China Cranks Up Fuel Exports in October, Beleaguered Refiners Brace for More in 2021

November 24, 2020

China ramped up oil product exports in October even as refiners elsewhere struggle to stay on their feet in what is set to be the new norm as the global refining sector faces up to unrelenting Chinese expansion and COVID-19-induced fuel demand decimation, according to industry sources and government data.

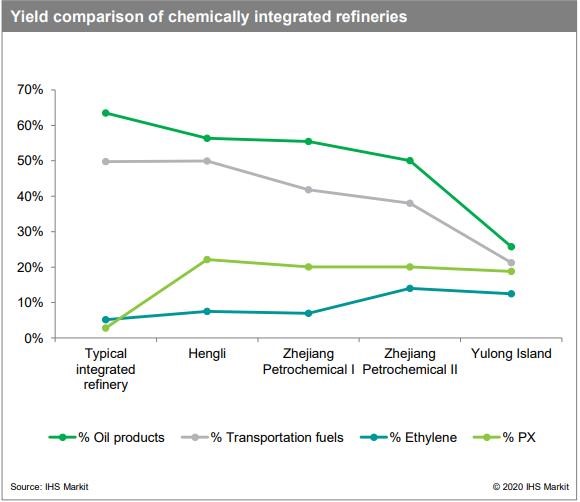

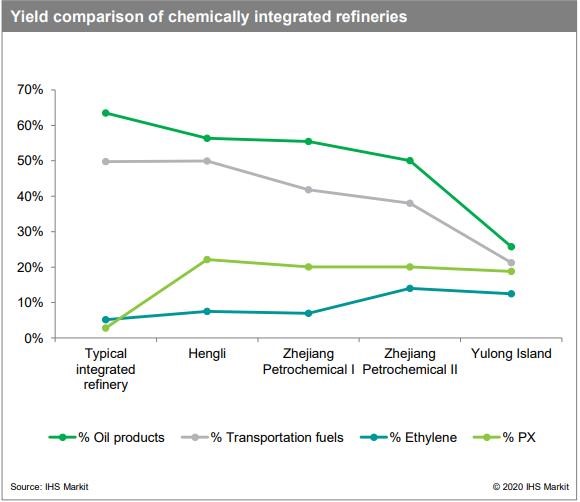

The newly-built highly-integrated mega Chinese refinery-cum-petrochemical complexes are immensely more efficient than the 50-60 year-old clunkers that they are replacing across the globe spanning from the U.S. west coast to the Philippines, bringing a new paradigm to the oil market, they said.

Even though Chinese refineries are built primarily to cater to the domestic market, the export market is a safety valve whenever there is an imbalance in fuel or petrochemical demand, which easily amounts to 1 million b/d in an average month. Such volumes weigh heavily on inefficient, standalone sites that are increasingly exposed and consequently shuttered.

“We have these new refineries coming up in China that were planned 3-5 years ago but China does not need the extra capacity right now, the world also does not need it. We are going to see margins getting worse for refiners in the region and more capacity will be shut,” said one trading source.

The world’s largest crude oil importer shipped out 4.52 million mt of gasoline, diesel and jet-kerosene in October, up 73% from the 2.62 million mt exported in September, General Administration of Customs data showed. The volumes were little changed from a year ago, which were weighed by a 72% collapse in jet-kerosene shipments due to the virtual grounding of international air travel.

Yet at the same time, Chinese refiners, set to become the biggest global refining center at the expense of the U.S., cranked up runs to a record-high of 59.82 million mt, or about 14.15 million b/d, in October even as domestic demand failed to live up to expectations during the autumn holiday season.

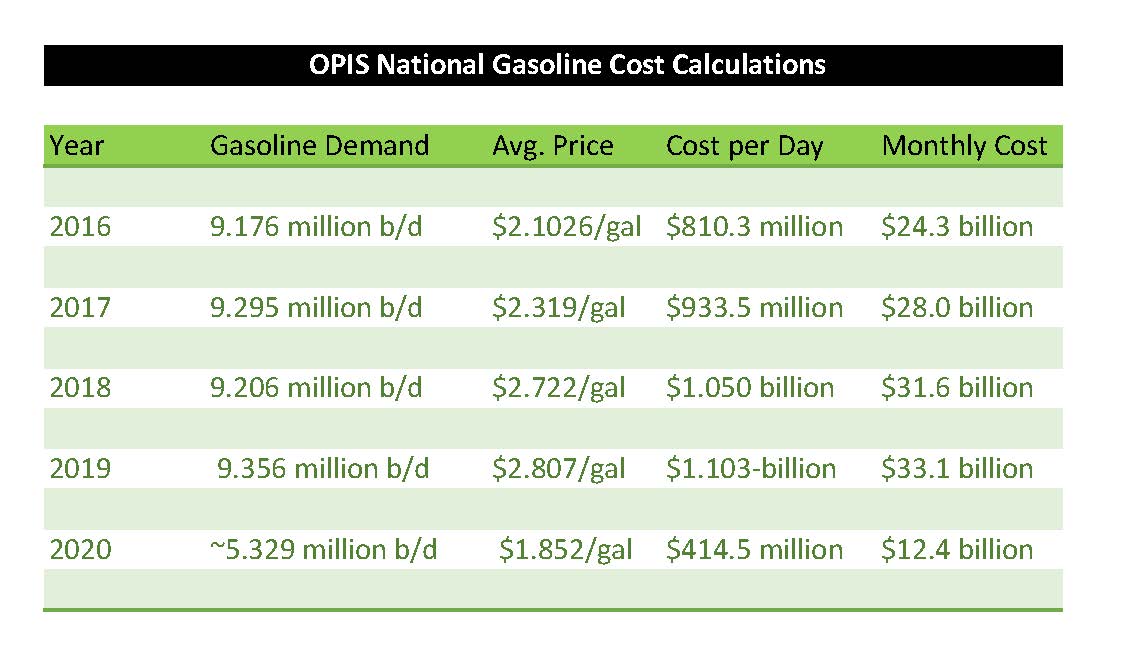

The U.S. has an operable refining capacity of about 18.62 million b/d, which shrank to as low as 13.32 million b/d in April 2020 before rebounding to 14.68 million b/d, according to data from the Energy Information Administration (EIA). About 1 million b/d are likely to be permanently shuttered because of poor refining margins due in part to the demand erosion wreaked by COVID-19.

On the other hand, China’s refining capacity is forecast to climb to 20 million b/d by 2025 from 17.5 million b/d at the end of this year, according to the Economics & Technology Research Institute (ETRI) of the China National Petroleum Corp.

“Chinese refineries are not intentionally built or designed to serve the overseas market in the first place, until now many refineries see the export market as their last resort, or a valve to clear up any surplus,” said Feng Xiaonan, IHS Markit downstream analyst in Beijing.

However, Feng concedes that the refiners do enjoy competitive advantages over other regional players if they are relatively free to export and have sufficient government granted quotas.

“The reason is multi-fold, 1. They can bear lower product cracks by leveraging on the more profitable chemicals side. 2. Economies of scale. 3. High production flexibility, e.g. they can intentionally gear up their oil product yield when the market is in favor of these products and vice versa,” she said.

The new sites coming onstream in China typically have processing capacities of 300,000 b/d or more and are integrated with petrochemical units that allow them to swing from a so-called petrochemical to an oil-product mode as the economics dictate.

Two well-known facilities that have come on-stream over the past year are centered around 800,000 b/d crude processing capacities each that stretch downstream all the way to aromatics and ethylene derivatives such as polystyrene and polyethylene among the many plastic products produced.

Earlier this month, China awarded a further 3 million mt of export quotas as part of its final batch for this year, raising the tally for 2020 to 59 million mt from 56 million mt last year, industry sources said.

The volumes suggest that the Chinese government for now is comfortable for its refiners, both state and privately-owned, to have a bigger share of the overseas market which traders said would extend deeper into Australia, New Zealand and the west coast of the Americas where refining capacity is shrinking.

So far in Asia, Royal Dutch Shell announced the closure of its 60-year-old 110,000 b/d Tabangao refinery in the Philippines and plans to cut capacity by half at its biggest 500,000 b/d facility in Singapore. Shell said it aims to have just six integrated refineries by 2025.

BP Australia earlier said it would convert its 152,000 b/d Kwinana refinery in Western Australia into an import terminal. Ampol said Oct. 8 it is studying a similar conversion of its 109,000 b/d Lytton site, echoing a statement by Refining NZ, the sole operator in New Zealand. The Australian government last month announced plans to subsidize refiners as long as they maintain operations in Australia, days after Viva said it may shut the 120,000 b/d Geelong site.

One of the export quota recipient, Zhejiang Petrochemical Corp. (ZPC) was given 1 million mt. The company, which is majority owned by Rongsheng Petrochemical Co., is in the final stages of getting the second phase of its 800,000 b/d refinery up and running.

“One million mt for use in one month is a lot, most of this will end up as gasoline and that will have an impact on the market. We may have to brace for more such news next year,” the trading source said.

--Reporting by Raj Rajendran Rajendran.Ramasamy@ihsmarkit.com

--Editing by Trisha Huang Trisha.Huang@ihsmarkit.com

Copyright, Oil Price Information Service

COVID-19: Vaccine Set to Raise Asia Fuel Demand to Pre-Pandemic Levels in 2021

November 10, 2020

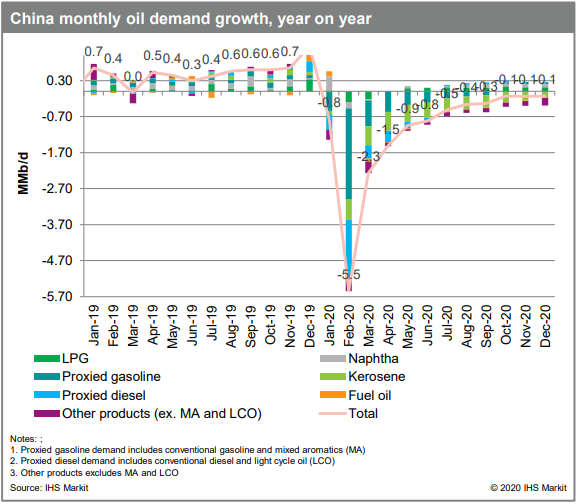

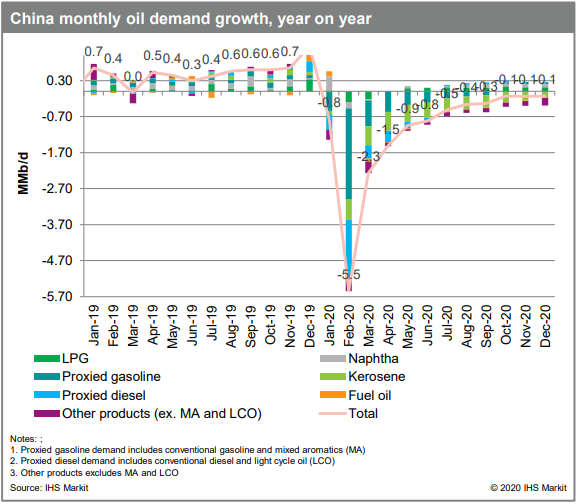

Oil product consumption in Asia may recover to 2019 levels next year following the discovery of a COVID-19 vaccine with optimism driven by the robust demand growth already seen in India and China but an immediate boost is unlikely with global demand lagging behind and time needed for a global inoculation program.

