What was long perceived as absolutely safe oil processing facilities in Saudi Arabia were obliterated by the Yemeni Drone attacks that took out more than half of the Kingdom’s oil output exposing plant security issues and longer-term supply security risks, market sources said.

This was the biggest attack on an oil asset in Saudi Arabia in decades. For years, the Kingdom had to put up with minor attacks on Saudi Aramco’s oil facilities that were typically close to the Yemen border but in May this was escalated by a drone attack on the East West Pipeline, which could now be seen as a test run.

Oil supply security from Saudi Arabia, taken as a given in the face of wars in the Middle East, North Africa and turmoil in other countries including Nigeria and Venezuela that have disrupted oil flows, is now vulnerable.

“The attack on critical Saudi oil infrastructure calls into question the reliability of supplies from not just one of the largest net exporters of crude oil and petroleum products but also the country that holds most of the world's spare production capacity,” Barclays Bank said in a research note.

A return of the supply risk premium, a feature of the market during the Gulf Wars, is likely and depending on market views on possible disruptions to flows as much as $5-8 could be added to a barrel with near-term increments probably stabilizing in the $2-5/bbl range, market sources said.

Benchmark Brent crude futures jumped by the most in a single session since the 1991 Gulf War to trade at a high of $71.95/bbl, up 19.5% from Friday, and was last at $66.50 at 3:25 pm London time, up $6.28/bbl from Friday.

“Saudi Arabia spent a lot of money on U.S. military hardware and yet we have this attacks,” said one source. “What’s there to say there won’t be another attack and another attack.”

The people responsible for keeping Saudi oil infrastructure safe will be working overtime to ensure such attacks do not happen again but in the current evolving military and drone technology world, there are no guarantees and a bigger risk premium is inevitable, they said.

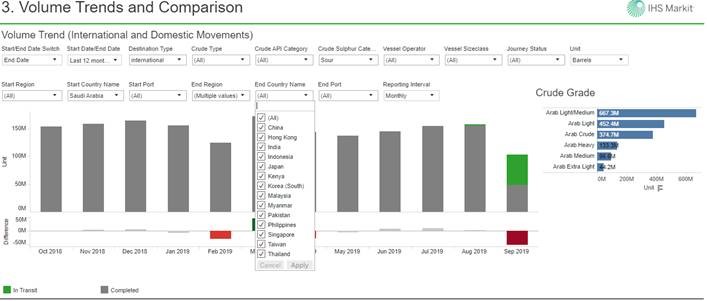

Asia is the biggest buyer of Saudi crude oil, taking about 5 million b/d of the Kingdom’s 7.4 million b/d of exports in 2018.

According to data from IHS Markit’s Commodities at Sea, the bulk of the shipments are line with Saudi export profile with Arab Light dominating shipments.

Oil sources said Aramco is currently looking to manage its crude export flows depending on the extent of the damage to the two oil facilities. It has so far not issued any force majeure or delayed shipments to term lifters, which is a comfort to the market, but still crude futures are $6/bbl higher, reflecting the new fears gripping the market.

The two sites, which pump a combined 5.7 million barrels a day (b/d), are responsible for churning out Arab Light and Arab Extra Light crudes, the Kingdom’s two premier grades.

The Abqaiq facility is Saudi Aramco’s largest oil processing facility and handled about 50% of the Kingdom’s crude oil production in 2018. While, Khurais pumps around 1.5 million b/d of mainly Arab Light crude.

In the current world of ample light sweet grades, the absence of Arab Light and Extra Light is not a huge burden but the absolute loss of oil if it persist for a longer period is a source of immediate concern, the sources said.

If the field is out for weeks rather than days then the oil market will be trading above the $70 mark even possibly testing $80, they said.

The release of strategic reserves in the U.S. if required and ample Aramco storage barrels across the globe in key sites including Okinawa, Rotterdam and Sidi Kerir in Egypt will put a temporary cap on oil gains and prevent further spike as long as the output loss is restored.

What the world does not need now is for the sabre rattling between the U.S. and Iran, with Washington blaming Tehran for the attacks, to escalate. The region is slowly turning into the powder keg that it was during the Gulf Wars and Iran-Iraq hostilities and oil prices will continue this uptrend if not cooled.

Geopolitics may once more become the buzz word and oil prices could become hostage to the threats and counter threats made in the two capitals, the sources said.

-- Raj Rajendran, (Rajendran.Ramasamy@ihsmarkit.com)

Copyright, Oil Price Information Service