East Asian refiners, especially those in China, are ramping up purchases of North Sea Johan Sverdrup and Grane crudes at the expense of traditional favorite Forties, as these medium-sour grades from Norway are ideal for the region’s newer complex refineries, industry sources said.

Increased purchases of these grades were partly helped by strong marketing from Johan Sverdrup’s biggest shareholder Equinor, which has been raising Asian refiners’ awareness of the new crude produced from the biggest North Sea discovery in decades, they said.

The reduction in heavy-sour barrels due to U.S. sanctions against Iran and Venezuela as well as OPEC+ output cuts have further boosted the grades’ popularity given its relatively low American Petroleum Index (API), they added.

Chinese refiners mostly prefer heavier, sour grades especially as demand for residues are strong both as a secondary feedstock and to produce low sulfur bunker fuel. They were, however, replaced due to the lack of supply amid a surge in U.S. shale oil production, which suits the independent simple tea pots, the sources said.

“China’s crude imports has been getting lighter and sweeter in the past three years, but this trend will likely be moderated or reversed from 2020 onwards, with almost all of its major refining capacity additions designed to run medium sour grades,” said Feng Xiaonan, IHS Markit downstream analyst in Beijing.

The increased availability of these grades at reasonable prices has led to the recent jump in China’s purchases of these medium-sour grades such Johan Sverdrup, Grane and Urals from both the Baltics and Black Sea, market players said.

Oil traders said refiners are keen on heavier crudes at the moment as very low sulfur fuel oil (VLSFO) has been fetching the best prices among oil products and yielding the best crack or refining margins recently.

One unexpected development from the aggressive marketing of Johan Sverdrup was the emergence of other similar North Sea grades, such as Grane, for use in China.

Grane has an API of 29 and sulfur content of 0.59% while Johan Sverdrup has 28 API and 0.8% sulfur, which makes both grades extremely attractive to Asian refiners in search of higher distillate yields and reasonable sulfur that also leverages on their investments in desulfurizers.

Chinese customs data showed crude oil imports from Norway jumping three-fold to 107,000 barrels a day (b/d) in November compared with a paltry 33,000 b/d a year ago, while purchases from the UK rose marginally to 261,000 b/d.

The nation has been buying record volumes of crude oil on the back growing refining capacities. In December, purchases rose to 45.76 million mt, preliminary data from the General Administration of Customs show. This works out to about 10.8 million b/d, just off the record 11.1 million b/d imported in December.

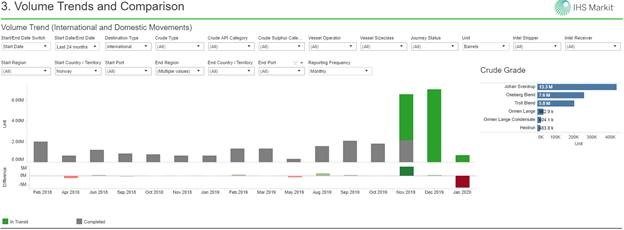

According to IHS Markit’s Commodities At Sea (CAS), exports of Norwegian grades to Asia were inconsistent over the past two years, with no cargoes shipped in some months and exports averaged about 1.85 million bbls per month in the third quarter.

Shipments jumped to 6.58 million bbls in November with 7.07 million bbls loaded up in December for delivery to Asia, the CAS data showed.

Norwegian Crude Oil Exports to Asia, Including India

On the other hand, Forties shipments averaged 11.34 million barrels per month in the third quarter prior to the start-up of Johan Sverdrup in October but fell to 4.2 million barrels in December and 5.89 million barrels in November.

Sverdrop loadings are rising towards its phase 1 target of 440,000 b/d, with about 400,000 b/d slated to be shipped in February. It is now the highest-exported North Sea blend, rising past Forties, which is due to load around 370,000 b/d, according to loading programs.

Grane production is estimated at around 130,000 b/d.

UK Crude Oil Exports to Asia, Including India

Flows for all North Sea grades are expected to improve as the Brent-Dubai EFS shrank to below $2/bbl, which is at the smallest since last April, according to broker data. The front-month March spread was at $1.90/bbl on Wednesday.

The small premium of Brent-priced crudes over Dubai-related grades makes it economical for North Sea barrels to be shipped to Asian refiners.

According to ship tracking data, among the Forties cargoes bound for Asia is the very large crude carrier (VLCC) Mazyonah, which carried out ship-to-ship (STS) transfers with two other tankers at Scapa Flow. It is now off Scotland and due to arrive in China on Feb. 28.

The VLCC Athenian, which departed Hound Point on Dec. 20, is currently off the Cape Town and due in Qingdao Feb. 10, while the VLCC Maran Artemis left on Dec. 26 for Rizhao with an ETA of Feb. 15.

Finally, the VLCC Bukha arrived at Hound Point on Jan. 12 but has yet to leave the terminal.

On the Norwegian side on the other hand, Mongstad saw a slew of departures in December for East Asia. The first to leave was the VLCC Sandra on Dec. 3, due to arrive in China on Jan. 24 and last seen off Java island.

The Suezmax Stella left on Dec. 15 bound for Ningbo, due to arrive on Jan. 23 and is currently just off northern Sumatra. The VLCC New Horizon left on Dec. 15 headed for Qingdao with an ETA of Feb. 3.

The Suezmax Atina left on Dec 21 and is due to arrive in Zhoushan on Feb. 3, while the Marlin Silkeborg left on Dec. 29 bound for Singapore, having just passed the Suez Canal and is due Jan. 29.

The VLCC New Laurel left on Dec. 31 bound for Qingdao, its due to arrive on Feb. 21. Loadings in January so far include Aframax Torm Hilde, which left on Jan. 5 bound for Singapore, due to arrive Feb. 2.

The VLCC New Pioneer left on Jan. 10, heading to Ningbo, due to arrive March 1. The tanker also called at Sture Oil Terminal, departing on Jan. 12. The VLCC DS Venture is another tanker that called at Sture, departing on Dec. 30 with an ETA in China of Feb. 2. Grane crude loads from Sture.

Sources said the increase in Chinese refining capacity makes it timely that these crudes are now available to them.

-- Reporting by Raj Rajendran, Rajendran.Ramasamy@ihsmarkit.com

-- Editing by Carrie Ho, Carrie.Ho@ihsmarkit.com

Copyright, Oil Price Information Service