Drug makers Pfizer and BioNTech said on Monday that their vaccine was more than 90% effective in preventing COVID-19, raising hopes that the pandemic, which eroded global fuel demand, may be controlled, trading sources said. Crude oil surged on the news with ICE Brent up 6.1% on-day to $42.74/bbl as of 4:30 pm Singapore time.

Transportation fuels such as gasoline, gasoil and jet fuel strengthened on Tuesday in Asia, according to broker data.

"It is good news, although the requirement of very low-temperature storage could pose a logistical challenge. This could be the start of the series of new vaccinations under development. These vaccines will help accelerate the fuel demand recovery," said Premasish Das, IHS Markit research and analysis director.

"They would help all the transportation fuels, but particularly jet fuel can get a boost as it can increase consumer confidence triggering more travel."

Asian demand is expected to exceed the 2019 level in 2021, but global consumption will not recover to the 2019 level before 2023, Das said.

Oil product traders in Asia, however, maintained a cautious stance for now, saying it is premature to expect the vaccine to raise demand immediately.

"It is too early to say as vaccine will anyway be launched by June 2021," said a gasoline trader. "Europe is under lockdown and demand is weak."

The January/March Singapore 92 RON spread remained in contango although the spread shrank to minus $0.80/bbl on Tuesday from minus $0.85/bbl in the previous session.

Pressured by weak demand and supply overhang, the benchmark 92 RON crack on Nov. 4 fell to $2.020/bbl, the lowest since Sept. 3, according to OPIS data. It recovered to $2.654/bbl on Tuesday.

Jet fuel also may not strengthen in the near term due to the logistics involved in getting a global inoculation program running, sources said.

"There may be a small uplift in air travel around mid-to-late 2021, assuming travel bans, restrictive measures are lifted, as people rush to travel after being grounded for so long. But then, it will still take time before market confidence returns to 100%," said April Tan, IHS Markit downstream research associate director in Singaporean.

In the marine fuels market, enquiries are muted as buyers of bunker hold back their purchases after the latest jump in prices.

The high sulfur fuel oil (HSFO) is in steep backwardation with the prompt balance November at least $4.50/mt more expensive than December cargoes, while the very low sulfur fuel oil (VLSFO) is at $1.50/mt in backwardation for the same period, said traders.

Demand could pick up for bunkers from cruise liners once the vaccine proves to be effective as borders open up and travelling resumes, said some bunker suppliers.

In the petrochemical sector, demand for polyester, derived from purified terephthalic acid (PTA), paraxylene and mixed xylene (MX), could improve as a life returns to normal, a petrochemical producer said.

Even if a vaccine reduces demand for propylene from the packaging and medical sectors, the demand loss is likely to be offset by renewed demand from the automotive sector, he added.

"Demand gain from COVID-19 offset only some losses from the other sectors. So, when the world becomes healthy, demand should increase further and that is the basic scenario of IHS Markit GDP and energy price assumption as well," said another IHS Markit analyst.

The surge in pandemic-driven demand for olefins derivatives such as packaging, medical equipment and hygiene products helped to offset the declines in automotive, coatings and durable goods demand.

Mobility curbs delayed the commissioning of new plants while supply of propylene from refinery sources was curtailed as refiners cut runs, according to Asia Light Olefins World Analysis - Propylene.

The factors that supported olefins demand also negatively impacted sectors that consume durable goods made from aromatics, including building, construction and furniture while empty roads meant lower demand for gasoline octane boosters MX and toluene.

Reference a single daily index for buying and selling jet fuel and gasoil profitably in Asia with the OPIS Asia Jet Fuel & Gasoil Report. Try it free for 21 days

--Reporting by Jongwoo Cheon Jongwoo.Cheon@ihsmarkit.com, John Koh John.Koh@ihsmarkit.com, Trisha Huang Trisha.Huang@ihsmarkit.com and Thomas Cho Thomas.Cho@ihsmarkit.com;

--Editing by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

Copyright, Oil Price Information Service

Huge Spot Crude Oil Purchase Points to Rongsheng Refinery Start at Year-End

16 October 2020

A bumper 10 million-barrel spot crude oil purchase by Rongsheng Petrochemical suggests it is keen to get the second phase of its massive 40 million mt/yr, or 800,000 b/d, refinery and chemical project at subsidiary Zhejiang Petrochemical Co. Ltd (ZPC) running in the coming months, trading sources said.

Rongsheng announced in August plans to begin trial runs at the second 400,000 b/d tranche of the project in the fourth quarter of 2020 and looks set to achieve this aim despite COVID-19-related construction delays due to social distancing restrictions earlier in the year.

Market participants said Rongsheng was absent from the spot market for a couple of months and returned this week to buy the medium-sour Middle East cargoes, which led some to believe it was restocking but added that the scale of the purchase does point to some use in the new facility.

"At least part of the purchase can be attributed to the Phase II trial," said one source.

The refiner bought grades including Upper Zakum, Qatar Marine, Basrah Light, Oman and Al-Shaheen, they said, adding that the cargoes were for delivery mostly in December with some going into January, they said.

