation was at about plus 3cts/gal.

Meanwhile, the West Coast market has been enjoying the highest refining margin for the past several weeks, and this bullish trend is expected to remain strong at least until mid-May. The major question during a bull run is when would the party be over.

The end of the bull run in the West Coast refining market could be hard to pinpoint as it would depend on the successful return of several ailing refineries to normal rates as planned and sufficient fuel imports. So far, sources expect all West Coast refineries to return to normal operations sometime in May, albeit not all at the same time.

According to Wells Fargo in mid-April, the West Coast-ANS crack increased to $32.57/bbl versus $25.79/bbl last week and $15.49/bbl a month ago. The West Coast was and still is the strongest in the nation.

--Edgar Ang, eang@opisnet.com

Copyright, Oil Price Information Service

The OPIS West Coast Spot Market Report is the nation's premier price index for refined petroleum products.

Get a complete 5-day picture of the Los Angeles, San Francisco and Pacific Northwest refined spot markets plus West Coast crude oil postings, PADD 5 DOE inventory levels, feedstock values and more. Start your free 5-day trial!

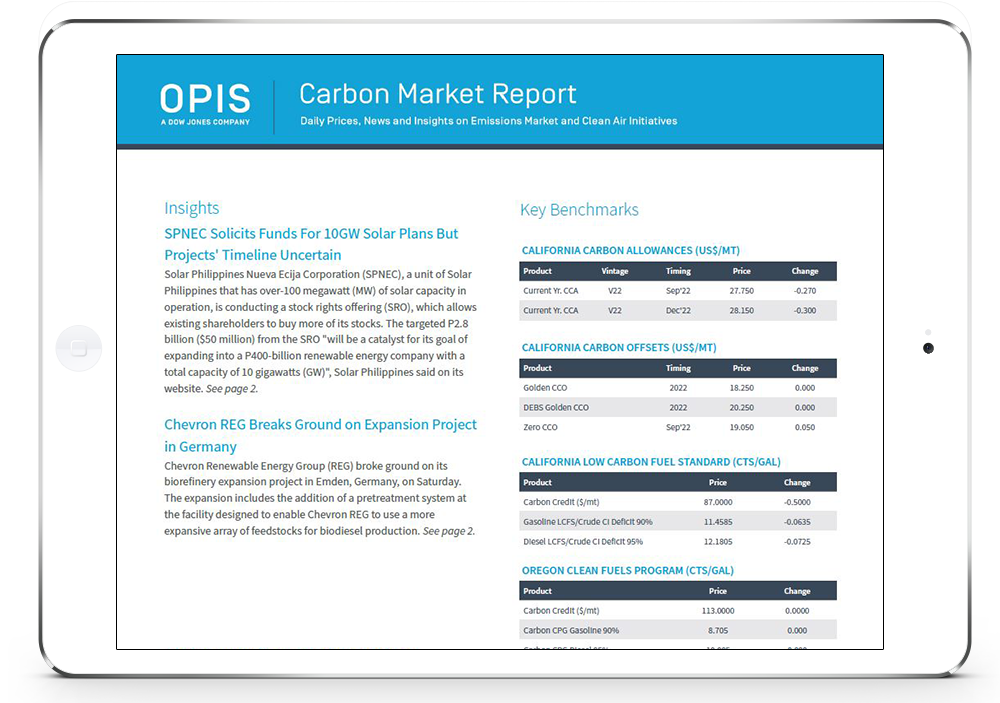

Ever-evolving climate change policies impose a growing influence on traditional fuel markets and carbon credit markets can be extremely volatile. Easily track and manage carbon compliance costs to your business with the OPIS Carbon Market Report.

Try the OPIS Carbon Market Report free for 10 days! You’ll get a daily PDF report plus alerts sent to your inbox as news breaks.

OPIS, A Dow Jones Company

© 2024 Oil Price Information Service, LLC. All rights reserved.