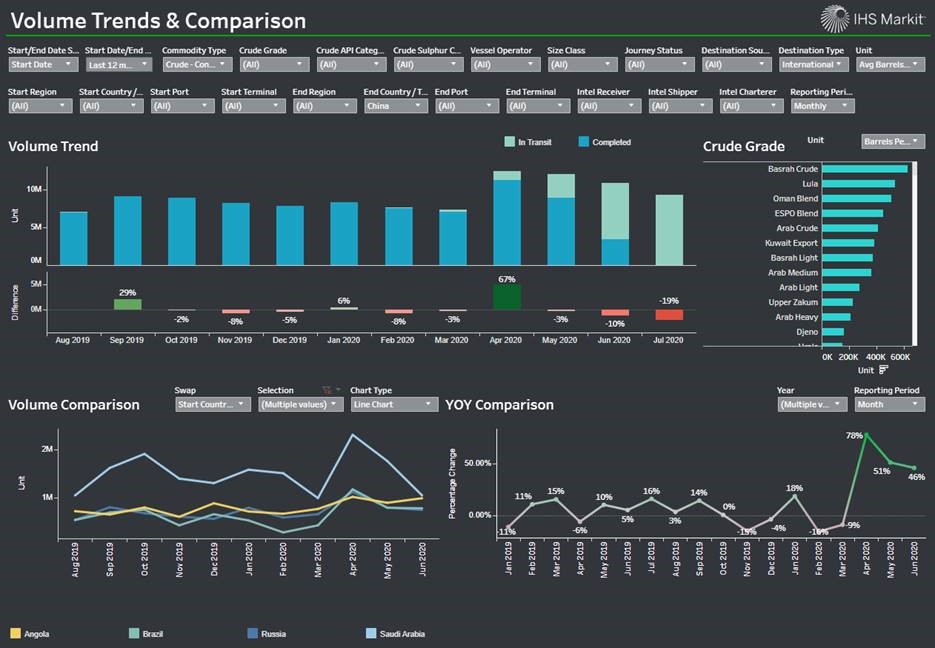

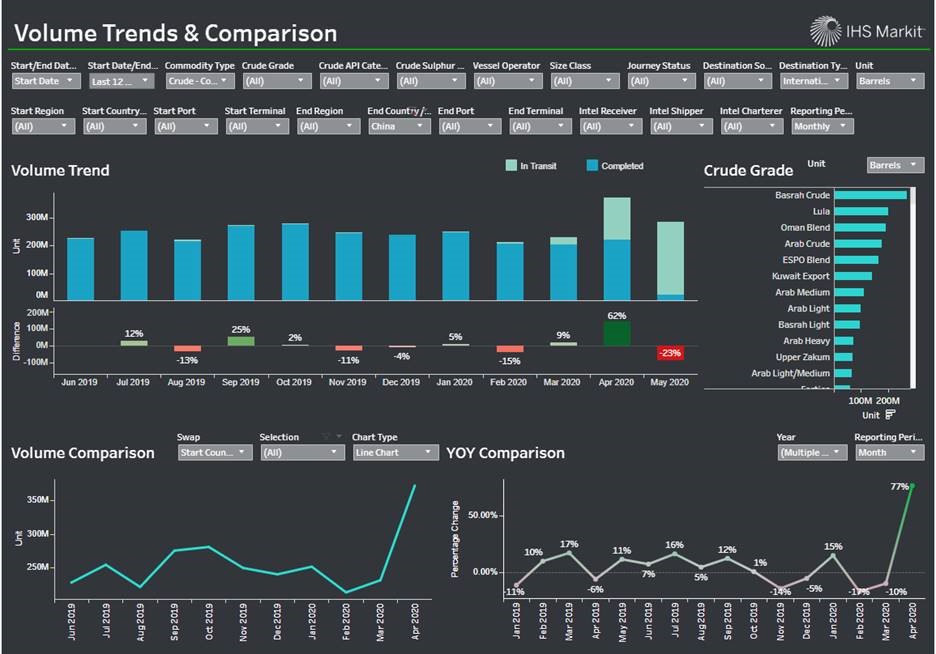

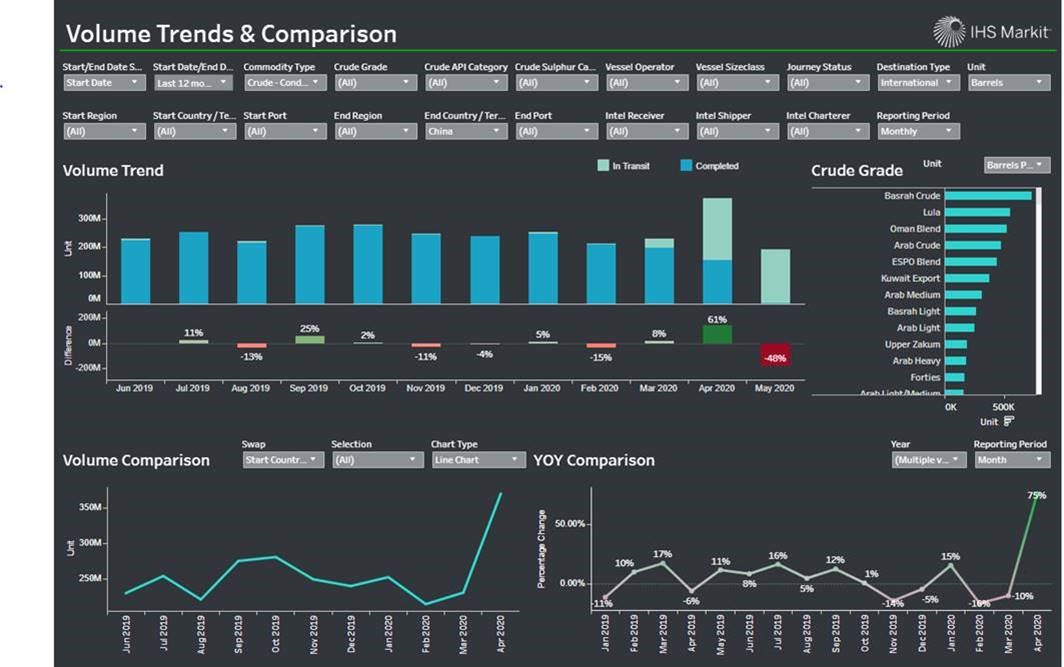

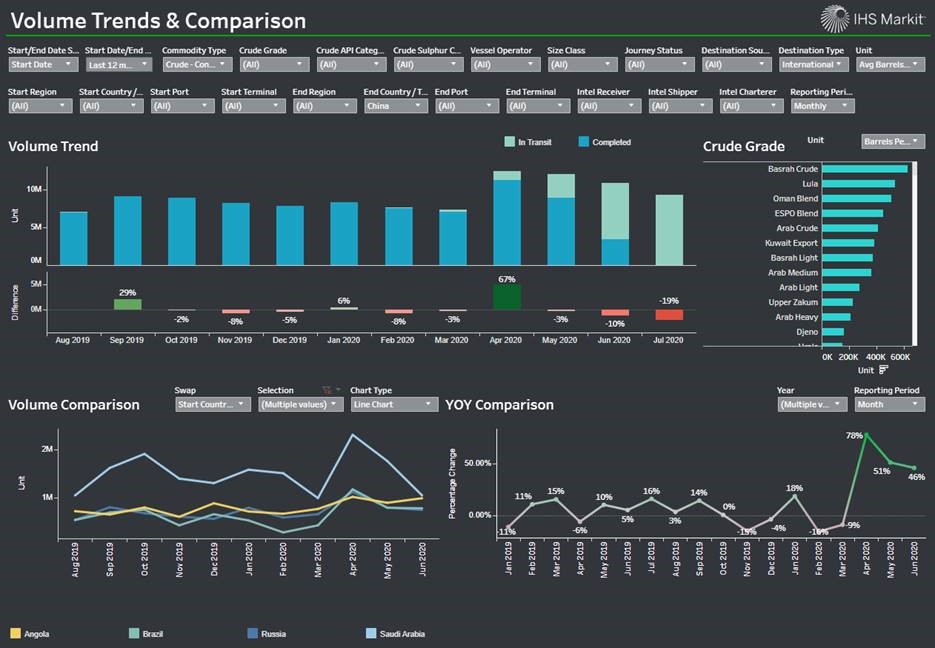

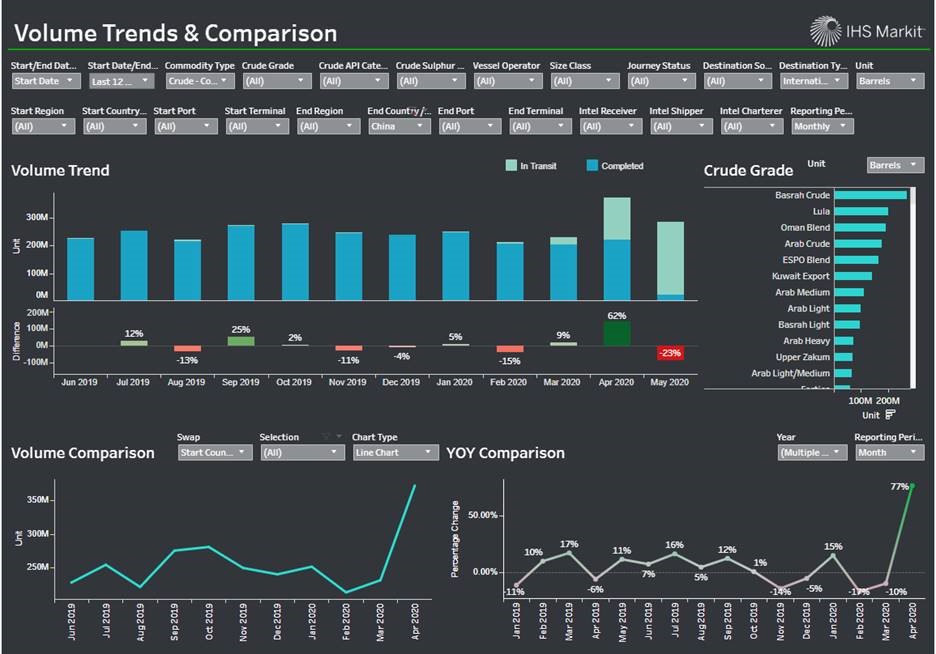

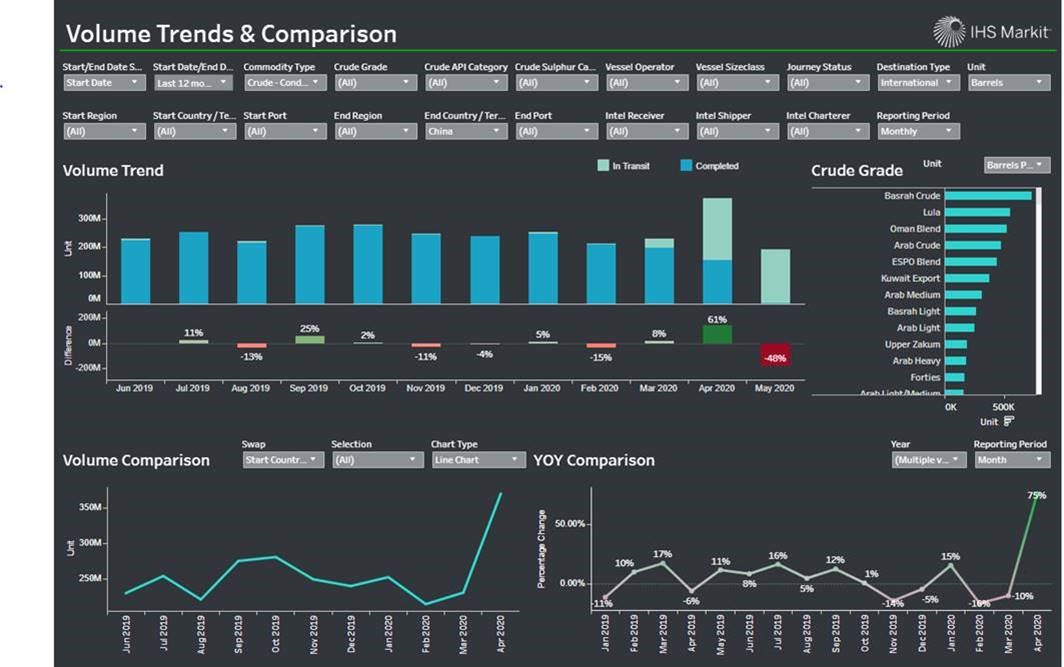

The purchase is not a sign of increased crude purchases from China for the final quarter as the nation has still to work through record imports made earlier in the year with deliveries in September coming in at a high 11.8 million b/d, up 2% from 11.2 million b/d in August and well above the 10 million b/d a year ago, according to preliminary data from the General Administration of Customs (GAC).

China took in an all-time high of about 12.9 million b/d in June as its extensive spring bargain hunt led to record summer/autumn arrivals resulting in massive port congestion and lengthy vessel wait times that have now eased, the GAC and IHS Markit Market Intelligence Network (MINT) vessel tracking data showed.

"The small recovery in imports is driven more by the temporary release of the backlog as port congestion eased instead of by fresh buying," Feng Xiaonan, IHS Markit downstream analyst in Beijing, said earlier. OPIS is a company of IHS Markit.

The refinery complex is designed to process medium-sour crudes into transportation fuels and feedstock for the petrochemical units.

Secondary refining units at the site include a 3.8 million mt/year reformer, a 5 million mt/year residue fluid catalytic cracker (RFCC), a hydrocracker, naphtha and residue hydrotreaters.

The petrochemical units include a 1.4 million mt/year ethylene and a 4 million mt/year paraxylene plants as well as related downstream polymer and polyester units. It also has a 600,000 mt/year propane dehydrogenation (PDH) unit.

ZPC completed hoisting several of its major refining units, including the crude distillation unit (CDU), residual hydrotreating unit and diesel hydrotreating unit by the time of this update, IHS Markit said in its Aug. 27 short-term outlook on the China crude market.

"Under normal conditions it would take at least another 4-6 months before they can get the entire plant ready for normal operation, but we can't exclude the possibility that they may choose to partially startup Phase II in order to meet their stated goal of a 2020 Q4 startup," Feng said on Friday.

Phase II is centered around a similar 400,000 b/d CDU as the first phase, placing ZPC in conjunction with Hengli Petrochemical as operators of the largest independent refining-cum-petrochemical complexes in China. Once completed there will be two such 800,000 b/d sites in the country.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report. Get your free trial here.

--Reporting by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

--Editing by Trisha Huang, Trisha.Huang@ihsmarkit.com

Copyright, Oil Price Information Service

Uncertainty and Volatility Cloud Europe's Jet Paper Market as Winter Nears

October 13, 2020

Sentiment remains divided over the direction of European jet fuel prices ahead of winter, following market turbulence which saw fourth quarter 2020 and first quarter 2021 paper tumble between July and August before surging higher from September until early October, sources told OPIS.

Continuing low refinery runs coupled with the autumnal turnaround season has tightened supplies from across the European barrel since September, creating backwardation in naphtha and gasoline and causing middle distillate differentials to strengthen versus distillate futures, according to OPIS and Intercontinental Exchange pricing.

European jet differentials versus front-month ICE Low Sulfur Gasoil futures jumped higher in September, helped by refiners minimizing aviation fuel production as the persistence of COVID-19 stalled the recovery of the sector.

IHS Markit analysts pegged refinery yields at just 2.6% of refinery input in May compared to 7.8% for the same period a year earlier.

Europe, which is structurally short jet fuel and usually imports more than 20 million metric tons a year, mainly from the Middle East Gulf and India, has largely been influenced by Asia, sources told OPIS. The European market has been focused on the strengthening regrade in Singapore, the difference in price between jet and 10ppm sulfur gasoil prices.

"The argument is that we are facing a very cold winter, and Japan will need to buy kerosene and refiners have cut production back. China's domestic aviation market has also bounced back. But I don't buy it myself because Japan's tanks are full, and the long haul (flights) sector is still suffering," one trader said. "There was also talk of jet fuel being blended into marine gasoil pools to help support the market."

At the start of September, the November regrade was trading at minus $5.10/bbl, with Singapore FOB jet paper trading the equivalent of around $18.50/mt below Singapore FOB 10ppm sulfur gasoil paper. By the end of the month, the November regrade had bounced higher to minus $3.08/bbl, while FOB jet paper narrowed to just $5/mt below Singapore FOB 10ppm sulfur gasoil, a contraction of $13.50/mt over the month.

There was a similar pattern in Europe. Q4 2020 jet paper for cargoes arriving CIF northwest Europe was trading around $23.50/mt below Low Sulfur Gasoil futures. By the end of month, Q4 jet paper bounced back to $9/mt below distillate Low Sulfur Gasoil, narrowing the discount by $14.50/mt.

"Most of the European swaps, and it has been volatile, have been trading during the Singapore market-on-close," another trader said. "People think the worst is over, and there is talk of refiners continuing to cut jet production out of the slate, and also expectations some refineries will be axed next year."

But the volatility and liquidity of jet paper raises uncertainty over whether the rally in both the Asian regrade and European paper will hold over the winter. Trading was very thin for Q4 and Q1 jet paper to begin with, although it has started to recover, according to jet fuel traders.

"It was all small bits, and gappy [at first]," said one trader. "It is correcting (now) with good refiner selling seen in last few days."

"I am happy to see the differentials higher, but what struck me as odd was the recovery was the recovery was much greater in Q4 and Q1 than next summer," said a refining source. "The whole of the curve has moved up, but if the aviation market is recovering then I would expected to have seen Q2 and Q3 swaps rally as much as if not more than Q4 and Q1, [which is the period] when demand falls off and when there is still no vaccine."

Differentials for jet fuel cargoes arriving into Europe typically trade at a premium of between $20 and $40/mt above distillate futures and have soared to above $80/mt when the market is short of supply. But the forward pricing curve for jet fuel prices collapsed after COVID-19 struck, as the pandemic grounded aircraft while countries went into lockdown to halt the spread of the virus.

At the end of April, fourth quarter jet cargo paper was trading at minus $3/mt on expectations of recovering demand. But the fourth-quarter swap levels collapsed during July as expectations of a recovery in jet fuel demand this year were dashed by further outbreaks of coronavirus and the imposition of more travel restrictions. By the end of August, the paper had slumped to minus $23.50/mt.

Demand for flying was recovering from the nadir of April until the peak demand month of August, where it reached around half the levels recorded for 2019. But the recovery has since stalled, and by next January, demand is forecast to deteriorate to 60% of January 2020 levels, according to Eurocontol, a pan-European air traffic management agency.

"I am going to quote you what the head of a major trading desk told me a few months ago. We don't know where the jet paper should be," one trader told OPIS.

"It could be minus $40, minus $20, or plus $20/mt."

Get daily expert analysis of the Northwest Europe and Mediterranean jet fuel, ULSD and gasoil markets with OPIS Europe Jet, Diesel & Gasoil Report. Try it free for 21 days.

--Reporting by Paddy Gourlay, patrick.gourlay@ihsmarkit.com;

--Editing by Rob Sheridan, rob.sheridan@ihsmarkit.com

Copyright, Oil Price Information Service

India May Ramp Up Crude Runs in December to Full Tilt on Diesel Recovery Hopes

October 6, 2020

Indian refiners are cranking up runs strongly on the back of robust domestic gasoline demand and signs of a recovery in diesel consumption amid speculation that crude throughput may even reach 100% in December, trading sources with knowledge of the matter said.

Moreover, increased domestic travel going into the holiday season and better manufacturing data have raised expectations for even higher diesel and jet fuel consumption amid wider use of public transportation and air traffic, they said, adding that liquefied petroleum gas use remains healthy.

Refinery runs at the world's third largest crude oil importer are forecast to increase to 90% in November from around 80-85% in October with further hikes anticipated in December, with one source adding that it could reach 100% due to the combination of renewed diesel and strong gasoline demand.

"Gasoline demand is super high and diesel demand is showing some signs of recovery," one India-based source said, adding that the rebound in diesel consumption has allowed refiners to crank up runs which were earlier hamstrung by limited middle distillate demand.

Even though diesel and in particular jet fuel demand is well below year-ago levels, strong month-on-month growth has brought fresh optimism going first into the Dussehra festival in October, followed by Diwali in November, which trading sources said should trigger an increase in demand for transportation fuels.

Another indicator of the changing tide was seen last week when Indian Oil Corp. (IOC), the nation's largest refiner, cancelled a gasoline import tender while seeking to sell the most diesel in a month for at least six years.

"Gasoline recovery has been strong and will receive a modest boost from seasonal demand due to the festive seasons. For diesel, the IHS Markit September Manufacturing PMI was 56.8 (4.8 points higher than August), indicating that industrial activities are recovering well, supporting diesel demand," said Kendrick Wee, IHS Markit research and analysis associate director in Singapore.

IHS Markit estimates Indian refinery utilization at 87-88% in November/December.

Domestic gasoline sales by the three largest state-run refiners, who together have 90% of the local market, grew 2% in September, the country's first monthly year-on-year growth since the March COVID-19 lockdown, the sources said citing preliminary data from the sellers.

Diesel sales were down 7% on-year but up 22% from August, which they said portends to possibly flat growth in October and even year-on-year gains by November.

India reduced refinery throughput in August to 16.1 million mt, or 3.82 million b/d, down a hefty 26.4% from a year ago, according to data from the Petroleum Planning & Analysis Cell (PPAC). This works out to 76% of the country's nameplate 5.02 million b/d capacity and 73.6% of the 5.19 million b/d processed a year ago, the data showed.

Crude oil imports reached 15.2 million mt, around 3.58 million b/d, in August, down 23.4% from a year ago but up by an almost similar margin from July, PPAC data showed. Intake was also the highest since April.

The expectations for fuel demand growth come despite the spread of COVID-19 as India has not instituted new nationwide social distancing measures even as cases soar to almost 6.7 million, the second-largest cases globally. It recently reopened schools.

In Maharashtra state, home to the commercial capital of Mumbai, for example, bars and restaurants were allowed to reopen from Monday, which could trigger a return of workers to the city that is facing staff shortages due to mobility issues.

There are no major refinery turnarounds planned in the fourth quarter aside from the month-long shutdown of the 400,000 b/d Vadinar facility in October.

Consequently, if runs are cranked up to full in December, crude oil trades will increase significantly from this month. Already there were signs of increased runs as purchases of November-delivery barrels rose, trading sources said.

OPIS Mobile News Alerts provides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility. Tell Me More

--Reporting by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com;

--Editing by Editing by Trisha Huang, Trisha.Huang@ihsmarkit.com

Copyright, Oil Price Information Service

Colder Japan Winter Forecast Portends More Kerosene, LNG Demand in Coming Months

September 28, 2020

Most parts of Japan will likely experience a colder winter this year, the country’s official weathermen said in its first forecast for the season, signaling a possible increase in the import of heating fuels such as kerosene and LNG.

All regions of Japan, except Tohoku and Hokkaido, will have a 40% probability of below-normal temperatures over the winter months of December to February versus a 30% chance of normal or above-normal temperatures, according its first winter weather forecast published by the Japan Meteorological Agency (JMA).

Temperatures over the same period in Tohoku will have a 40% probability of being normal, while those in Hokkaido will have a 40% chance of being above normal, the JMA data showed.

Kerosene

A harsher winter could prompt Japanese traders to increase their kerosene stockpiling for winter from October, bringing some reprieve to the embattled jet-kerosene market that has been severely hit by COVID-19, market sources said.

“Market players are seeking outlets for their jet fuel and kerosene due to the pandemic which hurt the aviation industry,” a trader said, adding “a cold winter forecast may drive kerosene sale and prices.”

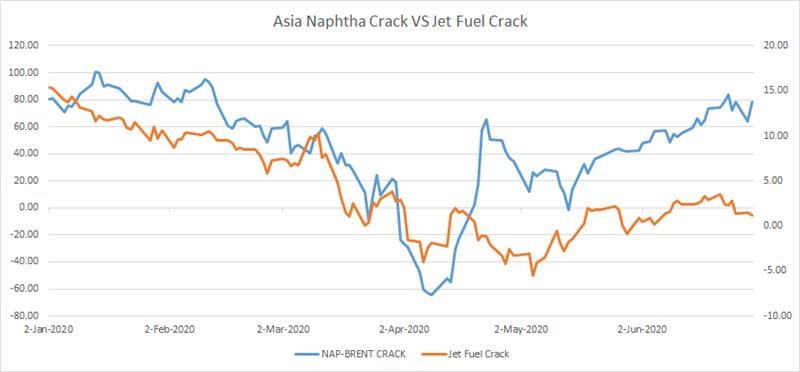

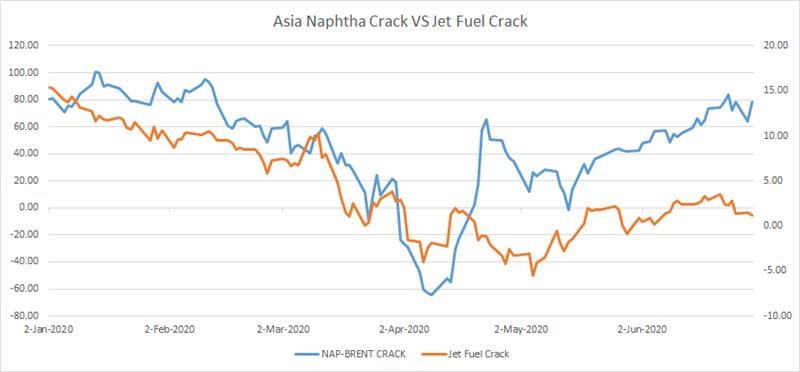

Asia jet fuel crack showed signs of strengthening in recent weeks, albeit still in the negative. Refining margins was at minus $0.05/bbl at the end of last week, up from minus $2.28/bbl on Aug. 31, which was the lowest point in more than three months.

But some trade sources, on the other hand, remain skeptical about the impact that the colder winter in Japan may have on the wider jet fuel market.

“The crack may not be able to reach half of the values in 2019 as year-end tourism is usually the main driving force behind kerosene and jet fuel,” one of the traders said.

Jet fuel crack averaged plus $15.70/bbl over October to December 2019, OPIS data showed.

Any improvement in kerosene demand this winter would be a welcome change for sellers compared with last year when milder temperatures weighed on the country’s buying appetite for the heating fuel.

Japanese kerosene imports in December 2019 to February 2020 dropped to an average of 3.66 million bbls per month, down by 6.4% from 3.91 million bbls over the same period in 2018-19, data from the Petroleum Association of Japan (PAJ) showed.

Kerosene, which is essentially jet fuel with a few minor differences in its specifications, is widely used in small heaters throughout Japan during winter.

LNG

Colder weather over the peak gas demand season of winter could also boost Japan’s LNG demand and offset some of the COVID-19 negative impact on demand for the super chilled fuel this year, traders said.

“Cold winter weather in a major demand center like Japan is definitely a boost to overall fundamentals. In the very least, it will help pare the current high inventories in the country,” said a northeast Asian trader.

Japanese gas stockpiles have stayed high during the COVID-19 outbreak, which not only crimped spot purchases but also spurred the deferments of many long-term cargoes by importers earlier this year.

Several Japanese buyers exercised the downward quantity tolerance provision in their offtake contracts to cut long-term volumes, sources said.

Tepid year-to-date LNG demand is seen in sluggish import volumes, which fell to around 55 million mt from January to September 2020, 4.8% lower than the same time last year, according to shipping data by IHS Markit LNG Analytics.

But the latest colder weather forecast may have already started to turn the tide, a Japanese trader said, citing the emergence of three Japanese utilities in the spot market last week for October and November cargoes.

However, a second Japanese trader warned that any increase in LNG imports this winter might be modest.

“This winter’s total LNG imports into Japan won’t be as much as in previous cold winters as we are still working through pretty high inventories and are still facing reduced demand from COVID-19,” the trader said.

Understand the key drivers of LNG demand in China and the Northeast Asia Region with the OPIS Asia LNG Price Report.

--Reporting by John Koh, John.Koh@ihsmarkit.com, Carrie Ho, Carrie.Ho@ihsmarkit.com;

--Editing by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

Copyright, Oil Price Information Service

Egypt's MIDOR Issues Tender to Buy 3 Gasoil Cargoes For October, November

September 25, 2020

Egypt's Middle East Oil Refinery (MIDOR) company, located in Alexandria, has issued a tender to buy 90,000 metric tons of gasoil for October and November delivered into El Dekheila Port, according to a document seen by OPIS amid better-than-expected recovery in the region.

MIDOR is seeking one 30,000 mt (plus or minus 10%) cargo of 1% maximum sulfur gasoil for delivery to El Dekheila over October 11-13; one 30,000 mt (plus or minus 10%) cargo of 0.5% maximum sulfur gasoil for delivery over November 5-7; and one 30,000 mt (plus or minus 10%) cargo of 1% maximum sulfur gasoil for delivery over November 20-22. Bids should be submitted by September 28 and are to remain valid until October 2, according to the document.

Demand in Egypt seems to be recovering quicker than expected.

"We started to see some recovery in July/August and recent tenders from MIDOR and Egyptian General Petroleum Corporation (EGPC) are reflecting the recovery, but demand is still lower than last year at this time," said Farrah Boularas, an associate director with IHS Markit Downstream.

With the largest oil product market in Africa, Egyptian total inland product demand has grown at an annual average rate of 2.4% since 2012, reaching an estimated 916,000 b/d in 2019, reports IHS Markit, the parent company of OPIS." Before the COVID-19 crisis, the net gasoil import balance in Egypt was around 150,000 b/d on average; our base case scenario estimates the gasoil deficit to decrease to at least 100,000 b/d in 2020," Boularas said.

COVID-19 restrictions in Egypt were introduced in March and were gradually eased throughout June. Commercial flights and international tourism to Egypt resumed on July 1.

Of the available data to July, MIDOR imported roughly 63,000 mt of gasoil in June over two cargoes, some 33,000 mt of gasoil in May, almost 33,000 mt of gasoil in March, 33,000 mt in February, and two cargoes of gasoil totaling around 65,760 mt in January however, no gasoil was imported in April or July, according to its website. Exports on the other hand, consist almost entirely of jet fuel.

MIDOR delivers refined products to the national oil company, EGPC, and the local market. Its refinery has a crude distillation capacity of 100,000 b/d and is one of the newest and most sophisticated of Egypt's nine operating refineries, according to IHS Markit data. Egypt has a total atmospheric distillation capacity of 737,000 b/d.

EGPC owns a 78.7% stake in MIDOR, with the remaining equity held by Petrojet (10%), Engineering for Petrol and Process Industries (10%) and Suez Canal Bank (1.3%).

MIDOR didn't respond when contacted by OPIS for comment.

Get daily expert analysis of the Northwest Europe and Mediterranean jet fuel, ULSD and gasoil markets with OPIS Europe Jet, Diesel & Gasoil Report. Try it free for 21 days.

--Reporting by Jen Caddick, jenny.caddick@ihsmarkit.com;

--Editing by Rob Sheridan, rob.sheridan@ihsmarkit.com

Copyright, Oil Price Information Service

Asia Heavy Full Range Naphtha Pressured as Buyers Shun Kerosene-Rich Grades

September 25, 2020

Heavy full range naphtha (HFRN) traded at a bigger discount to lighter or cracker grades in Asia amid ample arbitrage barrels as splitter operators shun heavier grades with high jet-kerosene yield, the demand for which is decimated by COVID-19 mobility restrictions, market participants said.

HFRN traded at a discount to open-specification naphtha (OSN) with minimum 70% paraffin since late June as soft aromatics margins and lower splitter runs crimped demand. While paraffinic naphtha continued to trade at premiums to Japan assessments, discounts for HFRN steepened.

On Wednesday, Hanwha Total Petrochemical (HTC) bought HFRN for H1 Nov. to Daesan at a discount of $5/mt or larger to Japan prices, said sources. An HTC company source declined to comment.

On Thursday, Yeochun NCC (YNCC) bought OSN (minimum 70% paraffin) for H1 Nov. at plus $4.50/mt, effectively placing the HFRN-OSN spread at $9-$10/mt, bigger than the $5-$6/mt in mid-September.

Last Friday, GS Caltex bought H1 Nov. HFRN at minus $3-$5/mt but the absence of H1 Nov. OSN deals until Thursday meant that a meaningful comparison was not possible at that time.

Given that HFRN values are grade dependent, for the purpose of price discovery it is equally important to find out the specific grade purchased by HTC, a trader cautioned, adding that splitter operators currently prefer B grade HFRN with a lower jet-kerosene yield than A grade.

"Nobody wants A grade now. If given a choice, any splitter operator would pick other HFRN. B grade with less jet-kerosene is more attractive to buyers," the trader said.

So-called A grade is splitter grade HFRN while B grade is swing grade that can be used by either splitter or cracker, a source explained. Shipments from the Black Sea ports of Tuapse and Novorossiysk are classified as A grade, although Novorossiysk barrels tend to be the lighter of the two with variable specifications, the source added.

A driver of the recent HFRN price slide versus OSN could be due to some grades that are jet-kerosene rich, another trader said, adding that exports from Tuapse typically have a higher yield of the middle distillate.

"Buyers prefer whatever that has lower jet-kerosene. Some grades are full of kerosene which could explain the low premiums," the second trader said.

Despite the deepening HFRN discount and the relatively high freight rates for the benchmark Mediterranean-to-Japan route in recent weeks, the inflow of HFRN is unlikely to ebb because Europe needs to export surpluses to Asia, market participants said.

"Tuapse doesn't have many alternative outlets in Europe; cargoes still have to come to this region," the first trader added.

Monthly exports from the Russian Black Sea to East Asia averaged about 440,000 mt for the year to August, with 85.4% of the barrels landing in South Korea, IHS Markit Commodity at Sea (CAS) data showed. Inflow from the Russian Baltic Sea is not included.

Shipments in 2019 averaged 450,000/month, the data showed.

"Structurally, Europe needs to export at least 700,000-800,000 mt/month," a source added.

Rates to carry 80,000 mt of naphtha from the Mediterranean to Japan, a route known as TC15, topped $30/mt on Sept. 15 and held at this level until Thursday, compared with $26/mt a month ago, according to the Baltic Clean Tanker Index.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report. Get your free trial here.

--Reporting by Trisha Huang, Trisha.Huang@ihsmarkit.com;

--Editing by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

Copyright, Oil Price Information Service

Ineos Eyes 5-6 Week Shutdown of U.K. Grangemouth Petchems Plant in October

September 22, 2020

The U.K.-based Grangemouth petrochemicals plant operated by Ineos will shut down at the beginning of October, according to sources with links to the plant Tuesday.

The shutdown of the petchems facility in Scotland is planned to last between five and six weeks, those local sources say, and has been pushed back from a provisional mid-September start date.

Turnarounds at the nearby 210,000-b/d Petronineos-operated refinery and the petchem plant were originally scheduled for April this year, but the onset of the COVID-19 pandemic scotched those plans.

One source told OPIS that a short period of maintenance work on a 110,000-b/d crude distillation unit at the refinery was about to end, and so many workers engaged in that project will be redeployed to work on the forthcoming petchems plant shutdown.

A spokesman for Ineos said that the company does not comment on its day-to-day operations at Grangemouth.

OPIS Mobile News Alerts provides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility. Tell Me More

--Reporting by Anthony Lane, alane@opisnet.com;

--Editing by Rob Sheridan, Rob.Sheridan@ihsmarkit.com

Copyright, Oil Price Information Service

India Refiners Set to Raise Runs in Q4, Ample Product Stockpile to Cap Hike

September 22, 2020

Indian refiners are eyeing modest run hikes in the final quarter of this year following healthy fuel demand growth in the first half of this month but ample diesel and gasoline inventories will cap product output growth, industry sources said.

They also caution that should the government revert back to hard COVID-19 lockdown measures -- which thus far they have been reluctant to enact despite soaring new cases due to the hefty economic costs -- whether the nascent growth seen so far will quickly come to a grinding halt.

"Basically there is still a lot of inventory to be cleared up, gasoil is still worrisome considering its half of production and gasoline as well. However, there are some chances to increase runs in November. The festival season calls for it," said one refining source based in India.

India, the second-largest crude oil importer in Asia, reduced refinery throughput in August to 16.1 million mt, or 3.82 million b/d, down a hefty 26.4% from a year ago, according to data from the Petroleum Planning & Analysis Cell (PPAC). This works out to 76% of the country's nameplate 5.02 million b/d capacity and 73.6% of the 5.19 b/d processed a year ago, the data showed.

Crude oil imports reached 15.2 million mt, around 3.58 million b/d, in August, down 23.4% from a year ago but up by an almost similar margin from July, PPAC data showed. Intake was also the highest since April.

Total petroleum products consumption in August 2020 was at 83.8% of year-ago volume at 14.4 million mt versus 17.2 million mt in August 2019, according to the PPAC data. This is down 7.5% from 15.56 million mt in July.

However, sales in the first-half of September by the country's three largest domestic suppliers showed better growth traction.

Diesel sales by Indian Oil Corp. (IOC), Bharat Petroleum Corp. Ltd. (BPCL) and Hindustan Petroleum Corp. Ltd. (HPCL) edged up 19.7% from 1H August to 2.13 million mt, while gasoline and jet fuel rose 7.2% and 21.3% to 965,000 mt and 125,000 mt, respectively, according to data from the suppliers.

"We expect the demand recovery to continue and that would support higher refinery runs in October/November. However, from a year-on-year point of view, there is still a long a way to go to reach the 2019 level," said Premasish Das, IHS Markit research and analysis director.

IHS Markit estimates September refinery runs at 4.1 million b/d, rising to 4.4 million b/d in October/November, Das said, adding that the forecast may be slightly on the optimistic side.

India will be celebrating two major festivals in the coming months, firstly Dussehra in October, followed by Diwali, the important festival of lights, in November, which trading sources said should trigger an increase in demand for transportation fuels.

However, the unrelenting spread of COVID-19 cases has cast a cloud over the upcoming festivities and some are questioning if expectations of exuberance and the accompanying surge in fuel consumption may be over stated especially as attendances at newly re-opened schools were poor, according to a Press Trust of India report.

India now has the second-largest COVID-19 case load at 5.56 million and daily new infections appear to be slowing down with 75,000 reported in the past 24 hours to Tuesday morning, government and John Hopkins data show. Almost 90,000 people have died from the pandemic.

Gasoline and diesel consumption averaged year-on-year growth of 9.35% and 4.8% respectively, since 2011, according to PPAC data.

However, in the COVID-19 affected April-August months, gasoline and diesel consumption was down 25.3% and 28.5%, respectively, from the same period a year ago, PPAC data showed.

Major Indian refiners such as IOC and Reliance Industries have in the past month restarted large facilities at Panipat and Jamnagar, respectively, which should raise crude throughput going forward, the sources said.

In August, IOC processed 3.9 million mt versus 6 million mt a year ago and over the same period Reliance churned through 1.4 million mt at its export-oriented site compared with 3.2 million in 2019 due to maintenance works, the PPAC data showed.

Fourth quarter run rates may edge closer to the 80% mark but is unlikely to breach 90%, they added.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report. Get your free trial here.

--Reporting by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

--Editing by Carrie Ho, Carrie.Ho@ihsmarkit.com

Copyright, Oil Price Information Service

OPEC+ Compensation Grace Portends Further UAE Output Cuts Into December

September 18, 2020

An OPEC+ move to extend the compensation period for nations that failed to fulfill output cuts to end-December suggest that the UAE, one of the bigger violator, is likely to stretch already announced crude oil supply reductions in October and November into December, trading sources said.

Abu Dhabi National Oil Co. (Adnoc), the biggest oil producer in the UAE, informed term customers of a 25% cut to November loadings on Wednesday after surprising the market early this month with a 30% reduction to all four of its export grades. The UAE pumped 3.11 million b/d in August or 520,000 b/d above its compliance target, the International Energy Agency (IEA) said in its monthly oil report published on Tuesday.

UAE Energy Minister Suhail Al Mazroui said the over production was due to peak summer power demand and announced in a Sept. 1 tweet of supply cuts. The Adnoc announcement, combined with stricter compliance and compensation by Iraq, has in recent days bolstered Middle East crude oil prices, the sources said.

"Adnoc is already talking to its customers of a cut in December, there is no formal announcement yet like that for October and November," said one trading source, adding that most Middle East grades are currently trading at premiums to their official selling prices (OSPs) from discounts last month.

Murban, the UAE's single-largest crude blend, was last estimated at around $0.20/bbl above its OSP compared with a discount of about $0.70/bbl last month, the source said, adding that some of the gains were also due to the deep cuts made in the latest round of OSP announcements. Upper Zakum, another big export grade, was at around plus $0.10/bbl versus minus $0.70/bbl a month ago.

The price bump were triggered by the cut to supplies which caused an initial knee-jerk buy reaction that reverberated across the various spot traded crude oil markets in the region leading to higher flat prices and firmer time spreads.

The Month 1-3 Dubai time spread, an important indicator in the Saudi Aramco OSP calculation, firmed to about $0.50/bbl in contango on Friday compared with the average minus $0.65/bbl in August, the sources said, citing broker data.

On the other hand, Basrah crude from Iraq has been losing ground in anticipation of increased supply for November after the country managed to claw back a significant portion of its over production in August and now in September, the sources said.

"Output cuts from Iraq will be less in October after they did quite well in August and we are seeing the same in September," the source said.

Basrah Light crude, which traded at around a $0.50-$0.60/bbl premium last month is now edging down towards parity to its OSP, while Basrah Heavy has dipped to plus $0.50-$0.60/bbl from +$1.00/bbl over the same period, they said.

In its statement on Thursday following a Joint Ministerial Monitoring Committee (JMMC) meeting under the leadership of the Saudi and Russia oil ministers, the group said that the monthly report prepared by its Joint Technical Committee (JTC) showed overall compliance by participating OPEC and non-OPEC countries at 102% in August 2020, including Mexico as per the secondary sources.

However, it said the group was looking closely at market developments particularly as new cases of COVID-19 spread in many countries affecting fuel demand. In its monthly report, OPEC downgraded global oil demand further by 400,000 b/d, now contracting by 9.5 million b/d to 90.2 million b/d.

This is in line with similar downgrades by others including the IEA as COVID-19 continues to decimate oil demand, particularly jet fuel as much of global international flights stay grounded.

The JMMC agreed to extend the compensation period until the end of December 2020, "after pledging that they will fully compensate for their overproduction. This is vital for the ongoing re-balancing efforts and helping deliver long-term oil market stability," according to the statement.

The need for better compliance and compensation was driven hard by the Saudi oil minister who warned nations against over producing and then making up for their indiscretions in a news briefing after the meeting, according to several media reports.

"Anyone who thinks they will get a word from me on what we will do next, is absolutely living in a La La Land...I'm going to make sure whoever gambles on this market will be ouching like hell," Prince Abdulaziz bin Salman was quoted as saying in a Reuters report when asked about OPEC+ next steps.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report. Get your free trial here.

--Reporting by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

--Editing by Carrie Ho, Carrie.Ho@ihsmarkit.com

Copyright, Oil Price Information Service

Aramco Cuts Term LPG After Holding for Two Months, More Contracts This Year

September 18, 2020

Saudi Aramco reduced its October liquefied petroleum gas (LPG) term supplies, on a voluntary basis, amid regional demand lulls after keeping allocations in line with nominations for two months amid higher overall term contract volumes for the full year from 2019, according to sources.

Around three cargoes of very large gas carrier (VLGC) size were either cancelled or deferred by mutual agreements, while some other buyers received advanced dates, said sources, adding that at least two of the cuts were to traders.

The LPG term allocations were announced shortly after the Joint Ministerial Monitoring Committee (JMMC) meeting held on Thursday evening, where Saudi Arabia oil minister Abdulaziz bin Salman said that all countries that overproduced need to compensate for exceeding their output quota.

Aramco set in end-Aug. its September Contract Price (CP) for propane at $360/mt, unchanged from August and butane at $355/mt, up $10/mt on-month, as term discussions for next year got started. No cancellations of term cargoes were reported for September.

The October propane CP swap was assessed at $371/mt on Thursday, $11/mt above the September CP, having reached a bottom at $347/mt on Sept. 11 since the September CP was set in end-August.

The kingdom slashed term cargoes in six of the 10 months this year, with a brief boost to eight in April and made no change for July and August, while the total reduction coming up to 21 parcels, based on OPIS record.

It could have sold more cargoes on term contract this year compared to last year, and as a result, some monthly cut seems unavoidable, said market sources.

The country shipped out 495,000 mt of LPG in August, well below the monthly average of 665,750 mt and down 37% on-year, while Its January to July flows totaled 4.75 million mt, a 5% increase on-year, according to OPIS waterborne data.

A few importers did not nominate for the month, based on OPIS record.

Other Middle East producers including Abu Dhabi National Oil Cor. (Adnoc), Qatar Petroleum (QP) and Kuwait Petroleum Corp. (KPC) did not cancel any term liftings for October, despite Adnoc notifying term customers of a 30% cut to crude oil volumes next month. According to sources the producer may have sufficient inventory.

Three free-on-board (FOB) October loading cargoes were sold via tenders by Middle East suppliers so far.

QP sold in early Sept. a 45,000 mt propane parcel for loading from Ras Laffan in early-Oct., while KPC sold one 11:33 lot for early-Oct loading and another 22:22 for Oct. 17-18 loading, based on OPIS record.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report. Get your free trial here.

--Reporting by Lujia Wang, Lujia.Wang@ihsmarkit.com;

--Editing by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

Copyright, Oil Price Information Service

Slew of VLCCs booked on Time Charter as Replacements Amid Plunging Freight Rates

September 14, 2020

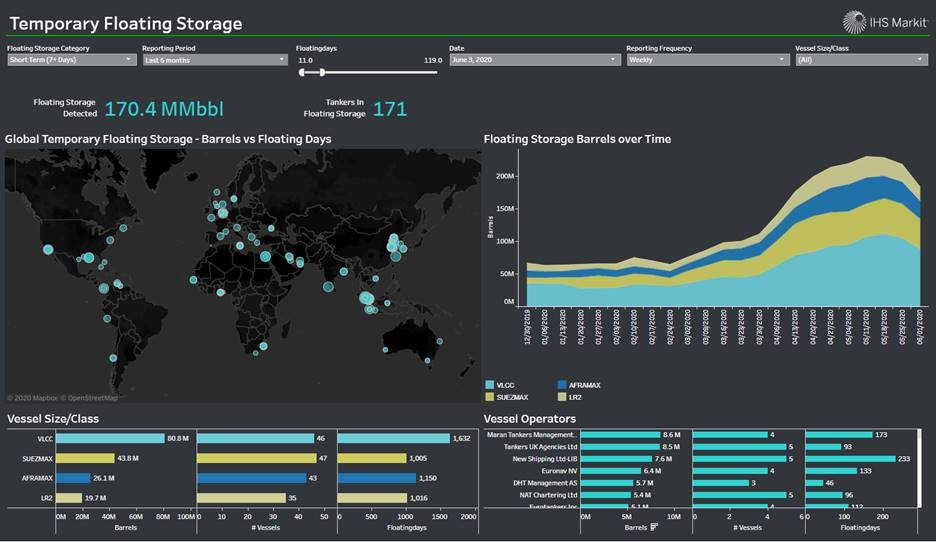

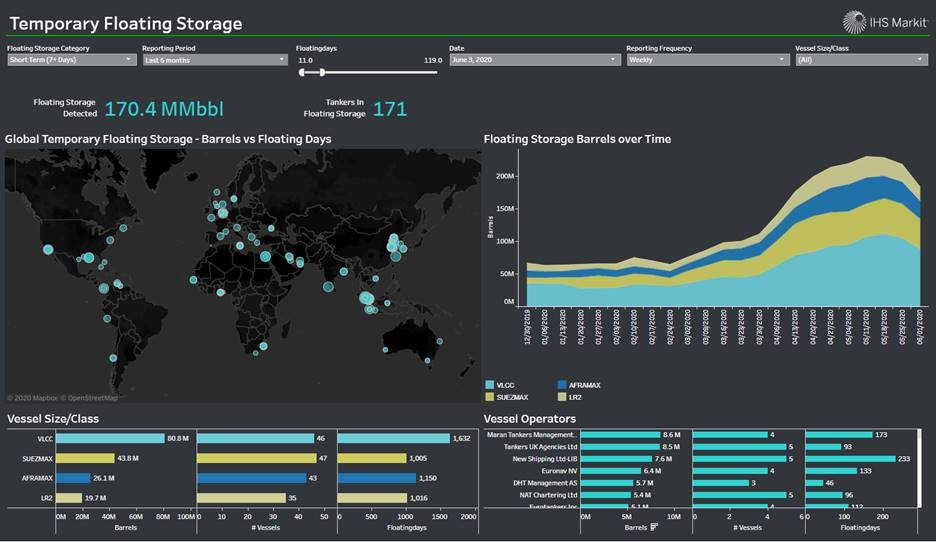

A string of very larger crude carriers (VLCCs) were snapped up in the past week as traders took the opportunity of tumbling freight to replace costly time charters (TCs) made earlier at the cusp of the super contango with bookings done at up to one-fifth the price six months ago, according to ship brokers, trading sources and fixtures.

The slew of charters raised expectations of a new round of a buy-now, sell-later trading strategy, or more commonly known as a contango or storage play, but traders said the forward price curve do not yet support such a move.

However, they were quick to add that current exceptionally cheap freight makes such a punt worth exploring as participants work to bring down their storage costs with some taking additional shipping length in the chance that a contango play develops. Such plays have earned trading outfits billions in profits and were also responsible for hefty earnings in the past quarter as oil companies grapple with low prices and poor margins due to the coronavirus disease 2019 (COVID-19)-led fuel demand destruction.

"The contango is not wide enough for an outright contango play. They were hired because tankers were cheap and if the crude market gets worse, then they can use it as contango play," one trading source said, adding that many of the fixtures were also replacements for those done on six-month TCs back in March and April.

According to shipping reports obtained by OPIS, 24 VLCCs have been booked on mostly three-six month TCs with one trading company having got the jump on others and managing to snap up at least four supertankers at below $30,000 per day with the cheapest at $25,000/day. The best deal on the list was for a 3+3-month booking delivered Singapore at $20,500/day, the list showed.

Later bookings were mostly done around the $50,000/day mark with most leading trading companies as well as Chinese national firms among the charterers, the list showed.

This compares with similar six-month TCs done in late April at as much as $130,000/day with many agreed at above the $80,000/day mark, according to past fixture reports.

Included in the list are three newly-built VLCCs, the Hunter Idun, CSSC Liao Ning and the Babylon, which were laden with middle distillates in their maiden voyage and may continue to carry clean products throughout the TC period due to ample diesel and jet fuel supplies and a better contango structure, trading sources said.

Large oil companies with a strong trading team, such as Glencore, Vitol, Trafigura, Gunvor, bp, Total and so forth, holding deep pockets and capacity to execute such costly contango plays typically reap rewards in the billions.

"Marketing adjusted EBIT of $2 billion (H1 2019, $1 billion) reflected oil, in particular, benefiting from the volatile and structurally supportive marketing environment," Glencore said in its first-half results, adding that this allowed the company to raise full-year guidance to the top end of its long-term $2.2-$3.2 billion range.

If there was any doubt as to which part of their business was responsible for the bumper earnings, Glencore said: "There were consistently good contributions across the board, however, oil in particular was able to capitalize on the presence of exceptional market conditions during the half."

The market condition refers to the super contango that developed after OPEC and Russia failed to agree on an output reduction agreement, leading to Middle East producers opening their oil taps and slashing prices, which coincided with the COVID-19 demand decimation to send prices tumbling at vast discounts for prompt cargoes versus forward barrels.

Back in late March, the forward curves showed a six-month contango of $10.50/bbl for Brent, $6.90/bbl for Dubai and $9.90/bbl for WTI. At the same time, physical differentials against these benchmarks sank to historical or multi-year lows in just about every producing region including the Middle East, North Sea, Russia and West Africa, traders said.

For example, Dated Brent, used to price as much as two-third of all global crude oil, fell to a discount of about $10/bbl to front-month ICE Brent, they said. However, for now the numbers have yet to come anywhere near such a dire situation with Dated trading at flat to a modest premium to ICE Brent, they added.

A similar picture emerges on the forwards, which while in contango is about one-third of that chalked in the last super cycle with the six-month spread at -$3.10/bbl for Brent, -$2.50/bbl for Dubai and -$2.80/bbl for WTI, sources said.

However, the latest increase in output from the OPEC+ group and continued lackluster demand due to a resurgence of COVID-19 cases amid fresh lockdown measures have raised the specter of another super contango, the trading sources said.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report. Get your free trial here.

--Reporting by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

--Editing by Carrie Ho, Carrie.Ho@ihsmarkit.com

Copyright, Oil Price Information Service

Aramco Likely to Slash October Asia Crude OSP on Lower Spot Prices, Weaker Demand

September 1, 2020

Saudi Aramco is on cue to slash its October official selling price (OSP) to refiners in Asia by about $1.20/bbl for its biggest Arabian Light grade after below expectations cuts in September in the face of lower spot prices and a slowdown in fuel demand, trading sources said.

The world's largest crude oil exporter cut its Asia September OSP for Arabian Light to buyers in Asia by $0.30/bbl, half of market expectations shaped late month weakness. However, the reduction was in line with full-month average Dubai forward price structures.

In October, a bigger cut is on the cards at $1.00-$1.50/bbl as prevailing Middle East spot crudes lost a lot of ground, the sources said. The Dubai Month 1-3 spread is firmly in contango at an average of around minus $0.65/bbl in August compared with a premium of about $0.70/bbl in July, they said. That’s a $1.35/bbl swing.

“All the Middle East barrels are overpriced, Aramco has to make a big adjustment after last month,” said one trading source, admitting that the producer did not face great difficulties placing its September-loading crude even though it only made minor cuts to its OSP.

“There were some refiners who nominated very little for September after the OSP announcement but Aramco still managed to place their barrels. They have a lot of tricks, with so many different buyers,” he added.

Forecasts for the bigger cuts still held on Tuesday following unexpected news of a 30% cut by Abu Dhabi National Oil Co. in its October term loadings across all four grades in compliance with its OPEC+ obligations, according to a notice to buyers. The promise of a supply reduction temporarily boosted spot prices but it failed to change the price structure, Dubai crude remains entrenched in contango,

Aramco is forecast to cut its Arabian Extra Light by a bigger $1.30-$1.40/bbl due to continued weakness in the gasoline and even naphtha markets as driving was curbed by fresh outbreaks of the coronavirus disease 2019 (COVID-19) despite seasonal peak demand in the northern hemisphere. In September, the OSP was also reduced by a larger $0.50/bbl, a pricing list showed.

Naphtha usage as petrochemical feedstock was crimped by poor aromatics margins as downstream polyester and other derivative demand started to slow down in the face of the prolonged economic downturn wreaked by COVID-19. However, consumption in China for use in olefin production remains robust, a source said.

The heavier Arabian Medium and Heavy grades may see a smaller reduction due to better fuel oil demand, the trading sources said, adding cuts maybe around the $0.90/bbl mark. The OSP of both blends were dropped by a similar $0.30/bbl to the Arabian Light.

Another component in the making of the OSPs is flows from Saudi Arabia, which is less than that allowed under the OPEC+ accord, the trading sources said.

“Saudi is producing about 300,000 b/d less than their quota in August, they should have raised it by 500,000 b/d but there is a shortfall. So it also depend if Aramco wishes to use up all this slack by pumping out more in October,” another trading source said.

Due to its diverse demand base, Aramco has not faced an across-the-board requests for cuts to loading nominations as COVID-19 has had varying impact on nations in Asia with some enjoying a purple patch whilst others were in the doldrums and vice-versa, the sources said.

In China, crude imports for the rest of 2020 is expected to be capped by their massive purchases earlier this year that is still causing port congestion and ullage issues, they said.

“For the rest of the year we do not expect so much crude imports, fresh arrivals have already started to decline. The storage economics have worsened and there are high demurrage costs,” said Sophie Fenglei Shi, downstream research associate director at IHS Markit in Beijing. OPIS is an IHS Markit company.

In its latest short-term outlook on the China market dated Aug. 27, IHS Markit said that preliminary vessel tracking shows that there is still as much as 14 million b/d of crude waiting to be discharged in August, of which at least 3.5 million b/d is delayed from July and even June.

“We expect port congestion will be alleviated in September with less fresh arrivals coming in, and that China’s crude imports will begin to see a material step-down in October and beyond once the congested cargoes get fully cleared,” according to the report.

Demand in India will increase as two massive crude units, the Indian Oil Corp. 300,000 b/d Paradip refinery and a 380,000 b/d unit at the mega Reliance Industries Jamnagar site begin operations after around a three-week maintenance.

“The run rates won’t increase but we have units returning from turnaround,” a refining source in India said.

South Korean crude imports fell by the most in over a decade in August to 77.2 million bbls (2.49 million b/d), down 20.4% from a year ago and 10.6% on-month, preliminary data from the Ministry of Trade, Industry and Energy showed on Tuesday. Purchases dropped by 20.5% in November 2009.

These signs point to a challenging demand environment, which suggest Aramco is likely to heed customer requests for a bigger cut in October unlike what happened in September, the sources said.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report. Get your free trial here

--Reporting by Raj Rajendran,

Rajendran.Ramasamy@ihsmarkit.com

--Editing by Carrie Ho, Carrie.Ho@ihsmarkit.com

Copyright, Oil Price Information Service

China State Refiners Plan Biggest Oil Export in September Since April COVID-19 Lull

August 31, 2020

Chinese state-owned refining majors plan to export the biggest volume of clean oil products since the depths of the coronavirus disease 2019 (COVID-19) pandemic in April as higher summer runs led to brimming local tanks forcing many to turn to the overseas market, trading sources said.

The four refiners, PetroChina, Sinopec, China National Offshore Oil Corp (CNOOC) and Sinochem, plan to export 3.77 million mt of gasoline, diesel and jet fuel in September, according to a source with knowledge of the matter.

Diesel shipments will increase 10.9% on-month in September to 1.93 million mt, the highest since March while gasoline will drop 2.1% from August to 1.43 million mt, the data showed. Jet fuel exports, on the other hand, will shrink to 410,000 mt, almost a quarter of the 1.58 million shipped out on March.

"Demand on gasoline is showing signs of recovery in China as with other countries as COVID-19 measures were relaxed, enabling people to commute and travel to work again," a trade analyst said.

"Gasoline exports planned for September is lower than that in August given that Chinese refiners are expecting an increase in domestic demand," the analyst added.

On the other hand, middle distillates are feeling the weight of slower regional demand since early July following a resurgence of COVID-19 cases in pockets across the region with some on the verge of turning into a second wave.

The front-month diesel time-spread averaged at $0.28/bbl in backwardation in July, but flipped to $0.33/bbl in contango in August, according to OPIS data. The jet fuel contango widened in August to $0.75/bbl compared to $0.57/bbl in July.

"The increased volume of transportation fuels flowing into the market is going to add further pressure on cargo differentials that are already in the negative zones," a trader said.

"Traders will compete by lowering their offer prices in order to sell off their inventories," he added.

Singapore 10 ppm gasoil and jet fuel cargo differentials are currently at minus $0.35/bbl and minus $0.95/bbl, respectively, while 92 RON gasoline is at minus $0.10/bbl, according to trade sources.

A month ago, prices for 10 ppm gasoil and jet fuel were at plus $0.23/bbl and minus $0.36/bbl, respectively, with 92 RON gasoline at minus $0.39/bbl, OPIS data show.

Chinese refiners faced excess domestic supply of transportation fuels after the economy was again disrupted by COVID-19 outbreaks in July, coupled with heavy monsoon floods in various parts of China.

"Chinese refiners have a big volume of crude to process as they went into the market to buy a lot of cheap crude during the April price crash," another analyst said.

Chinese refiners went on an extensive bargain hunt in spring when ICE Brent crude prices sank to as low as under $20/bbl, which ended up in record shipments in the summer that is now extended to autumn, trading sources said.

The world's largest crude importer took in an eye-watering 53.18 million mt, or about 12.9 million b/d, in June, easily bypassing the previous record 11.3 million b/d that landed in May, according to Chinese General Administration of Customs data.

Refiners ramped up production in July with expectations that domestic economy will recover after the imposed COVID-19 lockdowns were lifted.

Production of gasoline, diesel and jet fuel rose in July by 10.2%, 3.9% and 5.4% to 11.78 million mt, 15.1 million mt, and 3.32 million mt, respectively, according to Chinese National Bureau of Statistics.

Sinopec restarted its 460,000 b/d Zhenhai Refining & Chemical Co. site in July after a four-month maintenance and its 250,000 b/d Tianjin facility after a two-month turnaround, leading to the higher output.

Reference a single daily index for buying and selling jet fuel and gasoil profitably in Asia with the OPIS Asia Jet Fuel & Gasoil Report. Try it free for 21 days

--Reporting by John Koh, John.Koh@ihsmarkit.com;

--Editing by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

Copyright, Oil Price Information Service

Asia Naphtha Buyers Pay Higher 2021 CFR Term Premiums on Tighter Supply Outlook

August 26, 2020

Naphtha buyers including Yeochon NCC (YNCC) and LG Chem paid higher premiums for their 2021 CFR term purchases than this year as the startup of a wave of new crackers in the coming months and next year shaped views of a tighter supply outlook, market participants said.

YNCC settled at a premium of around $7/mt to Japan naphtha price, two sources said. LG Chem concluded at plus $6-$7/mt while Korea Petrochemical Industry Co. settled at around plus $3/mt, according to several sources. Formosa Petrochemical Corp. (FPCC) bought cargoes for Oct. 2020-Sept. 2021 at plus $4-$5/mt.

These term deals were agreed with trading companies, said a buyer, adding that producers including Saudi Aramco, Abu Dhabi National Oil Co. (Adnoc) and Reliance Industries Ltd. also have trading arms.

“Generally, recent terms were concluded at higher levels than 2020,” said a trader.

Asia naphtha demand as a petrochemical feedstock will continue to grow as new crackers begin operations even as below-capacity refinery utilization rates in some countries squeeze supply further, they said.

In China, Liaoning Bora, Sinochem Quanzhou and the Sinopec-KPC joint venture are set to commission their mixed feed crackers in the coming months, according to analysts and the latest IHS Markit Asia Light Olefins Monthly Analysis.

PTT Global Chemical, Thailand's biggest ethylene maker, will add a new 500,000 mt/year naphtha cracker by December while in South Korea, YNCC is set to complete an expansion by early 2021, boosting the capacity of one of its three plants by 60% to 930,000 mt/year, according to the Monthly Analysis.

In addition, Lotte Chemical plans to restart its fire-hit Daesan cracker by end 2020, the company said earlier this month, adding it plans to diversify feedstocks and will more than double its use of liquefied petroleum gas (LPG) in three years.

While the buyers refrained from disclosing price details because the discussions were confidential, at least two said the negotiations were not easy.

“It has been very tough to negotiate with traders who strongly believe the market will be stronger next year,” said a buyer.

“The offers were a bit higher than expected, so this time we covered just part of our term requirement,” said another buyer.

The concluded 2021 prices, at mid-to-high single digits, also surprised to the upside because they were higher than paper values, two market sources said.

“When FPCC concluded, the 2021 paper curve was around flat, and the idea is that those premiums should follow paper,” said another trader.

The YNCC price was $3-$4/mt higher than what the paper market was indicating at the time, another source added.

Buyers currently in 2021 CFR term discussions include Hanwha Total Petrochemical for splitter grade, or heavy full range naphtha (HFRN), and Lotte Chemical Titan for light naphtha, sources said

Refinery run rates in Asia and the Middle East are expected to improve to 74% this month and reach 82% by January 2021, from below 70% in April during the depth of coronavirus disease 2019 (COVID-19) lockdowns, said April Tan, IHS Markit associate director in Singapore.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report. Get your free trial here

--Reporting by Trisha Huang, Trisha.Huang@ihsmarkit.com;

--Editing by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

Copyright, Oil Price Information Service

Shell to Shutter Philippines Refinery Permanently, First Asian COVID-19 Casualty

August 13, 2020

A Royal Dutch Shell refinery in the Philippines became the first Asian casualty of the fuel demand destroying coronavirus disease 2019 (COVID-19) pandemic as other sites in the region brace themselves for similar fallouts in the face of new virus outbreaks and poor refining margins while more sites come onstream in China.

Pilipinas Shell Petroleum Corp said on Thursday that its near 60-year-old 110,000 b/d Tabangao refinery in Batangas province was no longer economically viable and would be turned into an import terminal.

“Due to the impact of the COVID-19 pandemic on the global, regional and local economies, and the oil supply-demand imbalance in the region, it is no longer economically viable for us to run the refinery,” Pilipinas Shell President and CEO Cesar Romero said in the statement.

Refining margins in Asia are under tremendous pressure due to the sharp drop in fuel demand with the benchmark Singapore complex gross margin dropping to minus $3.78/bbl in May/June, according to an update by Refining NZ, which is studying the possibility of converting its refinery in New Zealand to an import terminal.

“This is not a surprise. We are working on a list of refineries in Asia that are vulnerable because of COVID-19 and this refinery keeps coming up in many of the criteria,” said Premasish Das, IHS Markit downstream research and analysis director, adding that there are sites in Japan, Australia, New Zealand and even in Singapore that face uncertain futures.

The Philippines closure will be a boon to the overall Shell system, given its mega refining complex in Singapore with a 500,000 b/d processing capacity, which will now have a new captive outlet as the unit in Tabangao was operating at around 80-85% of capacity prior to its temporary closure in May due to COVID-19, trading sources said.

“The Shell Singapore system could be supported when demand recovers next year,” said one source, adding that transportation fuels such as gasoline, jet fuel and diesel as well as bitumen will be among the products that will be shipped from the Singapore Pulau Bukom site.

The new Tabangao import terminal will cater to the fuel needs of Luzon and Northern Visayas, while the North Mindanao Import Facility (NMIF) in Cagayan de Oro will serve the growing energy needs in the balance of the Visayas islands and the entire Mindanao region, Pilipinas Shell said in the statement.

The permanent shutter will open up a new market for the recently-built refineries in neighboring countries such as the Maura site in Brunei and Pengerang in southern Malaysia, which will face stiff competition from a slew of new and old plants in China, trading sources said.

Asian oil product demand is expected to contract by about 4.3 million b/d and 3.7 million b/d year-on-year in first and second quarter, respectively, according to IHS Markit estimates. OPIS is a unit of IHS Markit.

“Recovery will be gradual amid change in consumption patterns and fears over a second wave of infections. Regional oil demand is not expected to recover to 2019 levels on a quarterly basis through second quarter 2021,” Das said.

The demand recovery is patchy and in some instances such as in Victoria state in Australia, the Philippines, Vietnam and India it has taken a step back as new lockdown measures were introduced at local levels to stop the COVID-19 spread, according to latest consumption data.

Consequently, refiners have turned down runs while others have closed units for maintenance with a few running their numbers internally to work out the long-term future of the sites as was the case with Pilipinas Shell.

OPIS Mobile News Alerts provides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility. Tell Me More

--Reporting by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com;

--Editing by Carrie Ho, Carrie.Ho@ihsmarkit.com

Copyright, Oil Price Information Service

Singapore Gasoline Crack at Risk of Turning Negative, Fundamentals Worsen

July 30, 2020

Asia gasoline is set to slump with the benchmark Singapore 92 RON crack, or refining margin, on the verge of turning negative in the face of rising supply and demand recovery losing its momentum amid new coronavirus disease 2019 (COVID-19) cases and floods in India and China, traders said.

The 92 RON crack spread fell to $0.563/bbl on Thursday, the lowest since June 4, according to OPIS data.

This margin crashed to minus $12.986/bbl on April 14, the lowest on OPIS records going back to July 2014 as authorities took lockdown measures to contain COVID-19, dampening demand for the transportation fuel. Consumption recovered slowly as these preventive measures were eased on signs of the pandemic slowing.

But COVID-19 spread again, prompting some authorities to reinstate lockdown measures and hindering recovery in gasoline consumption.

To deal with this weakening local demand, some countries, especially China, increased exports, which exacerbated the oversupply in Asia, traders said.

"It is inevitable since the supply glut has not eased," said a Singapore-based trader, when asked if the 92 RON crack will fall below zero.

Some refiners cut runs or shut plants for turnaround, but that may not be enough since demand in Asia lost steam, he added.

In China, Sinopec has lowered operating ratios at some refineries as their inventories jumped due to the recent flood, trading sources said.

The country's largest refiner slashed rates at its 170,000 b/d Wuhan facility to as low as 126,000 b/d in mid-July, according to the sources. It also lowered runs at the 160,000 b/d Hubei and 180,000 b/d Anhui sites, the sources added, declining to provide further details.

Sinopec officials were not available for comment.

Traders booked three tankers so far to lift 155,000 mt for August, after chartering 15 vessels to pick up 680,000 mt in July, according to shipping fixtures. The list also showed one tanker was booked to load 35,000 mt of gasoline and gasoil each in July and August.

A total of 12 tankers were chartered to lift 420,000 mt of in June, the fixtures showed.

In India, where authorities have re-imposed lockdown measures, Reliance Industries Ltd (RIL) and Indian Oil Corp (IOC) will shut crude distillation units (CDUs) for maintenance works, as reported earlier.

RIL brought forward the turnaround of a 380,000 b/d CDU at the export-oriented 705,200 b/d Jamnagar refinery to this week from the initial schedule of Oct. 15, according to sources. The works were expected to finish in three to four weeks.

Those overhauls and lower runs at other refineries may limit Indian gasoline exports, a trader with an Indian refiner said.

However, demand in Asia is weakening again, keeping inventories at high, traders said.

"We had hoped that demand in some countries such as Vietnam, but that didn't materialize," said a Seoul-based trader. Vietnam is also facing a fresh outbreak of COVID-19.

Reference a single daily index for buying and selling jet fuel and gasoil profitably in Asia with the OPIS Asia Jet Fuel & Gasoil Report. Try it free for 21 days

--Reporting by Jongwoo Cheon, Jongwoo.Cheon@ihsmarkit.com;

--Editing by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

Copyright, Oil Price Information Service

Sinopec To Double Gasoil Exports in August Following Refinery Restarts

July 29, 2020

Sinopec, China's biggest refiner, plans to double gasoil exports to at least 800,000 mt in August from July, adding to an already bulging Asian market as weaker domestic demand pushed them to look overseas, according to market sources.

"It should not come as a surprise given that Sinopec restarted two of its biggest refineries recently," a trader with knowledge of the Chinese market said.

China exported 1.45 million mt and 1.04 million mt of gasoil in May and June, respectively, according to data from the General Administration of Customs (GAC). Shipments in July are expected to rebound to 1.2 million mt, market sources estimate.

Sinopec restarted its 460,000 b/d Zhenhai Refining & Chemical Co. site after about a four-month maintenance and its 250,000 b/d Tianjin facility after a two-month turnaround, as reported previously.

Chinese refiners went on an extensive bargain hunt in spring when crude prices sank to as low as under $20/bbl for ICE Brent, which ended up in record shipments in the summer that is likely to be extended to the autumn, trading sources said.

The world's largest crude importer took in an eye-watering 53.18 million mt, or about 12.9 million b/d, in June, easily bypassing the previous record 11.3 million b/d that landed in May, according to GAC data.

"Chinese refiners probably saw a good opportunity from the slump in oil prices and expectations that the domestic economy will recover after the imposed coronavirus disease 2019 (COVID-19) lockdowns were lifted," a trade analyst said.